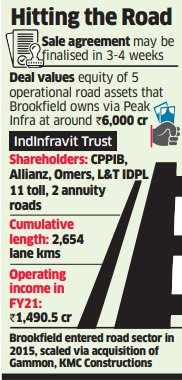

Brookfield is finalising the sale of its roads portfolio in India to IndInfravit Trust, an infrastructure investment trust (InvIT) led by Canada Pension Plan Investment Board (CPPIB), for an enterprise valuation of ₹9,000-9,500 crore. Road traffic and toll revenue have seen an uptick with the waning of the Covid pandemic.

Both sides signed an “exclusivity agreement” on Friday and expect to finalise the sale agreement in the next three-four weeks, said people aware of the development. Cube Highways was also in the final lap.

Omers and German insurer Allianz are the other key shareholders of the IndInfravit Trust along with L&T Infrastructure Development Projects (L&T IDPL), which also acts as sponsor of the vehicle.

The transaction values the equity of the five operational road assets that Brookfield owns through platform Peak Infrastructure Pvt Ltd at around ₹6,000 crore. The business has debt of ₹3,000-3,200 crore. All these are under long-term concession agreements with the National Highways Authority of India (NHAI).

Brookfield and CPPIB declined to comment. Allianz and L&T didn’t respond to queries.

Brookfield entered the sector in 2015 after buying the road assets of stressed engineering company Gammon Infrastructure Projects Ltd. It then acquired road assets from Hyderabad-based KMC Constructions.

However, Peak handed back two projects acquired from Gammon – Andhra Expressway and Rajahmundry Expressway – to NHAI after managing them. Currently, the Brookfield portfolio includes up to 2,427 lane km of national highways and 103 toll booth operations that serve over 120,000 vehicles each day, according to the company.

In 2019, Brookfield had tried to sell its 150-km, Mumbai-Nashik Expressway and engaged in talks with several players such as Cube Highways and IRB Infrastructure. However, a deal didn’t fructify.

ET was the first to report on September 6 last year that Brookfield was planning to sell Peak for $1.2 billion in enterprise value. KPMG is advising Brookfield on the sale process.

Brookfield and CPPIB declined to comment. Allianz and L&T didn’t respond to queries.

A spokesperson of Omers declined to comment.

The sale process received significant traction as about 12 infrastructure-focused funds as well as strategic investors including IRB Infra, Cube Highways, Macquarie, Actis, CDPQ and KKR among others had shown interest.

IndInfravit Trust was established by L&T IDPL in March 2018. It has a portfolio of 13 operational road concessions in Karnataka, Maharashtra, Rajasthan, Tamil Nadu and Telangana. In the first half of FY22, the trust reported a net loss of Rs 226.5 crore on an operating income of Rs 788.1 crore against a loss of Rs 470.1 crore on an operating income of Rs 1,490.5 crore in FY21, largely due to the pandemic and lockdowns.