Canadian fund CPP Investments (CPPIB), Singapore’s government-owned Temasek and Swedish buyout firm EQT AB that owns Baring Private Equity Asia are among a bunch of suitors in separate talks to acquire a significant minority stake in J M Baxi Ports & Logistics, owned by the eponymous Mumbai-based group.

The company is planning to raise about Rs3,000-3,300 crore (350-400 million), including Rs 1,200-1,500 crore by selling fresh shares, two people aware of the development said. Existing investor Bain Capital will sell the remaining shares, they said.

Non-binding bids are awaited, added the people.

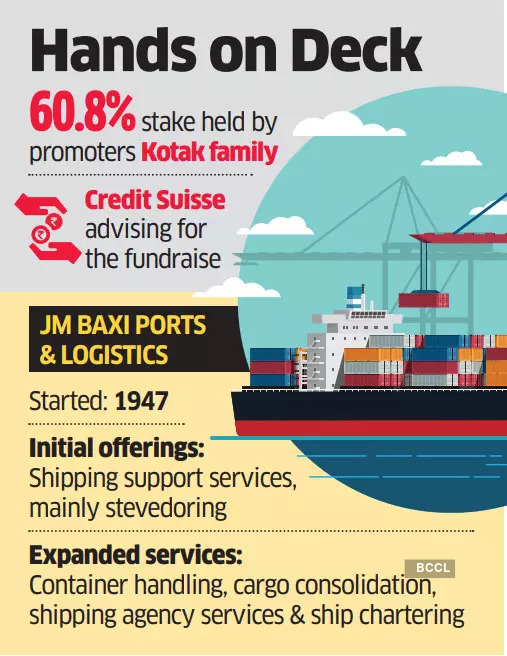

The Kotak family owns 60.8% of J M Baxi Ports & Logistics, while the remaining 39.20% is held by Bain Capital, which acquired the stake last year by investing Rs 1,317 crore. Out of this investment, Rs 200 crore was infused in fiscal 2022, which would be utilised for the acquisition of a 26% stake in Visakha Container Terminal from DP World and two purchases under unit JM Baxi Heavy Pvt Ltd.

Credit Suisse is advising the promoters for fundraising.

Spokespeople for CPP Investments, EQT and Temasek declined to comment, while an email and calls made to JM Baxi Group managing director Dhruv Kotak did not elicit any response till press time Tuesday.

J M Baxi Ports & Logistics (formerly International Cargo Terminals and Infrastructure) was set up in 1947 and started as a provider of shipping support services, mainly stevedoring. It gradually expanded to container handling, cargo consolidation, shipping agency services and ship chartering.

At present, it operates one container freight station of 90,000 TEUs at JNPT Port, rail operations with a Category-III licence, a logistics park near JNPT, cold storage at Sonepat, pan-India bulk cargo operations and also carries out bulk cargo handling operations at Rozi Jetty in Jamnagar, Gujarat.

The JM Baxi Group, founded by JM Baxi, Jayantilal Kotak and Manilal Kotak in 1916, is a leading port logistics player in the country with a presence across the value chain, comprising container train operations, container freight stations/inland container terminal, cold storage, warehousing, bulk logistics and port infrastructure.

J M Baxi Ports & Logistics has seven subsidiaries: Delhi International Cargo Terminals, Visakha Container Terminals, Haldia International Container Terminal, Kandla International Container Terminal, Paradip International Cargo Terminal, JM Baxi Heavy Pvt Ltd and Ballard Pier.

“At present, the overall containerisation levels of the cargo handled at various ports remain low in the country which makes the long-term prospects for container traffic favourable. Consequently, the group has witnessed a healthy ramp-up of volumes in its port operations as well as its CFS and rail operations over the years,” ratings firm ICRA said in a recent report. At the consolidated level, the group’s debt levels have increased in FY2022, it said. The company had Rs 1,250 crore of debt as of March 2021.

J M Baxi Ports & Logistics reported a consolidated net loss of Rs5 crore for FY21, against a net loss of Rs46 crore the year earlier. Operating income grew to Rs1,425 crore in FY21 from Rs1,266 crore in FY20.

The company has plans to file a draft red herring prospectus for a Rs 2,500 crore IPO.

“We do need to add more capacity to service our customers, to make sure we scale along with them to meet their logistics requirements to meet their end-to-end supply chain requirements. And obviously, if we need the capital, we need to tap the market,” Dhruv Kotak had told ET in June.

In March, JM Baxi made two acquisitions for Rs 200 crore. It bought the heavy machinery moving business of Allcargo Logistics. It also agreed to buy a unit of Lift and Shift Pvt Ltd that moves heavy equipment and components to locations where large infrastructure or manufacturing projects such as petrochemical plants are set up.

The logistics tech sector in India secured private equity and venture capital investments of $1.5 billion in 2021. Ecommerce-focused logistics firms like Ecom Express are backed by PE majors Warburg Pincus, CDC Group and Partners Group, while Delhivery is backed by the Carlyle Group and Japanese conglomerate SoftBank.