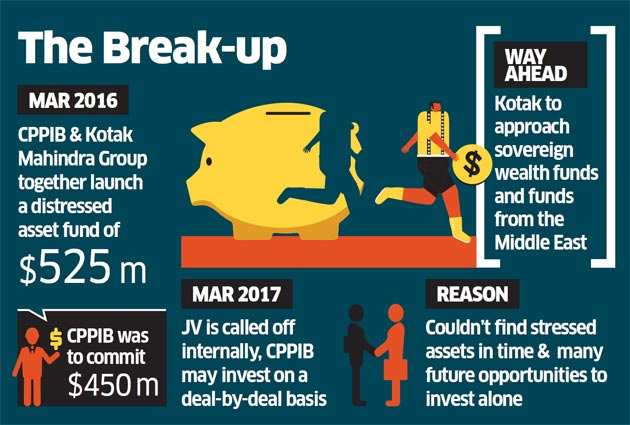

Canada’s largest pension fund CPPIB will call off its proposed joint venture with Kotak Mahindra Group to invest in stressed assets in India. The $525-million fund that was announced in March 2016 will be wound up as it failed to find investments in stressed assets, said two people with direct knowledge of the development.

Kotak Group will now go alone with commitments from some sovereign funds such as Abu Dhabi Investment Authority (ADIA) and Qatar Investment Authority on a deal to deal basis. Both ADIA and Qatar Investment Authority are investors in some of the funds of Kotak.

“Our venture with CPPIB will end by August,” a person with direct knowledge of the development said. “We will now invest from our proprietary book while also looking to join hands with our investors like ADIA and Qatar Investment Authority to buy stressed assets from NCLT.”

Last year, in a joint press release, CPPIB had said it had the ability to invest up to $450 million in the fund that was to have initial corpus of $525 million. “This investment will address the growing opportunity arising from the current stress in Indian banking and corporate sectors, and has a flexible investment mandate providing bespoke financing solutions, in addition to investing in stressed asset sales by banks with the aim to restructure, recover and turnaround companies in distress,” the company had said at that point of time.

For CPPIB that changed track by choosing to directly invest in the Indian market after being an investor in PE funds as investors who in industry parlance are called Limited Partners or LPs, a stressed asset fund was part of the larger India specific strategy.

The company claimed the new fund was a step in CPPIB’s strategy to build a diversified credit business and will add to its direct credit investment capabilities in India.

The ‘patient capital’ that was committed to the Phoenix ARC, the arm of Kotak Mahindra Group, aimed to capitalize on the stressed assets market.

A number of funds have been launched to invest in or acquire stressed assets in India as bad loans at banks mount and debt-laden companies seek to generate liquidity by selling assets. In February 2017, IL&FS teamed up with global PE fund Lone Star Funds to create a $550 million stressed assets fund to buy stressed Indian assets from the banking system of $2.5 billion. Last year, Piramal Group floated the largest $1billion distressed fund in joint venture with Bain Capital and this fund is now in talks with steel maker JSW Steel to buy distressed Bhushan Steel. JC Flowers tied up with Ambit Holdings for a $100-million distressed assets fund.

CPPIB may commit capital on a deal by deal basis in such a scenario,” said another person with knowledge of the development said. The alternate assets management business of the Kotak Mahindra group, set up in 2005, has raised around $2.49 billion across different asset classes including private equity funds, real estate funds, infrastructure funds and the special situations credit fund. ICICI and Aion Capital also teamed up to raise a $825 million fund in 2014 but has not been able to deploy much in the last three years.

In response to an email query, a CPPIB spokesperson said, “We have no comment on your story.” Kotak Mahindra Group spokesperson did not respond to ET’s email till press time Sunday.

As stressed loans in banking sector peak, distressed and special situations funds see opportunity in it.

A June 2017 report by global investment bank Credit Suisse titled ‘India Corporate Health Tracker,’ co-authored by Ashish Gupta and Kush Shah, pegs total stressed assets with banks in the fourth quarter of 2016-17 at Rs 14.5 trillion, or Rs 14.5 lakh crore, which is marginally less than the Rs 14.8-lakh crore figure from the December 2016 quarter.