Advent International and Temasek-backed Crompton GreavesBSE 0.43 % and homegrown PE fund Everstone Capital are competing to acquire home appliances brand Kenstar in the final leg of the deal.

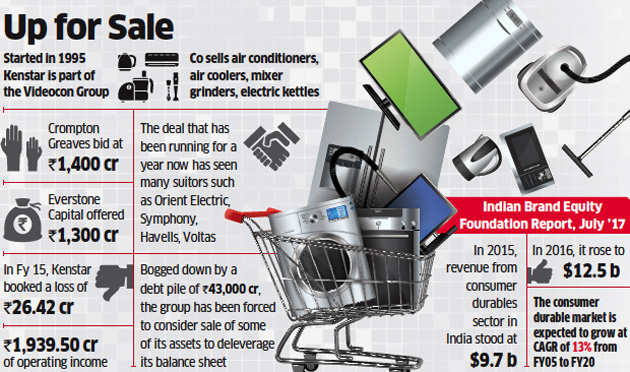

Both have submitted binding offers and are in negotiations with the Dhoot’s of VideoconBSE 5.00 % to enter into exclusive talks. While Crompton Greaves has bid at Rs 1,400 crore, Everstone Capital has offered Rs 1,300 crore for the company, said three people with direct knowledge of the deal.

“Crompton Greaves Consumer Electricals is the frontrunner,” said one of the persons with direct knowledge of the development. The deal that has been running for a year now has seen many suitors such as Orient Electric, Symphony, HavellsBSE 0.48 %, Voltas among others.

Started in 1995, kitchen and home appliances brand Kenstar is part of the Dhoot family owned Videocon Group. The company sells air conditioners, air coolers, mixer grinders and electric kettles and booked a loss of Rs 26.42 crore on the back of Rs 1,939.50 crore of operating income in the financial year ended March 31, 2015. Kenstar commands a healthy market share in different segments and has a strong dealer network. Investment bank Credit Suisse is advising the Dhoot family on the stake sale.

Emailed queries sent to the spokesperson of Crompton Greaves and Advent International did not elicit any response till press-time. When contacted, the spokesperson for Videocon declined to comment.

Weighed down by a debt pile of Rs 43,000 crore, the group has been forced to consider sale of some of its assets to deleverage its balance sheet. Last year, the lenders put pressure on the promoters to sell its Mozambique oil assets to state-run Oil and Natural Gas Corporation (ONGC) for $2.475 billion and its direct-to-home business to Dish TV.

“The promoters initially expected a value of about Rs 1,800-2,000 crore, however, since no bidder was ready to pay the price, the tag has been brought down to Rs 1,500-1,600 crore,” said another person with knowledge of the matter. According to him, Everstone Capital had put in a bid of Rs 1,350 crore for the company.

For Crompton Greaves Consumer that was taken over by private equity funds Advent International and Temasek Holdings in 2015 for Rs 2,000 crore, buying Kenstar would give it a deeper product portfolio that includes home appliances and air conditioners. Crompton Greaves’ current portfolio includes, fans, appliances, lighting, pumps, home automation, integrated security systems and wiring accessories. Crompton Greaves’ market share has since gone up from Rs 5,800 crore to Rs 13,518.9 crore as on date.

According to a July 2017 report by Indian Brand Equity Foundation, in 2015, revenue from consumer durables sector in India stood at $9.7 billion, which increased to $12.5 billion in FY16. The consumer durable market is expected to grow at CAGR of 13% from FY05 to FY20 with around two third of the total revenue being generated from urban population and rest is generated from rural population.

Companies such as Godrej group, Onida Electronics, Blue Star and Videocon IndustriesBSE 5.00 % are a few of the major domestic players operating in India’s consumer durable market. “The consumer durables market is expected to reach $20.6 billion by 2020. Urban markets account for the major share (65%) of total revenues in the consumer durables sector in India.