Deutsche Boerse AG’s proposed acquisition of London Stock Exchange Group Plc may result in about 1,250 job cuts across the companies.

The combined firm would lose a net 700 positions because 550 jobs may be created as part of the deal, Deutsche Boerse and LSE said in a filing today. The new exchange operator would generate pre-tax revenue synergies of at least 250 million euros ($279 million) annually from the fifth year after the deal completes.

“These anticipated revenue synergies are expected to arise as a direct result of the merger and could not be achieved independently,” according to the filing.

Some 200 new roles may be created from “growth initiatives,” and 350 positions from “operational synergies,” the filing said. As previously announced, Deutsche Boerse and LSE expect to cut costs by 450 million euros a year within three years of combining their businesses.

The companies employed 8,700 at the end of last year.

LSE shareholders should vote on the merger on July 4, which will follow the U.K. referendum on whether to remain in the European Union. The companies have said the merger will proceed regardless of the outcome. Deutsche Boerse shareholders have until July 12 to tender their shares.

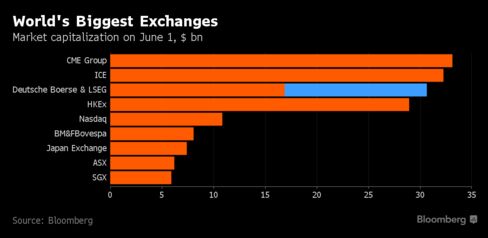

Deutsche Boerse no longer has to fend off a key rival in its pursuit of LSE. Intercontinental Exchange Inc. pulled out of the chase last month, leaving competition regulators and shareholders as the main obstacles to the deal taking place.

In a call to analysts on Wednesday, Deutsche Boerse Chief Executive Officer Carsten Kengeter said the firms’ antitrust application will probably be filed toward the end of June. Kengeter will become CEO of the combined company if the merger is successful.

Source: Bloomberg.com