The Department of Telecommunications (DoT) is set to give conditional approval to the merger of Vodafone India and Idea Cellular in the next couple of days, which will close the largest M&A deal in the sector and bring together India’s second and third largest telcos to create the country’s largest carrier.

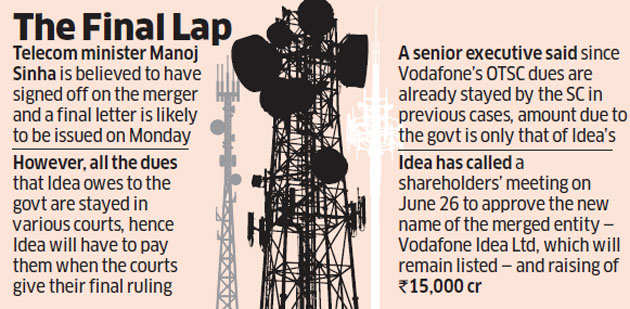

Telecom minister Manoj Sinha is believed to have signed off on the merger and a final letter is likely to be issued on Monday, said people in the know.

The DoT is expected to lay down conditions that Idea Cellular would have to submit a bank guarantee of Rs 2,100 crore as one-time spectrum charge (OTSC) — the market fee for administrative spectrum it holds — and seek an undertaking for paying dues from spectrum usage charge and license fee that both companies owe to the government, as per the merger and acquisition rules. All of these dues though are stayed in various courts, hence the KM Birla-owned company will have to pay them when the courts give their final ruling, whenever that may be.

“The department is likely to issue the letter giving conditional approval by Monday, which will seek the one-time spectrum charge to be paid immediately by Idea, and undertakings to pay dues to be paid in the future, including deferred payments,” said a person aware of the process.

A senior executive said that since Vodafone’s OTSC dues are already stayed by the Supreme Court in previous cases, the amount due to the government is only that of the Idea Cellular’s, which is why the bank guarantee demand is relatively low.

This demand can be challenged by the No 3 carrier in telecom tribunal (TDSAT) and if stayed can give Idea and Vodafone a clear path to merging their businesses. The Supreme Court recently upheld the TDSAT’s ruling asking DoT to allow TelenorIndia’s merger into Bharti Airtel without the submission of a bank guarantee for the OTSC dues.

Idea has called for a meeting of its shareholders on June 26 to approve the new name of the merged entity —Vodafone Idea Ltd, which will remain listed — and raising of Rs 15,000 crore. Vodafone will initially own over 45% in the combined entity with the Aditya Birla Group owning 26%, but both have equal ownership rights. Over time, their shareholding will be equalised as well.

The two telcos have already named the top leadership headed by CEO Balesh Sharma, besides the finance, HR, operations and circle heads.

The merged entity, which has been the result of continuous pressure on tariffs and profitability due to free voice and data offers from new entrant Reliance Jio since September 2016, will be better positioned to fight out in the intensely competitive Indian telecoms market, which has the world’s lowest data tariffs, sector watchers say.

But besides high leverage, Vodafone Idea will have issues of breach in customer market share and revenue market share in some circles, which they will have to bring down below the 50% mark in one year.

In Gujarat, Haryana, Kerala, Madhya Pradesh, Maharashtra and UP West, the merged entity will see its combined customer market share rise above 50%. The circles of Gujarat, Kerala and UP West are the ones where revenue market share will breach this cap. Estimates suggest the merged entity, which will have a market leading 420 million customers and over 37% revenue market share, will have to let go of 14 million customers over the next one year to abide by the merger and acquisition rules.

Source: Economic Times