Dr Lal PathLabs, India’s largest diagnostic chain, is looking at a potentially large acquisition to increase its foothold in south India. If the asset is of a strategic fit, it could look at a deal size of Rs 3,000 crore-Rs 4,000 crore, said a senior company official.

“We have around Rs 1,000 crore (net) cash, we can leverage our balance sheet, we can use our equity, size will not hold us,” said Ved Prakash Goel, group CFO, in an interview to ET. “There are people who are there in the market, the (valuation) expectation is high,” Goel said.

Dr Lal is typically looking at assets with Rs 300-400 crore revenue, with the right revenue mix, good quality and governance practices. It has formed an M&A team to evaluate potential acquisition opportunities in the market.

“In south, we are open to looking at M&A opportunities, we did (acquisition of) Suburban (Diagnostics in the Western region). It was our first large sized M&A, so we took about two years to figure out the whole integration process, how do we want to run it, lot of management bandwidth went into stabilising and putting into the growth path, right now the management bandwidth is available, cash on the books are available,” said Shankha Banerjee, CEO of Dr Lal.

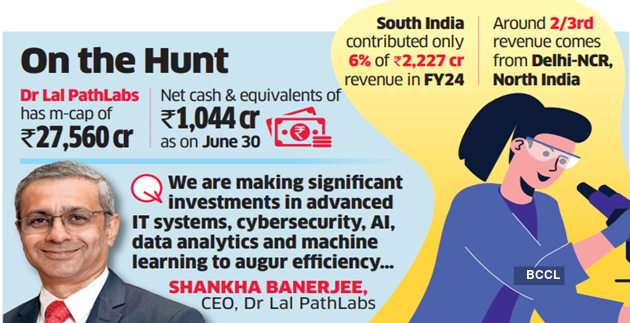

South India has been a weak link for the Gurugram-headquartered Dr Lal, contributing only 6% of Rs 2,227 crore revenue in FY24. Around two-thirds of Dr Lal’s revenue comes from Delhi NCR and the rest of North India. The Eastern and Western regions contribute 15% each.

Dr Lal has a market cap of Rs 27,560 crore, the Gurugram-based company’s stock rose over 60% in the last six months. The company has a net cash and equivalents of Rs 1,044 crore as on June 30, 2024. It has a debt equity ratio of 0.1%.

The promoters led by founder Dr Arvind Lal and his family members hold 54.6% stake in the company.

Dr Lal’s last major acquisition was Suburban Diagnostics in October 2021 during Covid pandemic when diagnostic valuations are all time high. Dr Lal paid over Rs 1,000 crore on Suburban acquisition, which gave it a major entry into Western region, especially Mumbai market, but not many were happy with the steep 18x of EBITDA valuation given to Suburban, whose EBITDA margins masked by huge short term Covid related testing gains. Currently Suburban EBITDA margin is half of Dr Lal’s EBITDA margins of 28% in Q1FY25.

Source: Economic Times