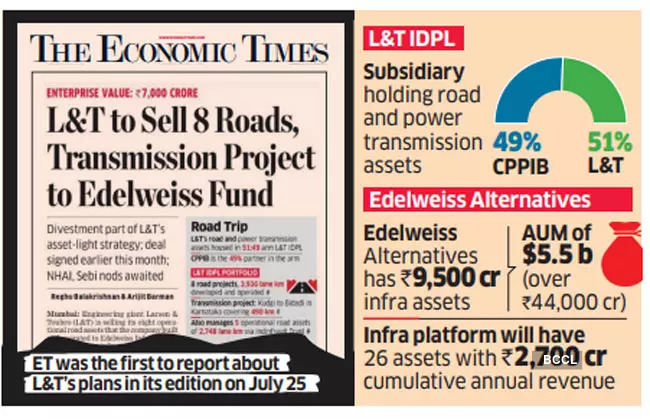

Infrastructure Yield Plus Strategy, the infrastructure platform managed by Edelweiss Alternatives, has acquired 100% equity stake in Larsen & Toubro Infrastructure Development Projects (L&T IDPL) for an enterprise value of about Rs 6,000 crore.

ET was first to report on this transaction in its July 25 edition.

L&T IDPL is the infrastructure portfolio owned by L&T and Canada Pension Plan Investment Board (CPPIB). Equity value of the assets involved in this deal will be Rs 2,723 crore. The portfolio comprises eight roads and one power transmission asset in India, spanning 4,900 lane km and 960 circuit km, respectively.

With this acquisition, the infra platform will scale up to 26 assets with cumulative annual revenue of nearly Rs 2,700 crore. The platform will be a diverse mix of power transmission and substations, renewables and geographically diversified highway assets.

L&T’s road and power transmission assets are all housed under a 51:49% subsidiary, L&T Infrastructure Development Projects. CPPIB is the 49% partner.

“These assets have a proven track record, are geographically dispersed and have long residual life, which is consistent with our investment strategy,” said Sreekumar Chatra, managing director, Infrastructure Yield Plus. “We believe our asset management and operating capabilities, together with that of L&T IDPL, will help scale up this platform.”

Edelweiss Alternatives has Rs 9,500 crore of infrastructure assets in its domain. It focuses on investing in infrastructure sectors such as power transmission, renewable power and highways.

“Asset monetisation and recycling capital holds the key to value creation and development in infrastructure,” said Subahoo Chordia, head of infrastructure funds, Edelweiss Alternatives.

Scaling Up

“We will continue to provide solutions to construction companies and developers to recycle capital to fund their growth. On completion of this acquisition, there will be a high-quality diversified infrastructure portfolio of 26 assets across 13 states, making us a leading infrastructure investor in India,” said Chordia of Edelweiss Alternatives.

Edelweiss Infrastructure Yield Plus acquired 74% in French utility major Engie Group’s solar energy assets in India in 2019.

Edelweiss-owned Sekura Energy had also acquired two operating power transmission assets from Essel Infraprojects – Darbhanga-Motihari Transmission and NRSS XXXI (B) Transmission – in 2018.

Since 2010, Edelweiss Alternatives platform has grown to be one of the largest such entities in India, with assets under management of $5.5 billion (in excess of Rs 44,000 crore).