Essar Steel’s insolvency proceedings could turn into a test case for India’s bankruptcy framework with lenders differing on the choice of the so-called interim resolution professional (IRP), the entity that will oversee the exercise, according to two people with knowledge of with the matter. One of these is an unsecured lender and has apparently broken with the other banks and opted to pursue its case separately.

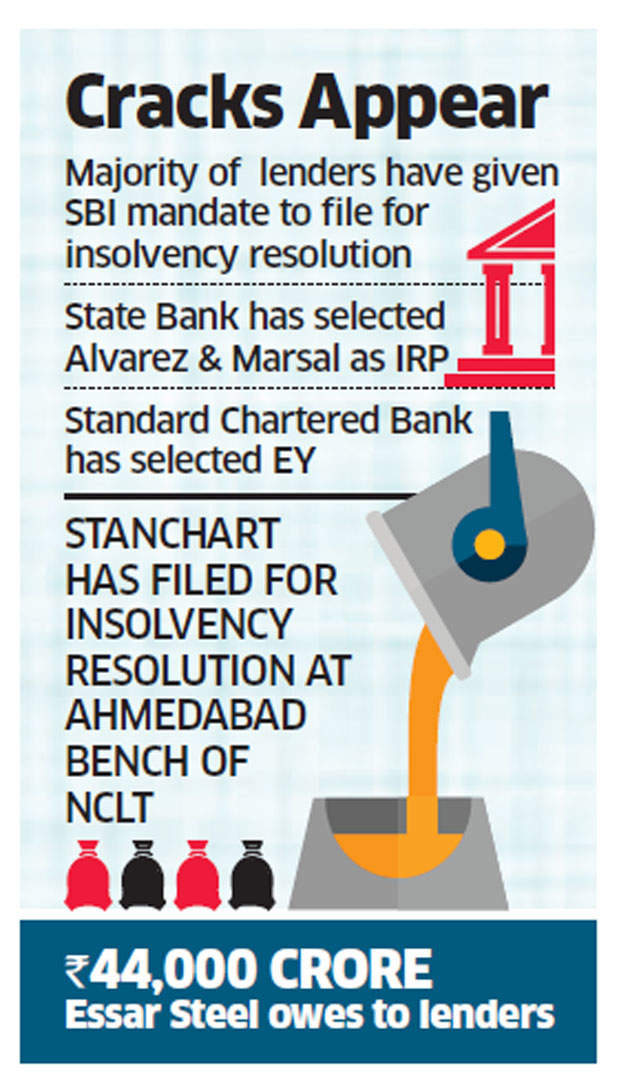

State Bank of India, the lead bank in the consortium of lenders, will file insolvency resolution proceedings against Essar SteelBSE 0.41 % in Ahmedabad’s National Company Law Tribunal (NCLT) bench. Standard Chartered Bank, the unsecured lender, did so a few days ago.

Essar Steel, which owes banks Rs 44,000 crore, is among the 12 companies identified by the Reserve Bank of India for speedy debt resolution through the Insolvency and Bankruptcy Code (IBC). The two banks that have differing claims over the assets of the company are testing the waters on how the NCLT reacts in such instances, said the people cited above.

“Last week, SBI received mandate from 89% of creditors to refer Essar Steel, so we plan to go ahead with it,” said a banker. “We are surprised that Standard Chartered Bank as an unsecured creditor has approached NCLT and not kept other lenders in the loop.”

Standard Chartered declined to comment in response to an email seeking its views. SBI executives too declined to comment.

SBI has hired Alvarez and Marsal as its interim resolution professional (IRP) while Standard Chartered’s choice is consulting firm EY, according to its filing with the bankruptcy court.

“There is some conflict brewing between secured lenders led by SBI and other lenders which is now apparent from the banks are looking at resolving stressed assets,’’ said the banker. “Secured lenders say that Standard Chartered Bank is an unsecured lender and would be entitled to receive their dues only if something is left after all secured creditors’ dues are paid.”