Homegrown private equity fund Everstone Capital is all set to sell its Singapore-based IT services firm Everise Holdings Inc in a deal worth $300 million. The management has hired investment bank Barclays to find a buyer.

Feelers were sent to global strategic buyers as well as PE buyout funds, two people aware of the development said. Everstone holds a significant majority stake in Everise while its co-founder and CEO Sudhir Agarwal holds a minority stake through his firm Sunrise BPO.

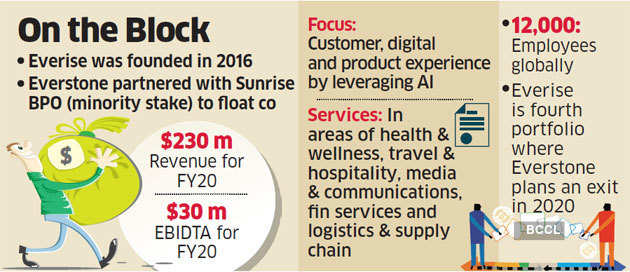

Everstone, which manages assets in excess of $5 billion, had partnered with Sunrise BPO in 2016 to launch Everise and expanded the business through multiple buyouts. Everise has a revenue of $230 million with an EBIDTA of $30 million for FY20.

An Everstone Capital spokesperson declined to comment, while a mail sent to Sudhir Agarwal did not elicit any response till press time. Founded in 2016, Everise has its focus on customer experience, digital experience and product experience by leveraging artificial intelligence (AI). Everise provides services in areas of health & wellness, travel & hospitality, media & communications, financial services and logistics & supply chain.

Everise has 12,000 employees globally with offices in 13 locations including the US, Guatemala, the Philippines and Malaysia. In 2016, Everise had acquired US-based C3 (CustomerContactChannels), a global CRM solutions provider founded in 2010. Through C3 buyout, Everise expanded its presence in seven operating centres across the US, the Philippines and Guatemala, with nearly 8,000 employees.

C3 was Everstone’s third investment through its latest private equity fund, ECP III, which raised $730 million in 2015, and the second investment into the ITES-enabled space after it acquired Servion Global Solutions, a leading customer engagement management firm, in 2014. Following the CR3 buyout, Everise has done a series of acquisitions and partnerships, including a partnership with Microsoft, acquisitions of Malaysia-based Hyperlab and US-based Trusource Labs, besides a joint venture with Korean BPO major UBase in Malaysia.

Everise is the fourth portfolio where Everstone plans an exit in 2020. Everstone has also begun discussions to sell part of its 25% stake in Mumbai-based nutraceutical ingredients player OmniActive Health Technologies. Global private equity investors Goldman Sachs, L Catterton and TPG are in early stages of discussion to acquire a minority stake in OmniActive Health Technologies, ET reported on February 4.

Everstone also plans to sell part of its stake in Burger King India Ltd, the national master franchisee of the American burger brand in India, through the initial public offering (IPO). Everstone, through its investment vehicle QSR Asia Pte Ltd, owns about 99% stake in Burger King India. The fund also plans an exit from Hinduja Group’s non-banking financing arm Hinduja Leyland Finance.

Everstone Capital, founded by former Goldman Sachs bankers Sameer Sain and Atul Kapur, had generated a 4.5X multiple on its investment in homegrown contract research and manufacturing services (CRAMS) major Rubicon Research, which was sold to PE fund General Atlantic last year.

Source: Economic Times