Everstone Capital, the Pan Asia private equity fund, is merging two of its healthcare portfolios as part of an eventual big-ticket IPO plan, said multiple people aware of the development.

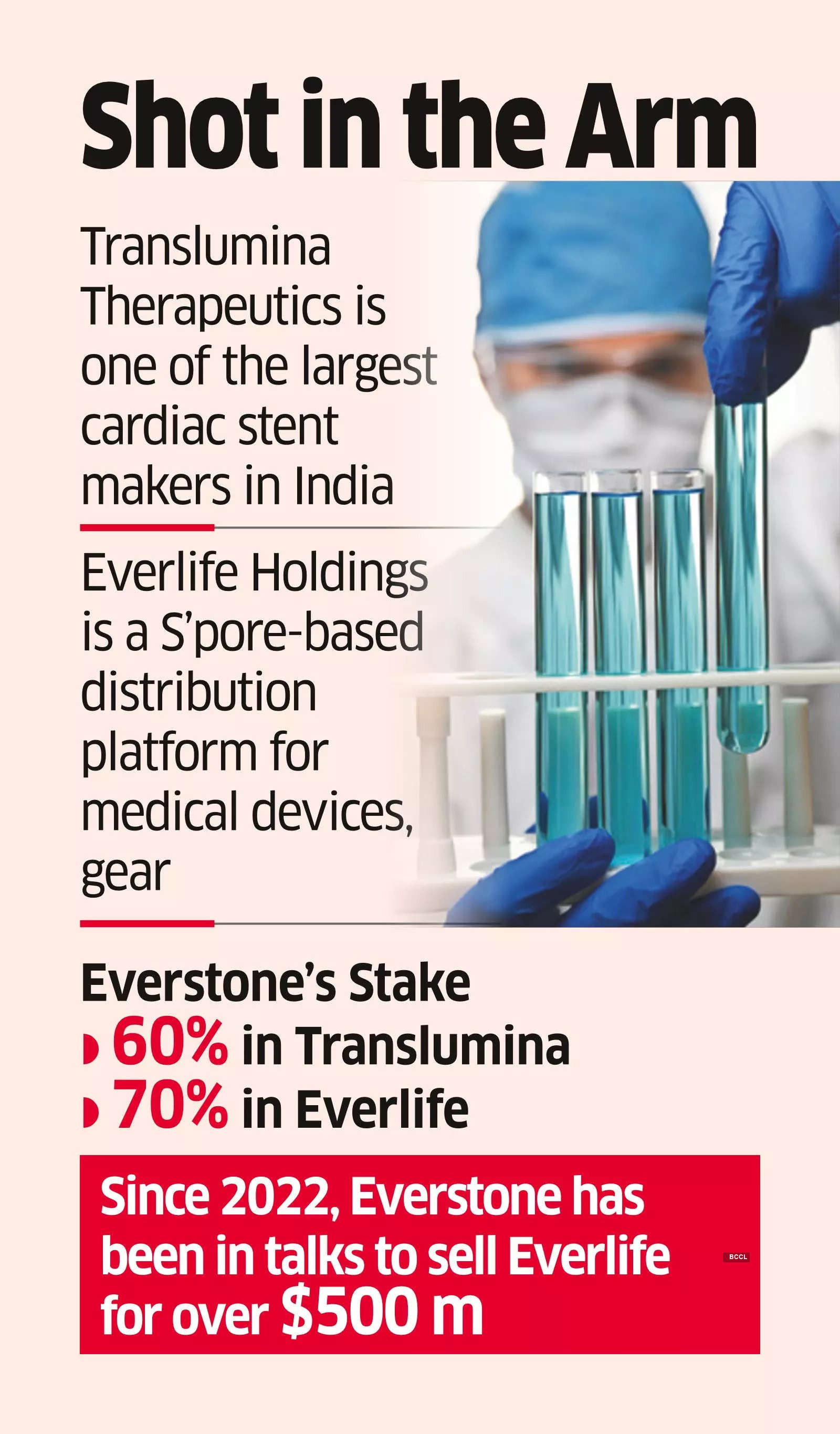

Translumina Therapeutics, one of the largest cardiac stent makers in India, and Everlife Holdings pte, a Singapore-based distribution platform for medical devices, laboratory equipment and supplies, are being merged to form a large healthcare entity, said sources.

The merged entity is likely to be valued at $1 billion, sources said.

The proposed valuation of the merged entity could not be confirmed independently.

As part of the process, a pre-IPO fundraising process was launched and feelers were sent to domestic pre-IPO funds. Everstone holds 60% stake in Translumina and 70% stake in Everlife.

Mails sent to Everstone Capital did not elicit any responses till press time.

Incorporated in 2010 by Gurmit Singh Chugh and Punita Sharma Arora, Translumina is an interventional cardiovascular device company with manufacturing facilities in Germany and India – in Hechingen and Dehradun respectively. In 2019, Everstone Capital acquired the controlling stake in Translumina Therapeutics.

Translumina is one the top three stent manufacturers in India, along with Sahajanand Medical Technologies (SMT) and Meril Life Sciences. It holds 18-20% share of the Indian cardiac stent market. With a current market size of $200 million, this market is slated to be one of the fastest growing in the world, growing at a staggering 14-15% CAGR over next decade, according to the 2023 Avendus Capital report.

It sells a variety of products such as Drug Eluting Stents; Shockwave Intravascular Lithotripsy (IVL); Impella heart pump; Drug Eluting Balloons and vascular accessories. In 2023, it acquired Netherlands-based Blue Medical Devices, and strengthened its presence in balloon catheters including Drug Coated Balloons (DCB).

The company distributes its products in over 50 countries across Europe, Asia, Latin America and the Middle East.

Multiple M&As

Everlife was set up in 2017, and made an acquisition of Malaysia-based medical products and solutions distributor Chemopharm Sdn Bhd. Later, it expanded business via acquisitions.

Everlife partners with major companies in clinical diagnostics to bring a range of diagnostic testing solutions including clinical laboratories, hospitals and clinics. Its portfolio includes analyzers, reagent kits and consumables covering a range of clinical applications and methodologies. Its major clients include Abbott, Edan, Bio-Rad, Nova Biomedical, Fuji Film, Siemens, Mindray, Thermo Fisher Scientific and Chrom Systems.

Since 2022, Everstone had been in discussions with various PE funds to sell Everlife Holdings for over $500 million while the transaction did not materialise.

In the same year, Everstone had sold its majority stake in Maharashtra’s leading hospital chain Sahyadri Hospitals to Canadian fund Ontario Teachers’ Pension Plan Board (OTPP).

Source: Economic Times