Canadian billionaire Prem Watsa’s Fairfax Group and Bain Capital are vying for a buyout of Vadodara-based active pharmaceuticals ingredient (API) maker Farmson Basic Drugs in a deal valuing the company at ₹4,000 crore. “Due diligence has been done by both the private equity firms. The final bids are expected shortly,” said a person close to the development.

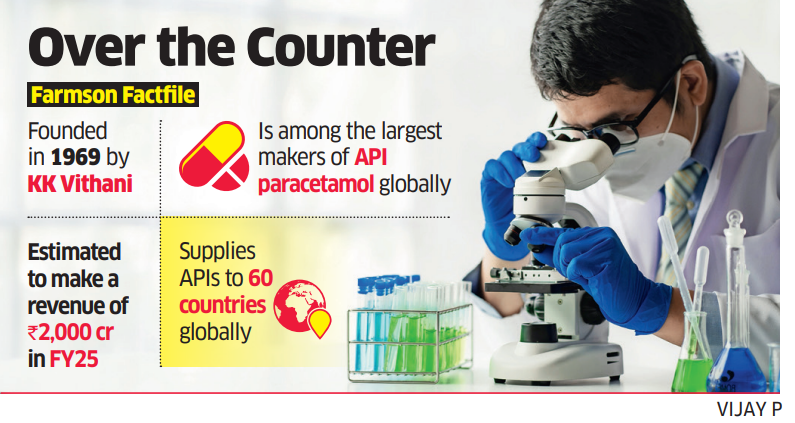

Farmson, founded in 1969 by KK Vithani, is among the largest makers of API paracetamol globally. The company is estimated to make a revenue of ₹2,000 crore in FY25. In FY24, the company made a revenue of ₹1,750 crore and posted a pre-tax profit (Ebitda) of ₹400 crore.

A Bain Capital spokesperson declined to comment, while mails sent to Farmsons, Fairfax did not elicit any responses till the press time. Farmson Basic Drugs (formerly Farmson Pharmaceutical Gujarat) is one of the leading paracetamol manufacturers in India and has the largest installed capacity for paracetamol manufacturing in the country. The company’s plants have various regulatory approvals in place including WHO-GMP by Food & Drug Control Administrative (India), and other countries such as Hungary, Russia and MOH Korea. Its exports constituting around 40% of the total annual sales.

Farmson supplies APIs to major pharmaceutical companies across India such as Sun Pharma, Alembic, Aurobindo, Cipla, Wockhardt, Intas, Ipca and global majors such as Gsk, J&J, Sanofi and Reckitt. It supplies APIs to about 60 countries globally. It has two manufacturing units in Vadodara for manufacturing paracetamol with aggregate capacity of 40,800 metric tonnes per annum (MTPA) and one unit for manufacturing para amino phenol (PAP)-key raw material for paracetamol, which is located at Jhagadia, Gujarat.

Farmsons focuses solely on the manufacturing of paracetamol resulting in concentrated product profile, said a CARE Ratings report. Paracetamol has been the mainstay analgesic and antipyretic since its commercial availability due to its low cost and consistent safety profile, thus mitigating the API obsolescence risk. The absence of any major R&D and a potential product pipeline constrains Farmson’s ability to diversify its product profile and revenue stream, it said.

The Indian bulk drugs/formulations industry is highly fragmented with presence of several standalone bulk drug manufacturers as well as many formulators with backward integration in bulk drug production. Large players with the ability to develop new and complex products have their margins insulated from pricing pressures.