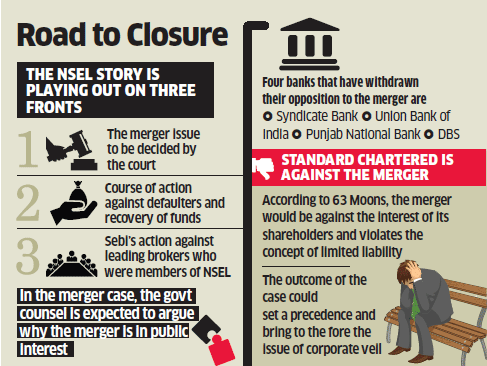

Four years ago this week, thousands of investors in India were shattered to discover that they were victims of a huge fraud at commodity bourse National Spot Exchange (NSEL). The exchange went kaput, arrests and interrogation followed, police and central investigative agencies filed charge sheets and a court battle began to decide whether the rogue exchange should be merged with parent FTIL (now 63 Moons). As the court case enters an important phase this week — government counsel is expected to argue why the merger is in ‘public interest’ — four banks that had lent to 63 Moons and challenged the merger, have withdrawn petitions.

Of these, three are public sector lenders — Syndicate BankBSE -3.27 %, Union Bank, Punjab National BankBSE -1.98 % — along with DBS Bank of Singapore. The only lender which continues to be against the merger is British bank Standard Chartered. The development is being closely tracked by investors, many of whom believe merger is the obvious way to salvage their money as the parent cannot distance itself from the subsidiary in which it held more than 99 per cent equity stake. According to 63 Moons, a merger would be against the interest of company shareholders and violates the concept of limited liability.

The outcome of the feud could set a precedence and bring to the fore the issue of corporate veil. The NSEL story is playing out on three fronts. First, the merger issue that would be decided by the court. Second, the next course of action against defaulters to the defunct exchange and possible recovery of action against defaulters to the defunct exchange and possible recovery of funds from assets that have been attached by law enforcement authorities. Third, Sebi’s action against leading brokers who were members of NSEL and acted as intermediaries in trades between investors and defaulters.

The Securities and Exchange Board of India (Sebi) has issued show cause notices to half a dozen brokers despite its observation that spot and ready forward delivery contracts (that were traded on NSEL) were not being regulated by the erstwhile Forward Markets Commission (FMC) and the capital market watchdog (which took over the functions of FMC) is not expected to take upon itself any regulatory function with regard to such markets. “It will not be a surprise if brokers explore legal options to challenge Sebi’s jurisdiction on the NSEL matter,” said another person familiar with the scam and the subsequent events following the collapse of the exchange.

NSEL, which was incorporated in 2007, obtained licences under APMC Acts of various states to run a commodity spot exchange. Even as it functioned in a regulatory void, not being under control of Sebi or FMC, the Union ministry of agriculture allowed it to flourish. Only in April 2012, around a year before the scam surfaced, did it question NSEL about the nature of the traded contracts.

The scam

The Rs 5,600-crore NSEL scam surfaced in July 2013 after a payment default by two dozen counter parties, who raised funds from 13,000 investors on the exchange against contracts ostensibly backed by commodity stocks found to be absent. Outstanding dues to investors stand at over Rs 5,000 crore. The government passed a draft order to merge NSEL with its parent FTIL in October 2014, in public interest, under Section 396 of the Companies Act, 1956. The final order was passed in February last year and is being legally challenged by 63 Moons on grounds, among other things, of vitiating the concept of limited liability.