Consumers have started to load their pantries with essentials to avoid stepping out frequently amid a spike in Covid-19 infections and state-level curbs, boosting their sales through both kiranas and ecommerce by up to 20% year on year since Christmas, company executives said.

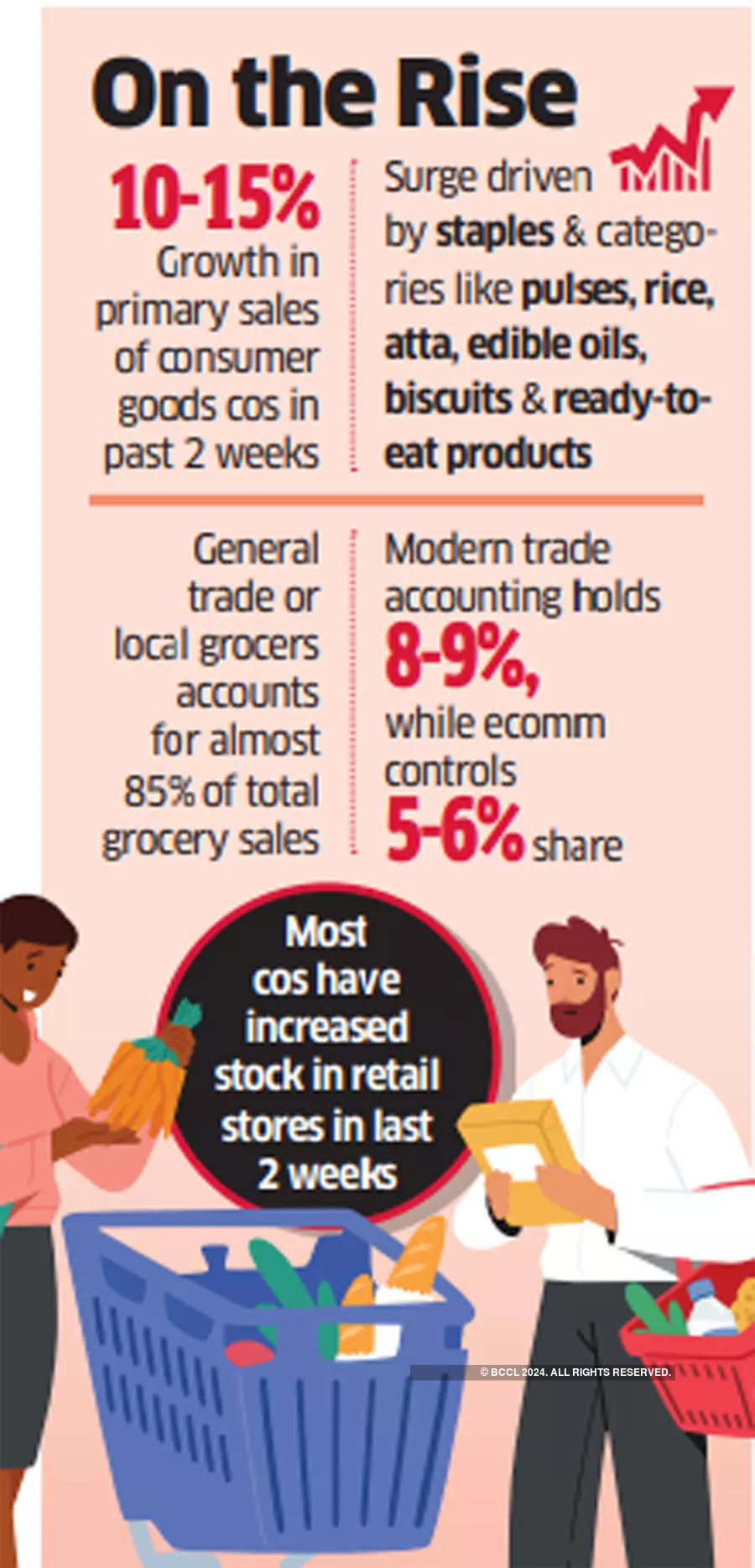

Increasing retail demand, in turn, has boosted primary sales (companies to trade) by 10-15%, reversing the trend during the December quarter when volume growth was low.

The surge is driven by staples, pulses, rice, atta, edible oils, biscuits, instant noodles, and ready-to-eat products.

Parle Products senior category head Mayank Shah said sales offtake has been going up every successive week after Christmas for essentials in a surprise return of pantry loading.

The country’s largest biscuit maker saw sales in general trade and ecommerce surge by 15% in the week between December 27 and January 2 and by 20% last week.

“While sales in modern trade are down, they too are stocking products for their upcoming Republic Day sales,” Shah said. “As a result, the slowdown in the market has reversed and our primary sales have surged by 10-15% after single digit growth in the last 2-3 months.”

The first wave of Covid-19 in 2020 saw huge stockpiling helping food companies post record sales, but during the second wave last year companies did not see such pantry loading.

While stores selling essentials are currently exempted from restrictions such as weekend closure or restricted timings, companies feel consumers are taking a more cautious stance now.

“Consumers are aware that the recent infection cases are not as serious as last year but are still highly contagious,” said Angshu Mallick, chief executive of Adani Wilmar. “So they have chosen to buy in bulk and stock up for a longer period of time instead of venturing out to buy essentials every week.”

Adani Wilmar sells Fortune brand of edible oils. Mallick said its sales have increased 15% in the past few days “primarily driven by the panic buying trend”.

An ITC spokesperson said there has been an overall uptick of 5-6% over usual levels due to the recent Covid outbreak with ecommerce growing by 30% in last fortnight.

“We believe that this will continue for some more time and while overall pantry stocking may not happen the way it did in the first wave, channel shifts to digital channels like ecommerce is bound to take place, depending on the severity of the pandemic, the local mobility restrictions, and reluctance of consumers because of the evolving circumstance,” the person said.

Most companies have increased their stock in retail stores in the last two weeks to minimise disruptions in business due to any supply chain issues.

The surge in sales comes at a time when most consumer goods companies are expected to post a tepid volume growth in the quarter ended December while their revenues grow mainly due to price hikes.

The fast moving consumer goods (FMCG) market is expected to grow 8-10% during the third quarter, its slowest expansion in the past four quarters, said a Crisil Ratings report that analysed more than 50 consumer companies.

A spokesperson of instant e-grocery delivery firm Blinkit said there has been a 25% spike in weekly orders as compared to the previous week. This is driven by packaged foods, with ready to eat, ready to cook, packaged milk and milk products sales up by 200%, frozen foods by 150%, and hygiene products by up to 150%. This spike is most evident in Delhi, Bangalore and Mumbai, the person said.

RS Sodhi, managing director of Gujarat Cooperative Milk Marketing Federation that makes Amul dairy products, said, “We are not seeing any panic buying in the market because consumers feel stores selling FMCG products will not be shut. For us, sales were strong even before the wave and they continued at the same growth rate.”

General trade or local grocers accounts for almost 85% of total grocery sales with modern trade accounting for 8-10% and ecommerce 5-7%, as per industry estimates.

During the first wave in 2020, people rushed to stock up on packaged food products across categories in bulk after several states imposed stringent curbs on inter-state movement and production. This time, the trend is mostly restricted to essentials.