Future Group has proposed that 45% of its debt will be transferred to the books of Reliance on the sale of assets but lenders are jittery since they haven’t yet received any assurance from the hypermarket operator on whether the offer is endorsed by the acquirer, said two people aware of the development. They are to vote this week on a plan that involves the multi-stage sale of Future Group’s assets to Reliance-linked entities.

The lack of assurance has raised concerns among lenders over RIL acquiring Future’s assets as per the terms of the August 2020 agreement, the people said.

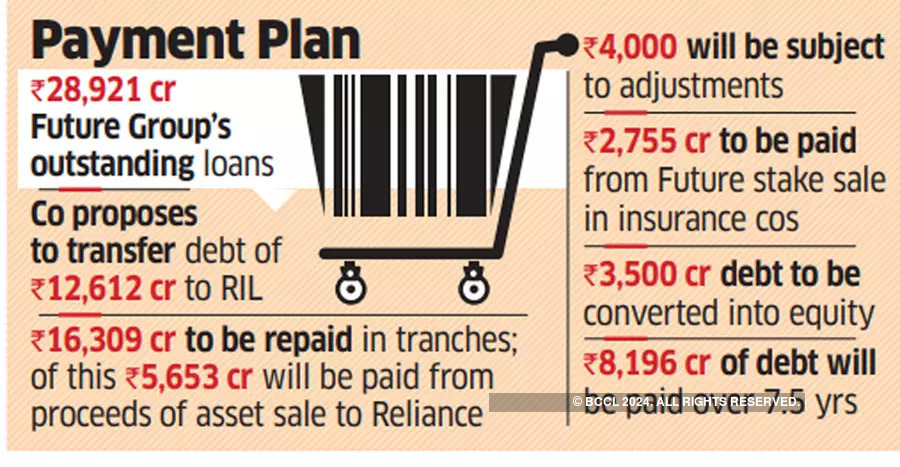

Against outstanding loans of Rs 28,921 crore owed by the 19 companies involved in the deal as of January 31, 2022, Future Group has proposed a transfer of Rs 12,612 crore owed to lenders, and domestic and offshore bondholders to RIL, said one of the persons cited above.

Almost all of the remaining Rs 16,309 crore will be through staggered payments to lenders. Some of this will be from the cash received from Reliance, some from the sale of stakes in its insurance joint ventures and a part by converting debt into equity, as per the proposal given by Future to lenders.

Future Group and RIL didn’t respond to queries.

The plan also states that the payment to lenders may be reduced if RIL-linked companies take control of the stores that are currently run by Future Group entities, said the people cited above. This has added another layer of uncertainty to recoveries, they said. The plan does not specify the amount that would be reduced per store taken over by Reliance, the first person said.

State Bank of India has written to Future Retail on the company’s stores taken over by Reliance, BloombergQuint reported on Tuesday, citing an April 18 letter from the lender. SBI has said lenders have rights over stock, moveable fixed assets at all the outlets, it said. In the event of a sale, all the money has to be used to settle dues of lenders.

Reliance took control of 946 of 1,500 stores of Future Retail a few months ago citing non-payment of rental dues. Effectively, Future promoter Kishore Biyani is no longer in control of half the stores that generate revenue. The inventories in the stores were the key assets pledged with domestic lenders while furniture and fixtures were pledged with offshore bondholders. Inventories and furniture will be valued at a fraction of the borrowings, according to a lender.

Meanwhile, Future Enterprises Ltd informed the stock exchanges on Tuesday that it has defaulted on payment of Rs 29 crore as interest on non-convertible debentures.

Future’s plan states that Rs 5,653 crore will be the cash payment to Future Enterprises Ltd (FEL) for the slump sale of assets. However, about Rs 4,000 crore will be subject to adjustments and Rs 2,755 crore would accrue from the sale of Future’s stake in life and non-life insurance companies. Debt of Rs 3,500 crore will be converted into equity and Rs 8,196 crore will be paid over 7.5 years.

For lenders, the distribution of the proceeds will be a deciding factor to vote on the plan. If a significant share of the outstanding loan is absorbed by Reliance, lenders would be in favour of the scheme. They will be reluctant if a large portion of the loan remains on the FEL books. This is mainly because Reliance is a triple-A rated entity that gives lenders comfort on timely payment of their dues while FEL would be a shell company run by Biyani after the slump sale and currently has a junk rating.

Shareholders and creditors are scheduled to vote on the scheme on April 20 and April 21, respectively. For the scheme to be approved, at least 51% of the creditors by value present during the meeting will have to vote in favour of the plan.

The vote is set to take place as lenders seek recovery of their dues in bankruptcy court from Future Retail, the flagship company of Biyani’s Future Group. Also, hearings are to resume at the Singapore International Arbitration Centre (SIAC) on the sale of retail assets to Reliance following an objection filed by Amazon.

The Rs 24,713 crore scheme of arrangement was signed between Future Retail and Reliance Industries in August 2020. The deal is stuck due to the legal challenges posed by Amazon. The ecommerce giant has alleged that as per the terms of its investment in Future Coupons in 2019, the promoter is barred from selling its stake to Reliance-linked entities.

Under the August 2020 scheme of the arrangement, Future Group will first merge 19 of its businesses including logistics, warehousing, retail and wholesale units into FEL. Thereafter, the logistics and warehousing businesses would be sold to Reliance Retail Ventures Ltd and the retail and wholesale businesses to Reliance Retail & Fashion Lifestyle Ltd.