NEW DELHI: Kishore Biyani’s recent partnership with Paytm for selling Big Bazaar products on the latter’s site is part of his broader strategy to build an alliance with Alibaba, Paytm’s largest shareholder.

Alibaba plans to debut it’s business-to-consumer (B2C) site Tmall in India in 6 months and one of the options being considered is morphing the Paytm marketplace into Tmall, said two people aware of the matter.

Biyani’s Future Group will be a key seller on Alibaba’s B2C platform, they said. They added that Biyani has ended Future Group’s exclusive selling arrangement with Amazon that was forged in October 2014.

Future Group is India’s biggest retailer and home to chains such as Big Bazaar, Easyday, and Central.

“India is an important emerging market with great potential and we are absolutely committed to developing this market for the long term. But we do not in principle discuss market speculations about our business plans in the media,” an Alibaba spokesperson said.

Future Group said it wouldn’t respond to market speculation. A Paytm spokesperson said Alibaba would be best placed to respond on questions about its plans for India.

“We are not aware of Alibaba’s plan for India. They are a great strategic investor for us. Our tie-up with Future brand is part of our larger strategic initiative of enabling O2O commerce. We are aggressively working on getting more such brands on the Paytm platform. Through the marketplace, we are focussing on offering options to our customers across both unstructured as well as structured goods. We will continue to build our platform with many such partnerships,” a spokesperson for Paytm said.

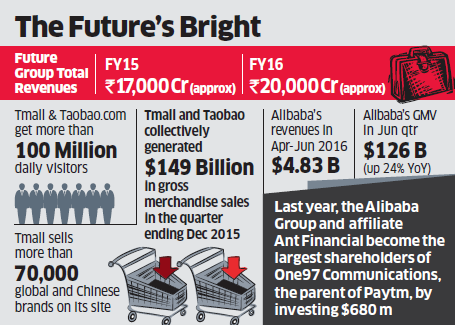

Tmall and twin B2C marketplace Taobao. com get more than 100 million daily visitors in total. Tmall, which calls itself the “5th Avenue of E-commerce”, sells more than 70,000 global and Chinese brands on its site. Tmall and Taobao collectively generated about $149 billion in gross merchandise sales for Alibaba in the quarter ending December 2015.

Alibaba to disrupt sector

Alibaba’s entry into India could disrupt a burgeoning e-commerce sector that’s led by Amazon, Flipkart, and Snapdeal.

Last year, Alibaba Group and affiliate Ant Financial become the largest shareholders of One97 Communications, the parent of Paytm, by investing $680 million, reflecting its drive to gain a foothold in the market.

India’s Internet and e-commerce market are expected to swell to $137 billion by 2020, up from about $11billion in 2013, according to a recent Morgan Stanley Research report.

Biyani ended the agreement with Amazon amid differences over its discounting strategy, said the people cited above. Future Group and Amazon India formed a partnership in 2014 to sell the Mumbai-based retailer’s fashion products exclusively.