Banks have recovered a cumulative ₹1,266 crore from Future Enterprises Ltd(FEL) after the group completed the sale of its general insurance business to its Italian partner Assicurazioni Generali S.p.A, in what is a rare recovery for banks from the debt-laden group.

The money was divided among banks earlier this week in the proportion of their debt as it was part of the restructuring plan initiated in 2021, four people familiar with the deal said.

That is not all. As per the plan, banks are also entitled to the proceeds from Future’s remaining 26% stake in Future Generali India Insurance Company.

“The stake sale was completed over the weekend and the money was remitted to the lead bank, in this case, the Central Bank of India, which has divided the proceeds among lenders. It is a small amount considering the huge amount the group owes to banks but there is some recovery nevertheless which is positive,” said one of the persons cited above.

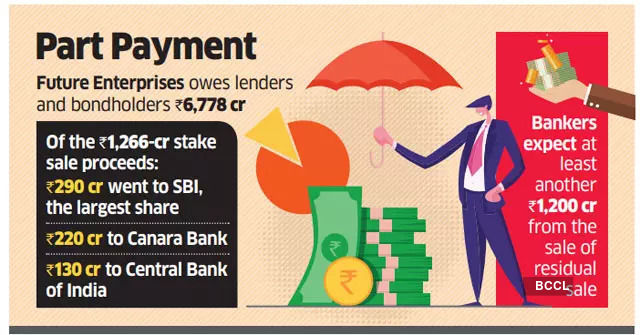

FEL owes lenders and bondholders a total of ₹6,778 crore. Out of the ₹1,266 crore, State Bank of India (SBI) received the largest amount of ₹290 crore followed by Canara Bank (₹220 crore) and Central Bank (₹130 crore).

“The money received was because of the one-time restructuring plan initiated by banks on FEL in 2021. According to that deal, Future will completely exit the general insurance business and the money will be paid to banks. So we are expecting at least another ₹1,200 crore from the sale of the residual stake,” said a second person aware of the deal.

After the sale of the stake, Generali owns 74% of the general insurance venture, the highest permissible according to local rules. “We are expecting the sale of the remaining 26% stake in the next one month or so, which could also lead to some recovery. In total, banks had accounted for about ₹2,300 crore from the sale, out of which approximately half has come. This recovery is crucial considering the chances of any resolution, in this case, look dim as of today,” said a third person aware of the transaction.

Last month, lenders voted down a proposal from Reliance Retail Retail to take over Future Group’s retail assets.

Bank of India, the lead lender for the flagship Future Retail Ltd, which operates retail stores under brand formats such as Big Bazaar, FBB and Easyday, had last month filed an insolvency petition against the company in the National Company Law Tribunal.

Source: Economic Times