General Atlantic and KKR are among 4-5 private equity firms competing for a majority stake in Faridabad-based hospital chain Asian Institute of Medical Sciences (AIMS), said people aware of the matter. A potential deal is expected to value the North and East India-focused 1,200-bed hospital chain at ₹1,500 crore, the people said.

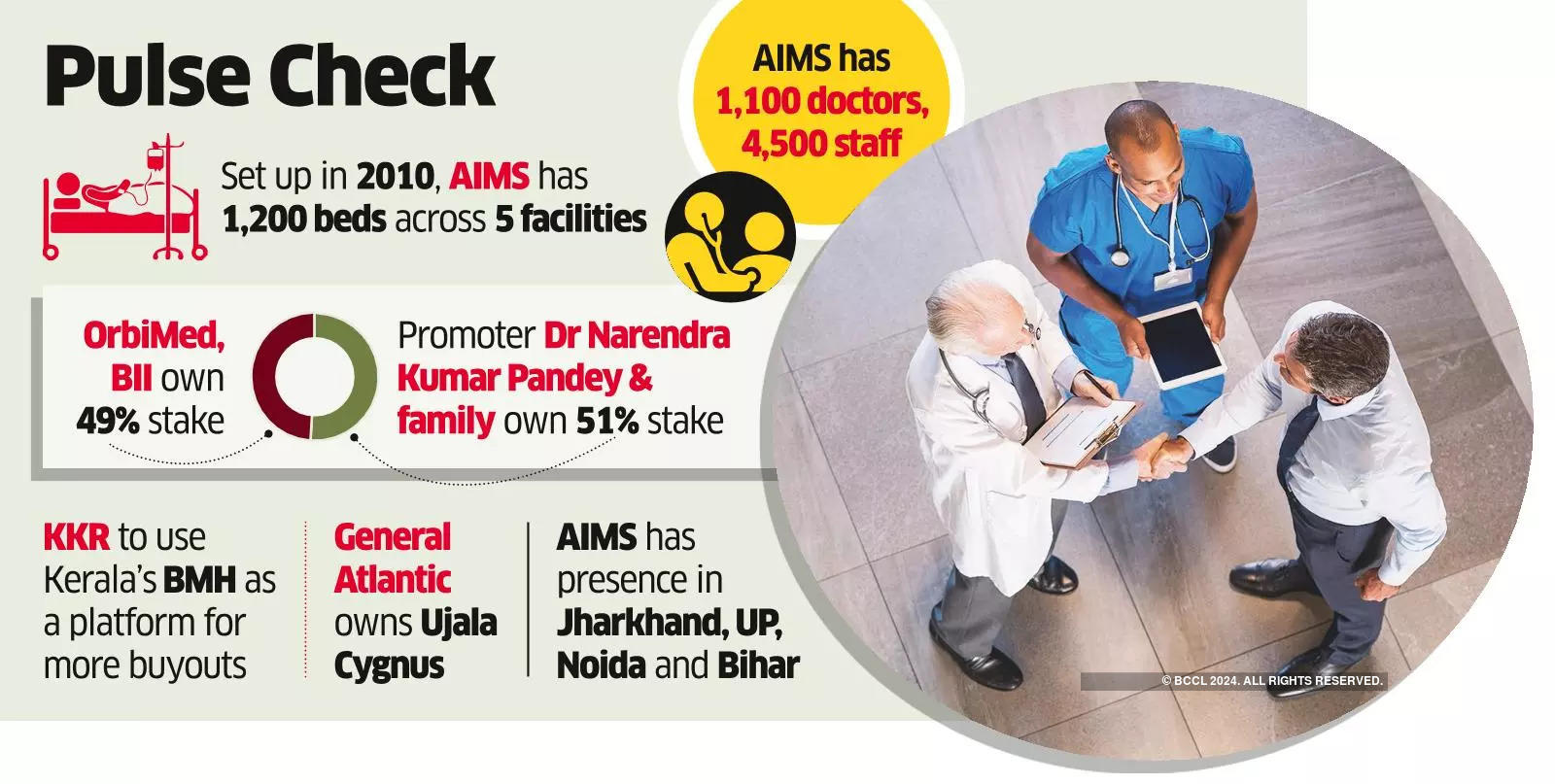

Others keen on the deal include Singapore-based Growtheum Capital and Asia-focused fund Everstone Capital. Funds like India Resurgence Fund (IndiaRF), backed by Piramal Enterprises and Bain Capital, also explored the deal, but eventually decided to withdraw, the people said. US-based PE firm OrbiMed and British International Investment (BII), UK’s development finance institution, collectively own a 49% stake in AIMS. Promoter Dr Narendra Kumar Pandey and family hold the rest.

Besides the existing investors, promoters are also selling a minority stake in AIMS with the exact portion subject to the company’s final valuation, the people said.

Chennai-based Veda Capital has been hired to run the sale process.

The people cited above said the PE firms have submitted their initial bids.

AIMS has a presence across Noida, Uttar Pradesh, Jharkhand and Bihar, comprising a total bed count of around 1,200. Its Faridabad-based super-speciality hospital has about 425 beds.

AIMS has a team of over 1,100 doctors and 4,500 trained professionals, specialising in more than 24 medical fields.

“This is true that OrbiMed and BII as our previous investors are in the process of exit,” said a spokesperson for AIMS, without disclosing further details.

Spokespeople at KKR, General Atlantic, India RF, and BII declined comment, while mails sent to OrbiMed and Growtheum Capital did not elicit any response.

General Atlantic plans to buy the stake in AIMS through its recently acquired hospital chain-Ujala Cygnus. In April, the US PE firm took a significant majority stake in Ujala Cygnus Healthcare Services, a 2,500-bed hospital chain in north India that serves tier-II and III cities through a network of 21 hospitals.

General Atlantic also had a minority stake in Krishna Institute of Medical Sciences (KIMS Hospitals), which it exited recently.

Early this month, KKR acquired about 70% stake in Kerala-based hospital chain Baby Memorial Hospital (BMH) in a deal worth $300 million (₹2,500 crore). It marked the US PE firm’s return to the Indian healthcare space two years after exiting Max Healthcare with a fivefold return.

Leveraging the BMH brand, KKR plans to acquire more hospitals of 500-1,000 beds in various cities and create a platform, Akshay Tanna, partner and head of India Private Equity, KKR had said.