The global private equity major General Atlantic is set to acquire about 70% stake in Ujala Cygnus Healthcare Services, the Delhi-based multi-specialty hospital chain owned by media group Amar Ujala, said multiple people aware of the development. The deal will value the chain at about Rs1600 crore.

GA will acquire about 51% stake held by existing investors – Eight Roads Ventures India, Evolvence India Fund and Somerset Indus Healthcare Fund. Besides the secondary transaction, GA will also acquire a small minority stake from the promoters along with a primary stake, added sources.

The deal is in the documentation stage and will be signed in a couple of weeks, said sources. The investment banking arm of EY advises the stake sale.

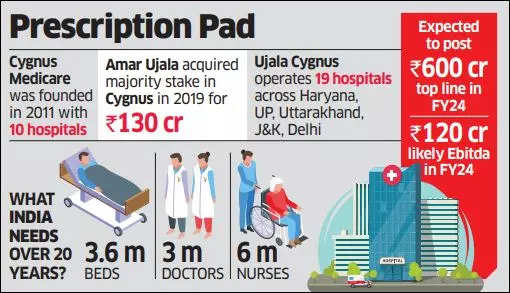

Founded in 2011, the chain operates 19 hospitals across Tier-II and Tier-III cities in Haryana, Uttar Pradesh, Uttarakhand, Jammu & Kashmir and Delhi, and has over 1800 beds. The hospital chain is expected to post a revenue of Rs600 with an EBITDA of about Rs120 crore in FY24, said sources.

In 2019, Leading media firm Amar Ujala Ltd had acquired a majority stake in Cygnus Medicare, which operated a chain of 10 super specialty hospitals, for around Rs 130 crore as part of its expansion plans in the healthcare segment.

Following the buyout, two of Ujala Healthcare hospitals were merged with Cygnus. Amar Ujala held a significant stake along with management control in the merged entity while the balance stake was held by Eight Roads Ventures, Somerset Indus, Evolvence India and previous promoters Dr Dinesh Batra and Dr Shuchin Bajaj.

The company’s future plans are to provide inclusive primary and preventive healthcare access across regions of Uttar Pradesh, Haryana, Uttarakhand, and Jammu & Kashmir, with an aim to establish 10 more hospitals in the next couple of years. The company is also looking to expand its footprints significantly in MP, Rajasthan and Bihar, said the company website.

Mail sent to General Atlantic, Shuchin Bajaj, director, Ujala Cygnus did not elicit any responses.

General Atlantic has its exposure in the Indian healthcare space with investments in Rubicon Research, ASG Eyecare and Hyderabad based KIMS Hospitals.

General Atlantic had invested $130 million in Krishna Institute of Medical Sciences (KIMS Hospitals) in 2018 to acquire a significant minority stake in the company. GA exited KIMS after the chain got listed in Indian bourses.

Last year, GA, along with Kedaara Capital acquired a significant minority stake in ASG Eye Hospitals, the largest eye care hospital chain in India, for Rs1500 crore.

The under-penetrated hospital sector in India has turned out to be one among the hot investment destinations for global PE funds. Recently, Blackstone -owned CARE Hospital emerged as the fourth largest hospital platform in India through multiple buyouts.

In October, Blackstone-owned hospital platform Quality Care India Ltd (QCIL) acquired Kerala’s KIMS Health Management Ltd (KHML), making the combined entity (with 3,800 beds) as the fourth largest hospital group after Apollo Hospitals, Manipal Health and Fortis Healthcare. Another PE fund TPG Growth also owns a 25% stake in QCIL.

Canada’s Ontario Teachers’ Pension Plan Board (OTPP) owns a significant majority stake in the Maharashtra-based Sahyadri Hospitals Group while Asia-focused fund Baring PE Asia owns a minority stake in Hyderabad based AIG Hospitals.

Singapore government owned Temasek has a wide presence in the Indian healthcare sector with investments in Manipal Hospitals and Kolkata based hospital chain Medica Synergie.

The Indian healthcare segment has been growing at a compounded annual growth rate (CAGR) of about 22% since 2016. At this rate, it is expected to reach $372 billion in 2022, said a 2021 Niti Ayog report. A 2020 Human Development Report showed that India ranked 155th in bed availability with five beds and 8.6 doctors per 10,000 people.

The hospital industry will require an investment of around $245 billion over the next 20 years, according to a recent PwC report. India needs to add 3.6 million beds, 3 million doctors and 6 million nurses over the next 20 years, it added.