Singapore’s sovereign wealth fund GIC has invested $170 million (₹1,280 crore) to acquire a minority stake in Asia Healthcare Holdings (AHH), the single-specialty hospitals platform backed by TPG Growth.

In one of the largest deals in the single-specialty healthcare services sector, GIC has acquired about 40% stake in AHH, which owns India’s largest mother & childcare hospitals chain Motherhood and leading fertility chain Nova IVF, said people in the know.

TPG Growth holds the remaining 60% of AHH after the GIC investment.

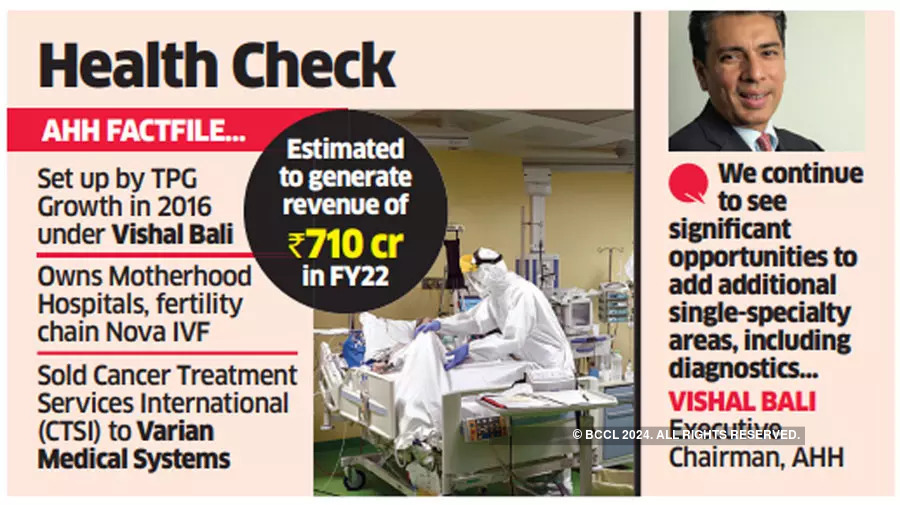

Incubated by TPG Growth in 2016 under the leadership of former chief executive of Fortis Hospitals Vishal Bali, AHH has invested about $200 million across healthcare enterprises that specialise in oncology, mother & childcare and fertility.

AHH was launched in 2016 with the acquisition of Cancer Treatment Services International (CTSI), which then operated a facility in Hyderabad. In 2019, Varian Medical Systems acquired CTSI. With the new funding, AHH will add more single-specialty entities under its network.

“At AHH, we have built a differentiated approach to bridge the demand-supply gap in healthcare services in India and the broader South Asia region by backing single-specialty healthcare delivery enterprises with a combination of capital, operating expertise, and cutting-edge clinical practices to power their growth,” said Vishal Bali, executive chairman of AHH. “We continue to see significant opportunities to add additional single-specialty areas, including diagnostics, and are confident that our operating model, supported by additional capital from GIC and TPG Growth, can achieve similar results across these specialties as well,” Bali added.

Since AHH acquired it in 2017, the Motherhood Hospital network has grown from three hospitals to 16 in 2021, with several other facilities under execution. AHH acquired Nova IVF in 2019 and grew it from 19 IVF centres to 50 centres across 35 cities in India and elsewhere in South Asia.

According to the people, AHH is estimated to generate revenue of ₹710 crore in FY22. AHH is considering entering new areas such as pathology diagnostics.

“For more than five years, we have been committing significant growth capital, resources, and operational skills to create leading single-specialty businesses across the healthcare services continuum under AHH,” said Ankur Thadani, business unit partner at TPG Growth.

“We are pleased to welcome GIC as a long-term partner to grow the platform and continue to drive improvements in healthcare quality and outcomes across a range of specialties and markets,” he added.

“We are delighted to partner with AHH management and TPG to bring our long-term capital, global network and resources to support the growth of the AHH platform,” said Choo Yong Cheen, Chief Investment Officer of Private Equity for GIC.

“The investment fits well with our strategy of investing in secular growth businesses in India,” said Pankaj Sood, GIC’s head of direct investments for India and Africa.