In the single largest commercial property transaction this year, Singapore sovereign fund GIC and Xander Investment Management partnership has acquired a commercial property in Hyderabad from Allianz Group and Shapoorji Pallonji Group at an enterprise value of around Rs 2,200 crore, people aware of the development said.

In May 2023, ET first reported that global insurance and asset management major Allianz Group and Shapoorji Pallonji Group were looking to exit the IT Special Economic Zone (SEZ) property and that GIC had emerged as the frontrunner to acquire the 2.4-million-sq-ft asset.

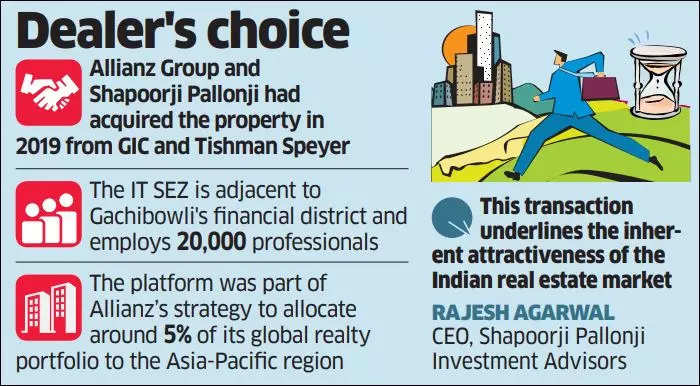

Interestingly, in 2019, Allianz-Shapoorji’s joint platform SPREF II Pte Ltd had acquired the property from erstwhile joint owners GIC and New York-based developer Tishman Speyer. GIC had acquired 50% stake in Tishman Speyer’s WaveRock in 2015 at an enterprise valuation of Rs 1,000 crore.

XIM, the private equity real estate arm of global investment firm, The Xander Group stated that a Xander partnership has acquired a 100% interest in the asset.

“Waverock is a valuable addition to our existing office portfolio in India and will enable us to offer existing and new tenants, premium space in another gateway Indian city… We continue to expand our investment footprint with thoughtful, market leading assets,” said Arpit Singh, Partner at XIM.

The property, with almost 100% occupancy, houses key tenants including Tata Consultancy Services, Accenture, Apple, and GAP. The IT SEZ developed by Tishman Speyer in two phases, which accommodates 20,000 professionals, is adjacent to the financial district at Gachibowli.

SPREF II has stated that it has completed the sale of securities held in TSI Business Parks (Hyderabad) Pvt Ltd (TSIBPH) that owns WaveRock.

The securities held by SPREF II in TSIBPH have been purchased by a joint venture of global institutional investors, marking one of the largest transactions in Indian real estate in 2024-25, Shapoorji Pallonji Group said without specific details of the buyer and the deal value.

“This transaction underlines the inherent attractiveness of the Indian real estate market. It also highlights our team’s experience to acquire good assets and enhance value towards providing profitable exits to our institutional investor partners,” said Rajesh Agarwal, CEO of Shapoorji Pallonji Investment Advisors.

SPIRE Investment Manager Pte Ltd is the investment manager to SPREF II platform. Shapoorji Pallonji Investment Advisors is an investment advisor to SPIRE.

ET’s email queries to GIC remained unanswered until the time of going to press on Wednesday. Allianz declined to comment. Query to Shapoorji Pallonji Group regarding the buyer and valuation also did not elicit any response.

Allianz Group, in its first real estate-related engagement in India, had partnered with Shapoorji Pallonji Group to create an investment platform for acquiring office properties in late 2017. The platform, SPREF II, is a Singapore-domiciled, rupee-denominated, and closed-ended fund with a total corpus of $500 million in equity.

The platform was part of Allianz’s strategy to allocate around 5% of its global real estate portfolio to the Asia-Pacific region. Allianz Real Estate, the real estate investment and asset manager within the group, had entered this platform on behalf of several Allianz companies.

Commercial real estate is a key segment driving these investments over the past few years. Institutions are ramping up their investment portfolios in the backdrop of opening an avenue for monetisation through real estate investment trusts (REITs).