Top buyout funds General Atlantic, TA Associates and KKR are the contenders to acquire a significant stake in ASG Eye Hospitals, the largest eye care hospital chain in India, two people aware of the development told ET. The new investor is likely to acquire about 49% stake in ASG for ₹1,100 crore ($150 million).

In this proposed round, existing investor Investcorp will sell its 15% stake while about ₹700-800 crore will be invested as primary capital, said sources. The deal will value ASG at ₹2,300 crore ($300 million).

ICICI Securities is running the sale process. Binding bids are expected by the end of this week, added sources.

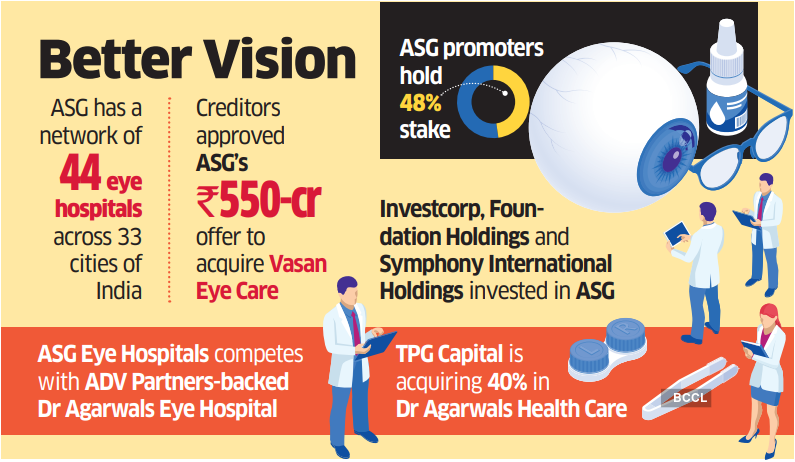

At present, promoters of Jaipur-based ASG hold about 48% stake while the rest is held by existing investors – Investcorp, Foundation Holdings and Symphony International Holdings.

ASG Eye Hospitals is set to sell about 49% stake in the chain and approached a clutch of PE funds including General Atlantic, ET first reported in March.

“ASG is constantly engaged in discussions with various investors and lenders to fuel this growth strategy. ASG prefers not to comment on market rumours and speculation,” said ASG Eye Hospitals spokesperson.

GA, KKR spokespersons declined to comment, while mails sent to TA, Investcorp did not elicit any responses till the press time.

Started in 2005 by Arun Singhvi and Shilpi Gang, ASG offers end-to-end ophthalmology services related to cataract, retina, glaucoma and refractive issues. It has a network of 44 eye hospitals across 33 cities of India.

Through its subsidiaries, ASG also operates eye care centers in Kathmandu, Nepal and Kampala, Uganda. The hospital has more than 180-plus eye specialists from different branches of ophthalmology. Under the NCLT process, creditors had approved ASG’s ₹550-crore offer to acquire the debt-ridden eyecare chain Vasan Eye Care. ASG earns about 69% of its total sales from 5 states – Rajasthan (23%), Bihar (15%), West Bengal (13%), Assam (10%) and Uttar Pradesh (9%) – a recent report from Care Ratings showed. Hence, the acquisition of Vasan is expected to give ASG a stronghold in the South Indian market.

ASG’s total operating income (TOI) increased from ₹90 crore in FY17 to ₹144 crore during FY21.

In its last round, ASG had raised ₹308 crore in a round led by UAE-based family investment office Foundation Holdings in 2019.

Source: Economic Times