Several global auto companies are said to be in the running for a minority stake in SsangYong Motor Co, the ailing South Korean subsidiary of Mahindra & Mahindra. The Indian conglomerate is looking to scale down its involvement in loss-making global subsidiaries and businesses, said several people aware of the matter.

Among potential acquirers are Renault Samsung Motors (RSM) and Mahindra partner Ford Motor Co, said people familiar with the matter. However, the US company denied this.

“Ford is not in discussion to buy a stake in SsangYong. We categorically deny and request you to keep Ford out of speculations as it impacts operations overseas,” the company said in an email.

RSM didn’t respond to emails sent on Sunday. There is no guarantee ongoing talks will lead to a definitive deal, said the people cited above.

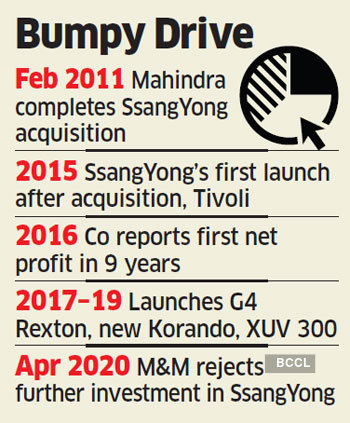

Mahindra acquired a bankrupt SsangYong in 2010. Mahindra hasn’t been able to turn it around despite several attempts. Its board moved a special resolution at its annual general meeting on Friday to reduce shareholding in SsangYong to less than 50% in one shot or in phases, paving the way for a new investor. The company will seek shareholder approval through postal ballot for the reduction in stake “and/or for cessation/extinguishment/change/ modification of control of the company over SsangYong, in full or in part at one time or over time,” it said in a regulatory filing.

However, Mahindra may only be allowed to offload 26% of its total 74.65% holding, as the South Korean government may bar it from exiting. The government may also insist on a small buy-in, said the people cited above. Exact financial details of the potential transaction are still not clear.

“SsangYong is in dialogue with investors and we would announce the status of these dialogues at an appropriate time,” Pawan Goenka, managing director, Mahindra, told ET.

In April, the Mahindra board rejected a proposal to inject fresh equity after the SsangYong management and labour union sought 500 billion won (Rs 3,300 crore) from the Indian parent as emergency funding to restructure business over the next three years.

According to Mahindra’s FY20 annual report, investment in SsangYong stood at Rs 2,450 crore at end of March.

SsangYong quarterly report noted that at end of March, it had 390 billion won ($322.4 million) in short term loans to be repaid in less than a year, of which 167 billion won is from foreign banks — JP Morgan, BNP Paribas and Bank of America. These banks had said refinancing of loans would be jeopardised if Mahindra cedes a controlling stake, with the buyer having to clear all outstanding dues before taking control.

In the face of rising debt, SsangYong sold a service centre in Seoul to an asset management company, raising $147 million. Korea Development Bank has refused any immediate assistance to SsangYong, preferring to fund companies affected by Covid-19. Recently, SsangYong’s external auditor refused to sign its financial statement, citing discrepancies and its “doubtful existence,” as the automaker posted a 98.6 billion won ($82.3 million) operating loss in the first quarter of 2020 and is likely to sink deeper into the red in the second quarter.

“This is the final chance for Mahindra to exit, after which Ssang-Yong may file for bankruptcy,” said a person in the know.

Source: Economic Times