Several global funds are in early stages of discussions to acquire a minority stake in BDR Pharmaceuticals, a mid-size drug manufacturer which has been in the limelight since the start of the Covid-19 pandemic.

Promoters Dharmesh Shah and family plan to sell an about 15% stake in the privately held company to raise about Rs 1,000-1,200 crore, according to people aware of the development. In this first round of fundraising, BDR is likely to be valued at Rs 7,000-7,500 crore.

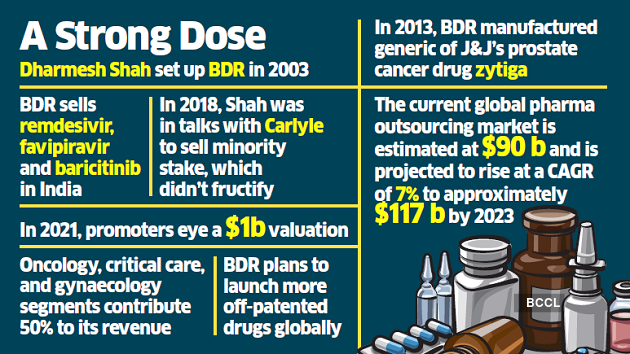

Funds like the Carlyle Group, Warburg Pincus and TA Associates are engaged in initial discussions, the people added. Investment bank O3 Capital is advising the promoters. In 2018, Shah had tried his luck to sell minority stake and had discussions with funds like Carlyle, but it did not fructify.

Spokespeople for BDR and Warburg Pincus declined to comment, while mails sent to Carlyle and TA Associates did not elicit any response till press time on Thursday. BDR is one of the top manufacturers in India of remdesivir, favipiravir and baricitinib, which are used in Covid-19 treatment. It is also the exclusive manufacturing partner of Cipla for remdesivir. Since the beginning of the pandemic last year, the Mumbai-based company has seen a sharp increase in revenue.

BDR sells favipiravir under its brand name BDFAVI, besides manufacturing the drug for

and Indoco Remedies. Recently, BDR got a royalty-free, limited and non-exclusive voluntary licence from Eli Lilly & Co for manufacturing and marketing baricitinib.

BDR has posted revenue of Rs 1,200 crore and operating earnings of Rs 400 crore in FY21, said people in the know. Oncology, critical care, and gynaecology segments contribute 50% to its revenue.

Under its two companies – BDR Pharmaceuticals International and BDR Life Sciences – the BDR Group remains an aggressive player in the manufacturing of active pharmaceutical ingredients and formulation drugs. It focuses on development in specialised therapeutic segments: oncology, critical care, gynaecology and neurology.

BDR has its manufacturing unit, specialised in oncology oral formulations, at Vadodara in Gujarat. It plans to manufacture specialised oncological injectables in dosage forms and a manufacturing site in Halol in Gujarat has been acquired for this, according to the company website. Its API facility for biotech products and another formulation plant is located at Savli, Vadodara.

Dharmesh Shah, who worked with Hetero Pharma since its inception in 1993, left the Hyderabad-based firm and set up BDR Pharma in 2003. BDR, which was into contract manufacturing of finished products for leading pharma players, entered into the field with its own brands with own marketing team and field force recently.

As its future plans, BDR will tap the opportunities in the off-patented drug market globally, especially in biosimilar space, and expand manufacturing facilities accordingly. In India, BDR is a pioneer in manufacturing off-patented drugs in areas like oncology. In 2013, it had manufactured a generic version of Johnson & Johnson’s prostate cancer drug Zytiga (abiraterone) for Rs 30,000 a month treatment against the J&J price of Rs 1.25 lakh.