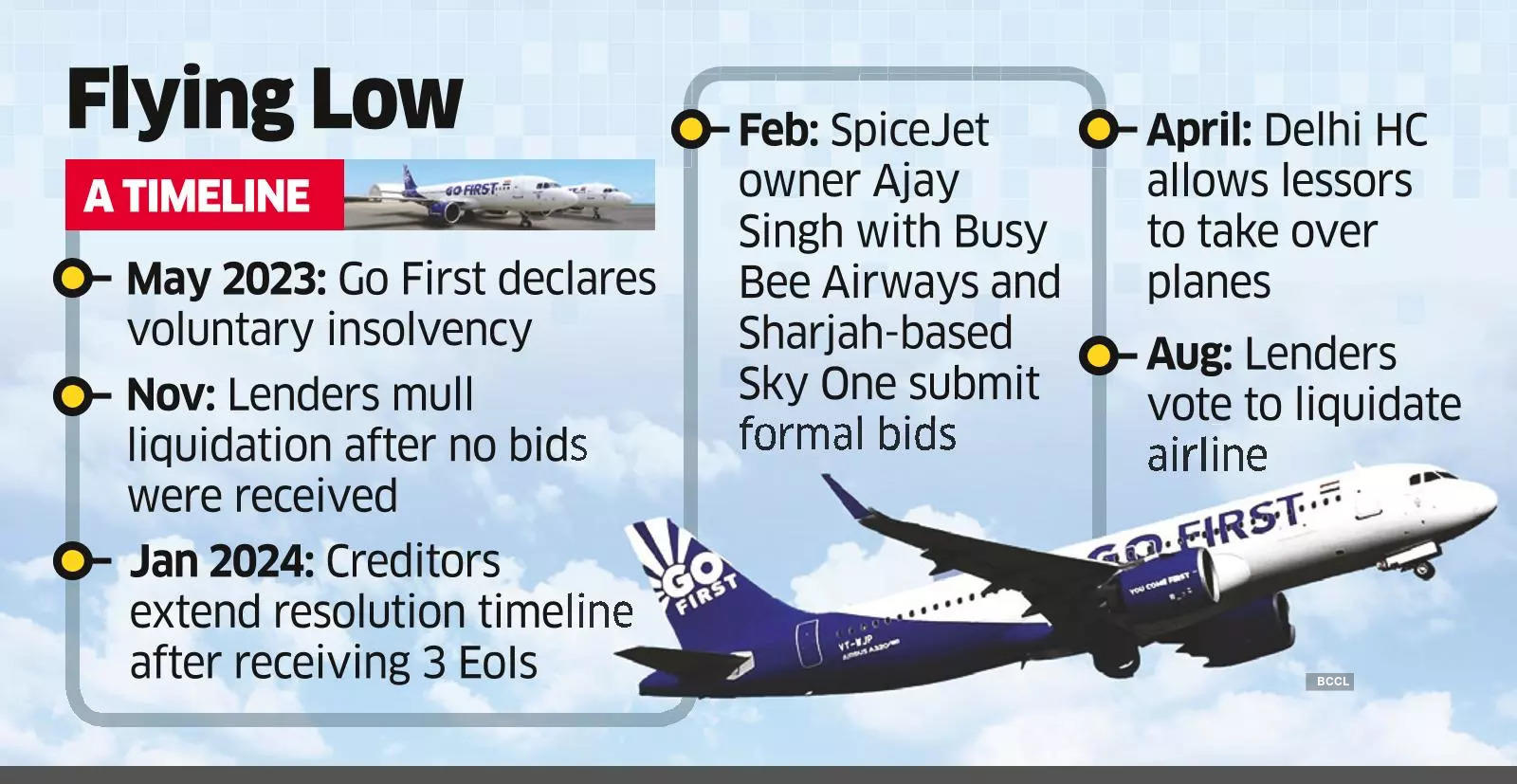

Creditors to Go First Airlines have unanimously voted to liquidate the carrier after almost a year of trying to find a buyer for the Wadia group-promoted company.

A liquidation plea has been e-filed with the Delhi National Company Law Tribunal (NCLT) on Sunday with resolution professional Shailendra Ajmera who has been appointed as the liquidator of the airline, three people familiar with the process said. ET had reported that lenders are moving towards liquidation in its July 17 edition.

“Liquidation was the only option left as both the bids were well below creditors expectations. Saturday was the outer deadline for creditors to make a decision which has now been taken. Now the NCLT will have to approve it,” said one of the persons cited above. Ajmera did not reply to an email seeking comment.

Lenders failed to make any headway in negotiations with both bids from a consortium of EaseMyTrip CEO Nishant Pitti and SpiceJet chairman Ajay Singh, and from Sharjah-based Sky One Aviation-below their expectations.

Although the insolvency process has ended, lenders expect a better recovery from the airline’s ongoing arbitration proceedings in Singapore against US-based engine maker Pratt & Whitney (P&W). Banks led by the Central Bank of India have sought more than $1 billion from P&W, accusing it of supplying faulty engines that were not replaced on time, resulting in the grounding of half the airline’s fleet and leading it to bankruptcy.

Also, on the lender’s recovery plans is a minimum of ₹1,965 crore from an auction of a prime 94-acre land parcel kept as collateral with them in Thane near Mumbai.

“Banks are pursuing recovery from the land collateral separately as it was pledged with them. That and some residual assets of the airlines like plane parts and machinery could fetch some recovery for lenders in the near future,” said a second person aware of the process. Go First owes creditors about ₹6,200 crore. Central Bank of India, Bank of Baroda and IDBI Bank are the secured creditors with ₹1,934 crore, ₹1,744 crore and ₹75 crore of admitted claims, respectively.

The airline has been grounded since May 3 2023 after the erstwhile promoters Wadia group filed for bankruptcy blaming the protracted delays in sourcing aircraft engines from American engine maker P&W. Lenders are still pursuing the arbitration claims started by the airline against P&W in Singapore.

In April, the Delhi high court asked the Directorate General of Civil Aviation (DGCA) to deregister and hand over all the 54 Go First planes to lessors. It also directed the resolution professional to provide all information regarding the airline to the lessors while restraining the airline from taking away any documents or spare parts from the planes effectively extinguishing all value in the airline.

The high court order all but ended hopes of a good valuation for creditors of the defunct airline because the lack of planes meant there was very little in the airline to sell as a going concern, which could derail the ongoing bankruptcy process without hopes of any revival.

Source: Economic Times