The Bhartia family of the Jubilant Group led by brothers Shyam and Hari Bhartia is in advance negotiations with Goldman Sachs to partner with them to acquire a 40% stake in Hindustan Coca-Cola Beverages (HCCB), the wholly owned bottling arm of the US beverage giant in India – the 5th largest market of the Atlanta based beverages giant.

Goldman Sachs is expected to finance the special purchase vehicle (SPV) created to own the HCCB stake, deploying Rs 3000-3500 crore through a convertible preferred equity instrument. A similar sized investment is being made by the Bhartia family themselves, said people aware of the development.

The investment by the Wall Street bell weather will be routed through the fast growing Goldman Sachs Alternatives vertical – an overarching vertical that does growth and private equity, hedge fund, real estate and private credit investments.

As per the terms of the agreement, that is in the getting stitched together, Goldman Sachs has agreed to cap their upside on the investment at 20% IRR with some downward protection. Goldman will subscribe to compulsory convertible preference shares that will get flipped during the planned listing of HCCB to facilitate their exit. Treated as a quasi-equity instrument, these deal terms will not include a coupon as is typical of debt trades. The initial public offering (IPO), expected in the coming 2-3 years, will follow a waterfall mechanism, with senior secured lenders getting priority on repayment. The Goldman investment will sit in between the debt – a lion’s share of which is being raised from mutual funds – and the Bhartia family’s equity.

Coca-Cola listing plans for HCCB, aims to replicate the asset-light, value-unlocking initiative by rival PepsiCo, said the people cited above. The stake sale is seen as a precursor, aiding in price discovery. PepsiCo has outsourced its bottling operations to billionaire entrepreneur Ravi Jaipuria-owned Varun Beverages, whose market value has leaped 47% in the past year and 20x since 2016 listing. The company’s board approved a Rs 7500 crore fund raise from institutional investors to strengthen its balance sheet as competition in the cola segment has heightened following the entry of Reliance Industries Campa.

Coca Cola India saw a sharp 42% drop in its FY24 consolidated profit of Rs 420.2 crore even though it saw a 4.2% topline spurt as per disclosures made to Registrar of Companies, ( RoC)

The Bhartia family has been in discussions with alternative asset managers like Bain Credit, Apollo Global Management, Ares Management, domestic mutual funds and foreign banks to raise over a billion dollars in financing for the acquisition, ET was the first to report in its October 21st edition.

Equity vs Debt

Despite being the biggest investment by the promoters of the pizza-to-pharma conglomerate, the Bhartia family did not want to overleverage themselves. “So, they are only part raising debt financing of Rs 3000-3500 crore from the MF market that is cheaper than M&A financing through the bank market. They spoke to several foreign banks, private credit players but eventually settled for a long-term partner instead of a mezzanine debt provider” said a person aware of the plans, on condition of anonymity.

Goldman Sachs declined to comment. Mails sent to Bhartia family did not get a response.

One of the sources added, sovereign wealth funds like Abu Dhabi Investment Authority (ADIA) and Mubadala (ADIA) too have been approached as well but this could not be independently verified. Goldman is believed to be keen to finance the entire amount themselves. Earlier this year Goldman Alternatives and UAE’s Mubadala signed a $1 billion private credit partnership for Asia Pacific Region. This came after a similar arrangement with Omers signed in 2023.

ADIA declined comment and mail to Mubadala did not generate any response.

The US investment bank’s alternatives platform has been backing several high growth companies in India like Biocon Biologics and API Holdings – the parent of Pharmeasy through similar structured capital infusions. Globally Goldman Sachs Alternatives manages $450 billion in assets. In July, together with Blackstone, the firm supported the take private initiative of L’Occitane International S.A.’s controlling shareholder — Reinold Geiger and related entities – by offering 1.55 billion euro financing capital. Goldman is betting on the growing on the back on growing beverage consumption, including colas in the country.

HCCB too is lining up a $1.5 billion capital expenditure programme over 5 years to invest in additional bottling lines, chillers. This includes plans to invest Rs 3,000 crore to set up a juice and aerated drinks facility in Gujarat, and Rs 350 crore on a new plants in Madhya Pradesh to manufacture sparkling drinks and juice in tetra packs.

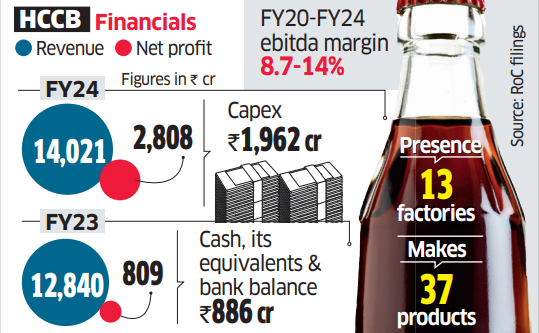

HCCB reported a 9.2% jump in FY24 revenues of Rs 14,021 crore. But its net profit soared 247% Y0-Y to Rs 2808.3 crore as it leveraged distribution scale in new markets including two and three-tier markets and maintained pricing. The company, which now operates 13 factories across India, manufactures and sells 37 different products across eight categories including soft drinks, juices, water, energy drinks and sports drinks.

Parallel Track

The Goldman negotiations are running in parallel to the debt capital raise from mutual funds. Investment bank Morgan Stanley is working with the New Delhi-based Bhartia family on this. The Wall Street bank was also the buy-side advisor in the negotiations. It’s not clear if it will part-finance the deal from its balance sheet and then sell down to other investors in the MF or insurance industry.

So far Jubilant Foodworks, India’s largest food services company, which has the exclusive franchise for Dunkin’ Donuts and Popeyes as well as Domino’s Pizza in India and a few other geographies has been the only exposure of the Bhartia family to the food and beverage services (QSR) industry. In 2019, JFL ventured into the Chinese fast casual segment with its own brand Hong’s Kitchen. Another group entity, Jubilant Consumer Private Limited (JCPL), offers a wide range of fresh produce, ready-to-cook vegetable combo packs, canned products and ready-to-eat fresh meals & snacks under the brand name Fresh Finds, as per the company’s website.

Source: Economic Times