The government received several expressions of interest (EoIs) for the strategic sale of stake in IDBI Bank held by the Centre and state-owned Life Insurance Corporation of India (LIC). A consortium, two foreign banks and a private equity firm are said to be among those that have submitted the paperwork.

“Multiple expressions of interest received for the strategic disinvestment of govt and LIC stake in IDBI Bank,” Tuhin Kanta Pandey, secretary, the Department of Investment and Public Asset Management (DIPAM), tweeted on Saturday. “The transaction will now move to the second stage.”

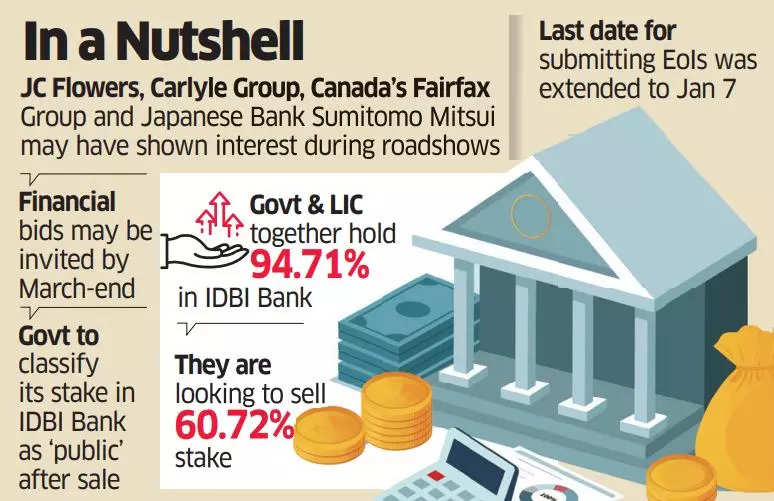

Saturday was the last date for submitting EoIs.

“There are two foreign banks, one consortium and a private equity firm among those that have submitted EoIs for the (IDBI) bank,” a person aware of the process told ET without giving details.

JC Flowers, Carlyle Group, Canada-based Fairfax group and Japanese Bank Sumitomo Mitsui are understood to have evinced interest in IDBI Bank during roadshows held by the government for the stake sale. There has been no official confirmation of those that have submitted EoIs.

The government has said that the potential investor should have a minimum net worth of ₹22,500 crore and have reported a net profit in three out of the past five years to be eligible to bid. A maximum of four members will be allowed in a consortium and the successful bidder will be mandated to lock in at least 40% of the equity capital for five years from the date of acquisition.

The government and LIC together are looking to sell 60.72% in IDBI Bank and had invited bids from potential buyers in October. The last date for submitting EoIs or preliminary bids was initially December 16 but was later extended to January 7. The government and LIC together hold 94.71% in the lender. The successful bidder will have to make an open offer for the acquisition of 5.28% of public shareholding.

“If all goes as per the schedule, the financial bids would be invited by March last week,” said the person cited above.

Min Public Float Norm

The Securities and Exchange Board of India (Sebi) this week allowed the government to reclassify its shareholding in IDBI Bank as ‘public’ post sale, making it easier for the new buyer to meet the 25% minimum public shareholding norm.

The timeline for increasing the public shareholding in the lender will be specified in due course, the government said.

The move was aimed at making the acquisition of state-run companies more attractive for investors, with IDBI Bank being the immediate beneficiary.

Source: Economic Times