The proposed merger between Grasim Industries and Aditya Birla Nuvo (ABNL) is in line with the group’s long-term strategy to shore up promoter holding to 40 percent in all listed entities.

In May 2004, group chairman Kumar Mangalam Birla had mentioned that he wanted to shore up the promoter holding to 30 percent. This was accomplished by December 2010, through a series of restructurings, creeping acquisitions and preferential allotments. This threshold was raised and, in October 2011, Birla stated he wanted to increase the promoter holding to 40 percent.

In September 2013, The Times of India quoted Birla as saying, “We will be happy with a promoter holding of 40 per cent in our group companies”. He would not do it through a share buyback but creeping acquisitions, he had said.

GETTING A FIRM HOLD

In 2004, group chairman Kumar Mangalam Birla said that he wanted to shore up the promoter holding to 30%

Kumar Birla’s wish was fulfilled by December 2010, through a series of restructurings, creeping acquisitions and preferential allotments

In October 2011, Birla stated he wanted to increase the promoter holding to 40 percent

The proposed merger is in line with the group’s long-term strategy

“This has also largely been achieved, except in Grasim where the promoter stake is currently 31.3 per cent. The proposed merger will increase the promoter holding to 39 percent – just a breath away from the 40 per cent target,” Institutional Investor Advisory Services (IiAS) said in a note titled That 70s Show on Monday.

“Across the group, the promoter family’s control over listed companies has been higher than its direct shareholding – an arrangement typically seen in the Indian markets of the 1970s. The current transaction lends itself to yet another of those structures,” IiAS said.

Also Read: LIC, Aberdeen Hold Key To Nuvo-Grasim Merger

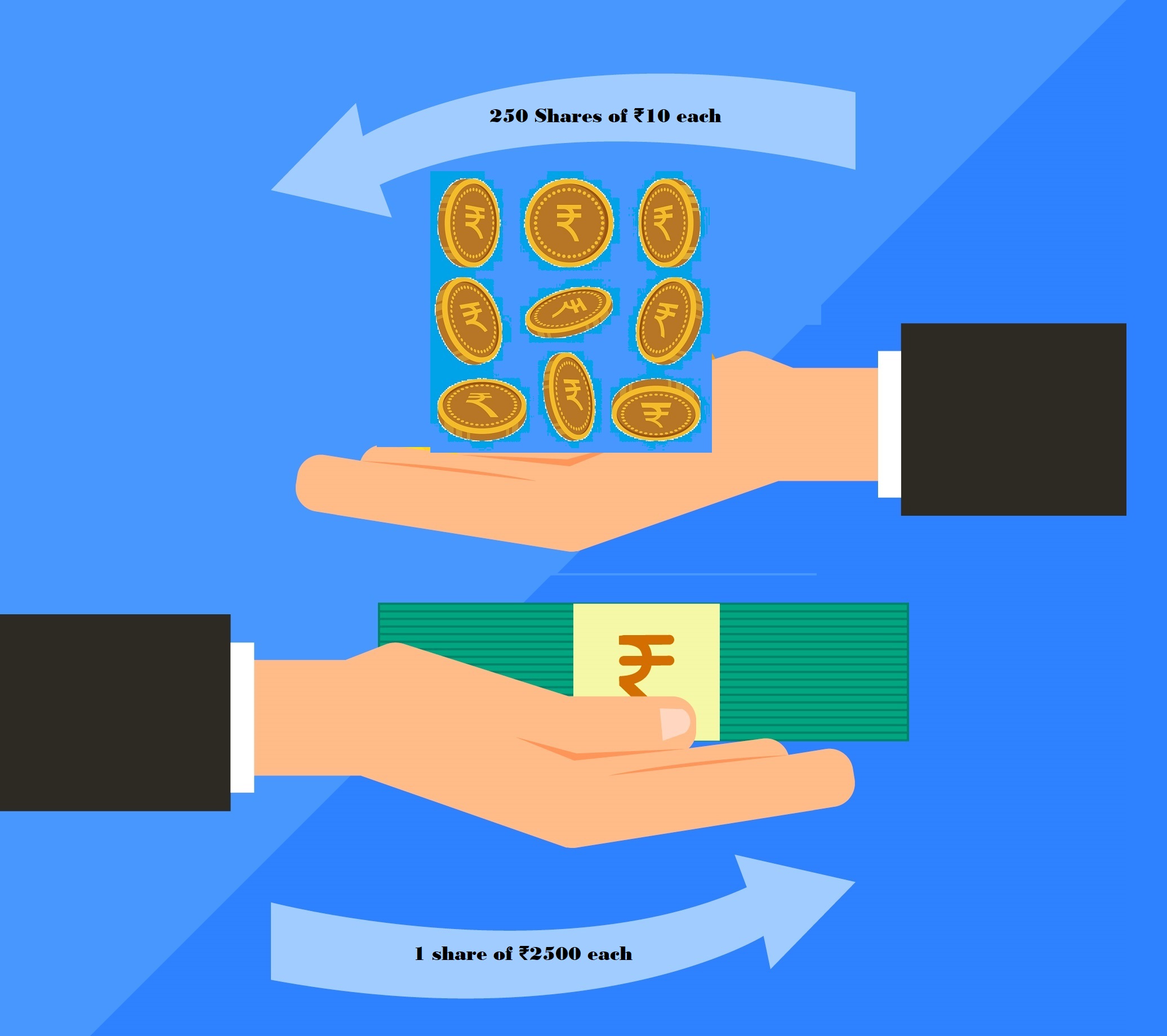

According to the proxy firm, there was a discernible pattern in the way shareholding has been increased. Between 2000 and 2007, the preferred mode was creeping acquisitions. From 2008 onwards, the stake increased, mostly through preferential allotments of shares and warrants. In 2015-16, and with the proposed transaction, the preferred mode to increase shareholding is through corporate restructurings.

The scheme is likely to give the promoter group a higher holding of almost 74 per cent effective ownership of the financial services business (ABFS) once it lists. “Had ABFS been demerged before merging Grasim, its shareholding would have mirrored that of ABNL’s. In such circumstances, the promoter group would have owned just 58.4 percent.”

The Birla Group’s predilection for preferential allotments during the 2007- 2014 years have diluted minority shareholders significantly. For example, in ABNL, between 2007 and 2014, promoter shareholding went up from 40.5 per cent to 57.2 per cent, through preferential allotments, resulting in minority shareholders’ dilution by 28 per cent.

“Once again, through the ABNL merger, Grasim’s minority shareholders will get diluted by 29 per cent, but promoters will have achieved their target of holding 40 per cent. Grasim will be a bigger company, but its shareholders get exposed to financial services and telecom businesses, which are capital-intensive and, given the competitive landscape, likely to remain cash-hungry. Shareholders need to ask themselves: is it worth it?” IiAS said.

Recent Articles on M&A

Source: Business-Standard