HDFC Life Insurance may call off its proposed takeover of the Max group’s life insurance business as the two have not been able to arrive at a mutually agreeable alternative structure for the transaction, which the regulator has rejected in its current form. Also, HDFC Life’s shareholders want to push ahead with listing plans and a merger is likely to delay that by at least a year, several people aware of the development told ET.

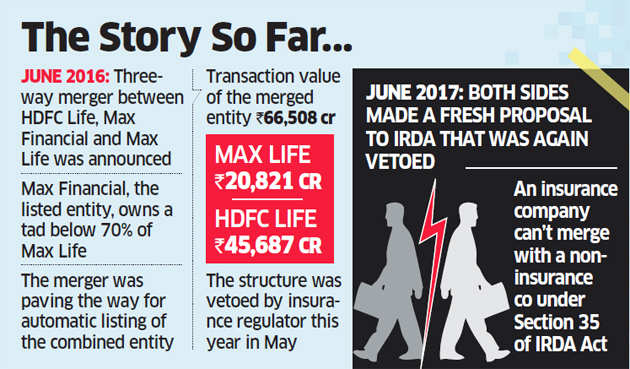

The three-way merger involving HDFC Life, Max Financial Services Ltd and Max Life Insurance that was proposed in June last year was rejected by the Insurance Regulatory and Development Authority (Irda) in May this year.

This was based on the grounds that an insurance company cannot merge with a non-insurance company under Section 35 of the IRDA Act. The original plan called for Max Life amalgamating with parent Max Financial and the resultant entity merging with HDFC Life, paving the way for an automatic listing.

A direct HDFC Life-Max Life merger could have been possible but this didn’t appeal to the Max group as the shares of the merged company would have to be issued to Max Financial, and not the shareholders of Max Financial.

“HDFC Life Insurance’s foreign partner, Standard Life Insurance, which owns a 35% stake, is not inclined to wait anymore as it wants to list the joint venture at the earliest possible and any alternate merger proposal would have taken another year from now, that too without any assurance (that the deal would go ahead),” said an executive familiar with the matter.

HDFC Life is a joint venture between HDFC Ltd and Standard Life. “No comment,” said HDFC Ltd chairman Deepak Parekh, when asked about the development. “We have a board meeting on July 17 and I cannot comment now.” A Max group spokesperson said: “We will have to decline to comment due to the confidentiality agreement.”

HDFC Life is a joint venture between HDFC Ltd and Standard Life. “No comment,” said HDFC Ltd chairman Deepak Parekh, when asked about the development. “We have a board meeting on July 17 and I cannot comment now.” A Max group spokesperson said: “We will have to decline to comment due to the confidentiality agreement.”

HDFC and its British partner had planned a listing of HDFC Life in 2015 when the Indian entity sold a 9% stake to Standard Life for about Rs 1,705 crore, valuing the joint venture at about Rs 19,000 crore, said another top banker familiar with the development. After the sale, HDFC owned a little over 61% of the venture.

Both partners now want to list HDFC Life to provide an exit route for shareholders. “It is about providing an enabling provision of exit window through listing,” said another person. “Any alternate structure for a merger will become a long-haul process.”

Another person said enthusiasm for the deal within HDFC had been inconsistent.