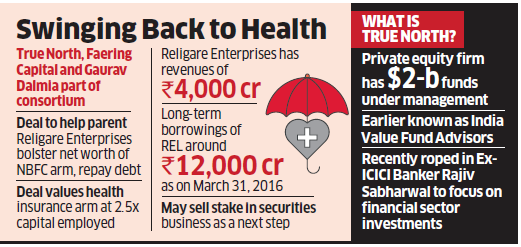

Religare Enterprises Ltd (REL), promoted by Malvinder and Shivinder Singh, is selling its entire 80% stake in Religare Health Insurance Co (RHI) to a consortium of investors led by private equity firm True North.

The deal, which values the health insurance firm at Rs 1,300 crore, will help bolster the net worth of publicly listed REL’s non-banking finance arm Religare Finvest Limited (RFL). Some of the proceeds will be used to repay REL’s debt. The consortium includes domestic investors such as Gaurav Dalmia and Faering Capital. “Since commercial launch in July 2012, RHI has reported steady progress and emerged as a leading standalone health insurer in India,” REL and True North, formerly India Value Fund Advisors, said in a release. “The business reported a gross written premium of Rs 503 crore for the year ended March 31, 2016.”

State-owned Corporation Bank and Union Bank of India own 5% each in RHI while the management has 10% in the form of employee stock options.

Both banks have been partners in the health insurance arm since it was floated in 2012. ET broke the story online Sunday evening, hours before the press release was issued.

“They (True North and REL) have signed the binding agreement on Sunday,” said a person involved in the deal. “The proceeds will be used for infusing capital in the non-banking arm – RFL. It will also be used to repay debt of REL.” The banks weren’t part of negotiations but have the right to exit at the same price, he said. Employees too are entitled to sell their stock.

True North outbid Warburg Pincus and another foreign PE firm thanks to its home base advantage, said the person quoted above. JPMorgan was the financial adviser to the deal.

“Religare wanted to sell control as it needed funds to revive its NBFC business. Warburg Pincus and other funds couldn’t have acquired more than 49% stake in Religare Health Insurance due to the sectoral cap (that applies to overseas owners). And that tilted the balance in favour of True North,” said another person familiar with the transaction. An Indian conglomerate that was also in the race could not match the price.

True North has been making investments in India’s healthcare business. It acquired a 40% stake in the Kerala Institute of Medical Sciences (KIMS) hospital chain for $200 million at the end of March.

ET had reported on January 7 that the Singh brothers were looking to sell management control in key businesses to tide over a cash crunch at the group level. The valuation of Rs 1,300 crore is more than 2.5 times the capital employed in RHI, making it an aggressively priced transaction. The company has about Rs 525 crore of capital employed. In FY2016, it posted revenue of about Rs 510 crore. FY2017 revenue growth is estimated at about 50% but the company is yet to announce results.

SECOND DEAL

This is the second transaction by REL in the last few months, having sold Religare Wealth Management (RWM) to the Anand Rathi Group for an undisclosed amount in February. RWM has assets close to Rs 4,500 crore while Anand Rathi has total assets worth Rs 10,000 crore under management (AUM) catering to high net worth individuals (HNIs).

REL is also said to be in talks to sell its securities business. RHI is engaged in the distribution and servicing of health insurance products. It operates through a combination of distribution channels including agents, insurance brokers, and banks. It has 56 offices and 2,200 employees, according to details on its website.

The deal won’t be affected by any curbs on the Singh brothers as REL is selling one of its assets and the proceeds will be used either for infusing capital into another subsidiary or repaying its own debt.

The Singh brothers have been locked in an arbitration battle with Daiichi Sankyo since May after a Singapore arbitration tribunal ordered the brothers to pay it damages for concealing information regarding wrongdoing at Ranbaxy while selling it for $4.8 billion in 2008. With interest, the award amount is now around Rs 3,500 crore.

Source: Economic Times