As the currency demonetisation announcement, last month occupied both mind as well as news space, one far-reaching development in the banking sector slipped under the radar. Canadian billionaire Prem Watsa’s Fairfax Financial Holdings was allowed to buy a 51% stake in Kerala-based old private sector Catholic Syrian Bank (CSB) in an unprecedented deal.

The deal, under which Fairfax will pick up a majority stake in the capital-starved lender for Rs 1,000 crore, is unique because it gives the Canadian company just 15% voting rights in the bank in line with the Reserve Bank of India (RBI) regulations. In other words, it opens up a new door for investors wanting a piece of the lucrative Indian banking sector within existing regulations.

Deal makers are quietly rejoicing even as they await the final contours of the agreement to emerge. Many old private sector banks like Catholic Syrian are in dire need of fresh capital and this new door could open up numerous opportunities.

“This is a fundamental shift in policy by the RBI because it allows a single party to own more than 50% in a bank. For small old private sector banks, it provides a way to get strong promoters with deep pockets who can invest in their growth,” said Saurabh Tripathi, partner, and director at Boston Consulting Group.

CSB has been struggling to raise capital for a long time. In April last year, it had filed for a Rs 400-crore public share sale offer which failed to take off even as another old private sector bank RBL beat it to list on the stock market in August this year. It is without a CEO since Anand Krishnamurthy resigned in August, though Amfi CEO CVR Rajendran is likely to take over soon.

Fairfax’s investment will help the bank get the ground ready for a share market listing. For the moment, it will quench its thirst for additional capital. Results for six months ended September 2016 on the bank’s website showed that it had bounced back to a net profit of Rs 53 crore after posting a Rs 150-crore loss in the year ended March 2015.

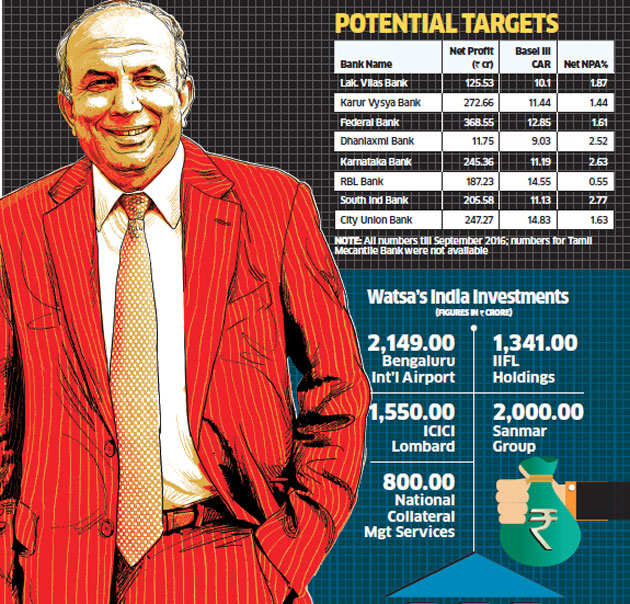

Capital adequacy ratio, which is a measure of a bank’s financial strength, was at 10.55%, just over RBI’s minimum 9% requirement. This deal gives the bank much-needed capital but, more significantly, it shows the way to other old private sector banks who require funds urgently. CSB’s Kerala peer Dhanlaxmi’s capital adequacy ratio, for example, is at a borderline 9.03% as of September, and the RBI has directed the bank to increase it to 10.25% by next year.

“This opens the doors to other investors, even institutional ones or distressed funds like JC Flower which can buy a majority stake in the bank and turn it around. PEs who had NBFCs could also now get a chance to invest in banks. This is unprecedented and it means these banks can now get more capital and, more importantly, get good people to run them,” said Abizer Diwanji, national leader for financial services at E&Y.

However, whether investors will be willing to put in money while agreeing to keep their voting rights capped is the million-dollar question. Some doubt whether shareholders of foreign institutional investors will agree to invest in banks where their decision making is limited.

“Prem Watsa’s deal to buy 51% stake in Catholic Syrian Bank is unlikely to open floodgates because they involve only 15% voting rights. This may, however, raise further interest from private equity or some institutional investors to invest in private banks, but not many may be keen given the cap on voting rights,” said Ashwini Kapila, managing director & head FIG at Barclays India.

But it potentially opens up the door for foreign investors with a solid reputation, who meet the required “fit and proper” criteria from RBI’s perspective, to take a long-term bet on India through an investment in the banking sector, he said. “If RBI allows this transaction, it sets an important precedent and signals to the market that it is open to considering such transformational deals in the banking sector,” Kapila said.

In its final guidelines for new banks released three years ago, RBI had said that non-operative financial holding companies of banks can take up to 40% of the equity capital of the bank which shall be brought down to 15% within 12 years. Most recently in May, RBI had created a separate category of a supranational institution which could take up to 40% in private sector banks. Foreign banks were also allowed to acquire up to 10% in a private sector bank which can be increased in exceptional circumstances, such as the restructuring of weak banks or in the interest of consolidation in the banking sector, RBI had said.

Tripathi from BCG said allowing a single investor to take 51% in a lender also opens the possibilities for mergers and acquisitions because promoters will have to ultimately reduce their stake to 15% in line with the norms for newly licensed banks, which can be done either by diluting capital for growth or by selling shares to new investors.

CEOs of other old private sector banks are watching this deal closely. “We have to see how this deal works. But it essentially means that the bank gets a financier to help build capital. There are two or three other banks which face similar challenges and it opens up an opportunity for them if they can find an investor willing to put in money,” said Shyam Srinivasan, CEO at Federal Bank.

Federal Bank is pretty well placed compared to its peers with a capital adequacy ratio of 12.85% as of September and a net profit of Rs 201 crore in the quarter. In the case of Tamil Nadu-based Lakshmi Vilas Bank, it is in greater need of capital with a capital adequacy ratio of 10.10% as of September. CEO P Mukherjee said the bank is watching this transaction. “We need to see what happens in this transaction. Though I must confess we have not put our mind to interpreting this development,” he said.