Miami-based infrastructure investment group, I Squared Capital, is set to acquire a significant majority stake in the India unit of Boston-based American Tower Corp (ATC), people aware of the matter said.

I Squared Capital is finalising the terms to acquire around 65% stake in ATC Telecom Infrastructure Pvt Ltd (ATC-TIPL), at an enterprise value of around $1.5-$1.75 billion.

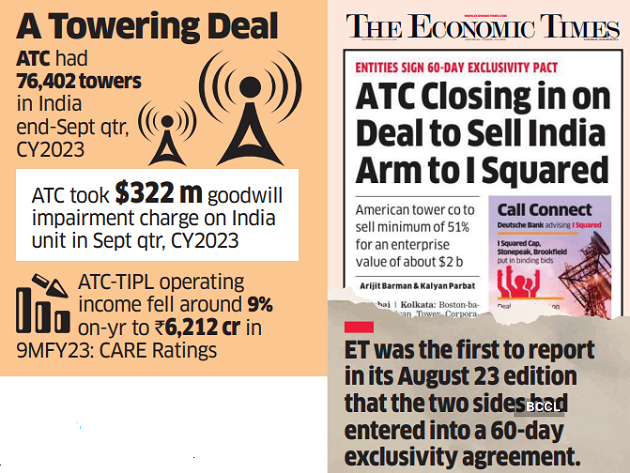

ET was the first to report in its August 23 edition that the two sides had entered into a 60-day exclusivity agreement for bilateral negotiations that ended in ATC selling a minimum of 51% in ATC-TIPL. On June 28, ET had also reported I Squared leads the race to buy ATC’s India arm.

ATC will retain a residual stake.

A formal announcement is expected this month or early December.

“I Squared Capital will take a significant majority stake in ATC-TIPL…the contours of an all-cash deal are being finalised at ATC’s global headquarters,” a person with direct knowledge of the talks told ET.

Both I Squared and ATC declined to comment in response to ET’s queries.

I Squared was initially competing with Canada’s Brookfield and US infrastructure fund Stonepeak Partners for the stake in ATC’s India unit, but the interest of the latter two global investors waned after their initial rounds of negotiations.

ATC, on its part, had originally planned to divest 50% to upto 100% of its India operations and had mandated Citi to help in the divestment. But potential suitors were not keen on a co-control model, forcing ATC to revise its plan and agree on relinquishing majority ownership. Deutsche Bank is advising Isquared.

Back in February 2023, ATC had informed the SEC that it was exploring strategic alternatives including the sale of an equity stake in its India operation to one or more private investors amid a challenging business environment in the country. This was after loss-making Vi had said in early 2023 it won’t resume full contractual payments of what it owed ATC. The tower company had appointed Citi to run a sale process while Deutsche Bank is advising I Squared.

Industry insiders say ATC was originally demanding around a $3.5-to-4 billion EV for its India unit based on a valuation of its 76,402-strong India towers portfolio at roughly $40,000-50,000 each.

I Squared now deploys funds from the $15 billion Infrastructure Fund III it closed last year. The fund has to date made more than 20 investments. Overall, I Squared has three funds focussed on infrastructure, credit and infra tech.

In a recent filing, dated October 26, ATC had informed the US Securities and Exchange Commission (SEC) that it took a $322 million (Rs 2,677 crore approx) goodwill impairment charge for its India unit in the quarter ended September 2023, amid continuing business challenges in the country and its plans to sell equity interests in ATC-TIPL.

“The company (read: ATC) has undertaken a process to evaluate various strategic alternatives with respect to its India operations, which could include a sale of equity interests in its India operations…as part of this process, it has received indications of value from third parties, which are less than carrying value. The company has incorporated this information as a significant input used to determine the fair value of the India reporting unit as of September 30, 2023, and during the three and nine months ended September 30, 2023, it recorded goodwill impairments of $322 million,” ATC said in its SEC filing.

Valuation Hump

Lawyers, consultants and bankers aware of the latest ATC-I Squared negotiations said premium valuations demanded by ATC were a sticky point throughout the exclusive talks.

Bidders including I Squared had rejected the premium valuation ask as worries around the sustainability of tenancy revenue inflows in future, especially amid the continuing financial struggles of Vodafone Idea (Vi) — ATC’s biggest customer in India. More so, since Vi has still not closed its much-delayed fundraising, which has also stalled its 5G network rollout even while its bigger rivals, Reliance Jio and Bharti Airtel are set to conclude their pan-India 5G coverage targets in a few months.

Vi recently said the redemption period of half of the 16,000 optionally convertible debentures (OCDs) issued to ATC’s India arm had been extended to 18 months from the allotment date, instead of the initial six months, giving it some relief. Vi has allotted OCDs worth Rs 1,600 crore to ATC TIPL against its dues. It is estimated to owe ATC around Rs 2,000 crore.

Earlier, ATC had betted on the India market opportunity, beefing up its towers portfolio aggressively through acquisitions. In 2015, it had initially acquired around a 51% stake in erstwhile Viom Networks from Tata Teleservices and SREI Infrastructure Finance for Rs 7,635 crore. After becoming a majority shareholder in Viom, it merged its Indian businesses.

Thereafter, ATC increased its stake to 63% in the merged entity, rechristened ATC Telecom Infrastructure. Eventually, ATC took 100% ownership in its Indian unit and became the third largest tower infrastructure services provider in the country, behind Indus Towers and Brookfield-owned Summit Digitel that bought Reliance Jio’s telecom towers.

Source: Economic Times