US private equity firm I Squared Capital has emerged the frontrunner to buy a controlling stake in American Tower Corp’s wholly owned Indian unit after the latter’s negotiations with Brookfield remained inconclusive, people aware of the developments said.

I Squared Capital is evaluating buying around 90% stake in ATC’s India unit, ATC Telecom Infrastructure Pvt Ltd (ATC TIPL), they said.

Another US infrastructure fund, Stonepeak Partners is also in the fray but I Squared Capital, as of now, is seen as the main contender, they added.

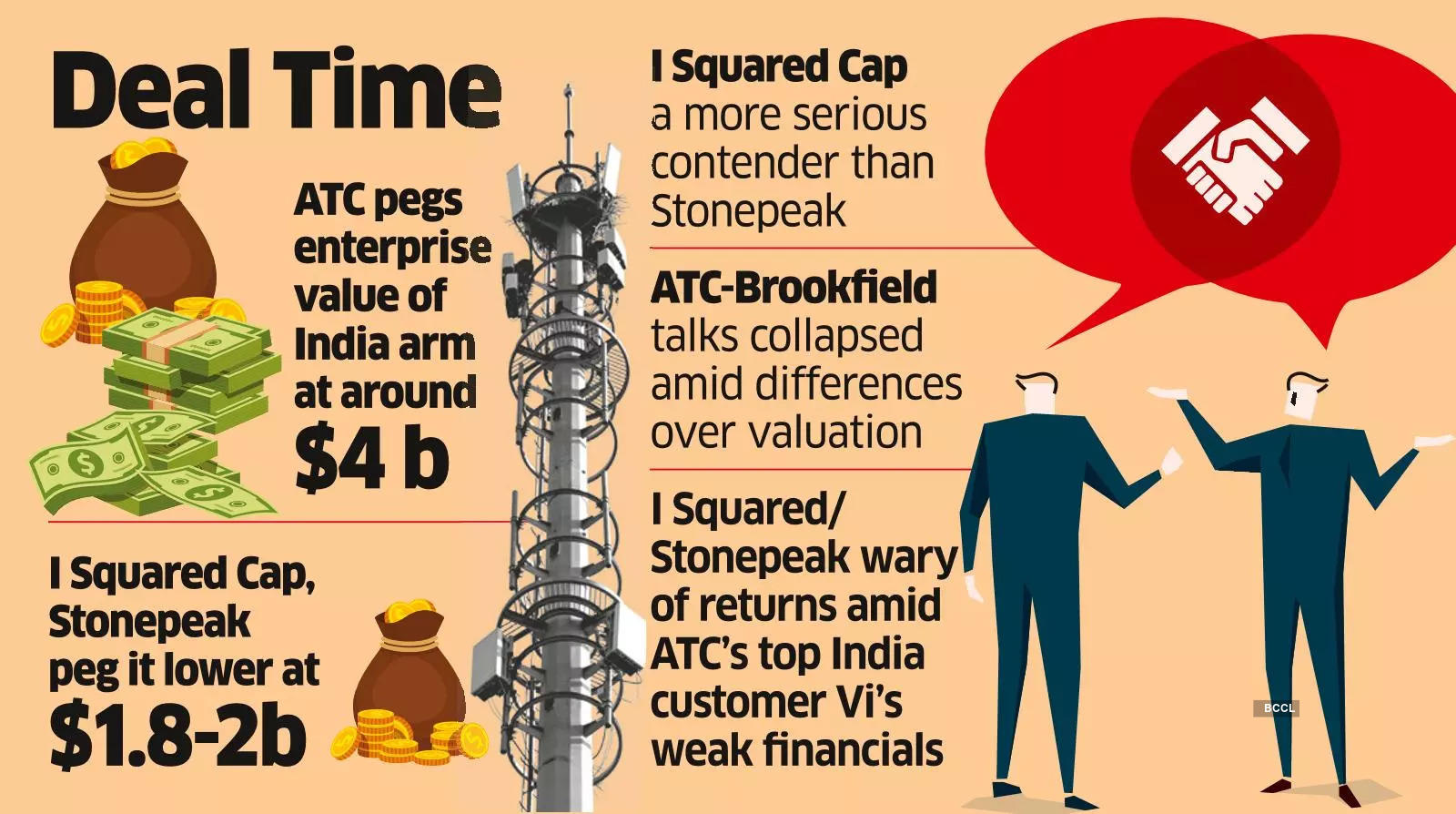

Binding bids are due early next month though senior executives, lawyers and consultants aware of these discussions said the premium valuations sought by ATC remain a sticky point.

ATC’s negotiations with Canada’s Brookfield fell through primarily over valuation differences, another person aware of the matter said. Brookfield had been evaluating a full buyout.

Sources close to Boston-based ATC continue to peg the enterprise valuation (EV) of its Indian arm at around $4 billion, while I Squared Capital and Stonepeak are expected to bid at $1.8 –$2.2 billion EV.

However, the price discovery process is still underway, sources said.

The valuation disconnect stems from I Squared and Stonepeak’s concerns around the sustainability of tenancy revenue inflows in future amid the pending fundraise and continuing financial struggles of Vodafone Idea (Vi) – ATC’s biggest customer in India.

ATC’s demand for a higher valuation for its India business largely stems from its near 77,000-strong India towers portfolio that it prices at almost $50,000 apiece.

“ATC can demand a higher valuation of its India venture but under current circumstances, I Squared and Stonepeak are unlikely to pay $50,000 per tower as they aren’t convinced about generating adequate returns and recovering their money via steady tenancy revenues, given key customer Vi’s weak financials and the fact that the latter is yet to close its long pending fundraise or even start rolling out 5G networks,” another person cited above said.

At press time, I Squared Capital and Stonepeak declined to offer comment while ATC did not respond to ET’s queries.

New York-based Stonepeak is already a stakeholder in ATC’s US data-centre business, but it does not yet have a presence in India.

In February, ATC had said in a filing to the US Securities and Exchange Commission (SEC) that it’s exploring sale of an equity stake in its India operation to one or more private investors amid a challenging business environment. Subsequently, in its annual report for 2022, it had warned that the financial results of its India arm could take a further hit in case of more payment shortfalls by its main customer, Vi.

Its original plan was to divest 50% of its India operations and had mandated Citi. Potential suitors were not keen on a co-ownership model, forcing the company to revise its plan and agree on a change of control transaction.

ATC has already taken a $411.6 million impairment charge due to Vi’s partial payments. The telecom joint venture of UK’s Vodafone Plc and India’s Aditya Birla Group represented roughly 3.2% of ATC’s total revenue ($10.71 billion) for the year ended December 31, 2022.

In February, Vi had allotted optionally convertible debentures (OCDs) worth Rs 1,600 crore to ATC TIPL against its dues. Vi is estimated to owe ATC around Rs 2,000 crore.

But in a subsequent April 2023 filing, ATC had informed the US SEC that it had recognised $15.7 million (around Rs 130 crore) of unrealised losses in the first quarter of calendar 2023 on the OCDs issued to it by Vi.

Over the years, ATC had betted strongly on the India market opportunity, beefing up its towers portfolio aggressively through acquisitions. Back in 2015, the US tower company had initially acquired around a 51% stake in erstwhile Viom Networks from Tata Teleservices and SREI Infrastructure Finance for Rs 7,635 crore.

After becoming a majority shareholder in Viom, it merged its Indian businesses. Thereafter, it increased its stake to 63% in the merged entity, and rechristened ATC Telecom Infrastructure. Eventually, ATC acquired 100% in its Indian subsidiary and became the third largest tower infrastructure services provider in the country behind Indus Towers and Brookfield-owned Summit Digitel that bought Reliance Jio’s telecom towers.

Industry experts, though, point out that bulk of these tower asset acquisitions by ATC were done at peak valuation and today their value has sharply diminished as it’s a market where tenants largely dictate the terms.

In fact, people aware of the latest negotiations remain sceptical about ATC concluding a controlling stake sale in its India unit anytime soon as price discovery is still ongoing amid prevailing uncertainty around Vi concluding its external fundraise.

Vi’s efforts to raise around Rs 20,000 crore via a mix of debt and equity have yielded no results for well over a year now. It urgently requires a fresh capital infusion from its promoters, which, in turn, is expected to lead to third-party equity funding. Such a scenario would also trigger the much-needed investments in Vi’s 4G network expansion and towards its pending 5G rollout, which would also boost the India business prospects of tower firms like ATC.

But that still hasn’t happened, which has resulted in lenders delaying refinancing of a portion of Vi’s existing bank debt. Vi ended the March quarter with a whopping Rs 2.09 lakh-crore net debt and a paltry cash balance of Rs 230 crore.

I Squared continues to deploy from its $15 billion Infrastructure Fund III, closed last year. It has to date made over 20 investments. Two-thirds of the fund has already been committed. A $2-billion energy transition fund is also being planned. Overall, I Squared has three funds focused on infrastructure, credit, and infratech.