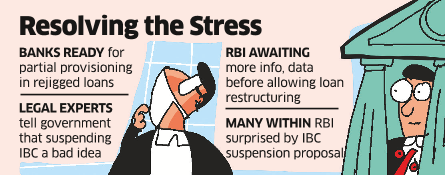

Banks are in a quandary over the resolution of stress among corporate borrowers as they find themselves caught between the government’s proposal to suspend the bankruptcy code for a year and the Reserve Bank of India’s reluctance to allow a one-time loan restructuring in the absence of adequate information and data.

Legal experts and some of the resolution professionals are learnt to have sent feelers to senior government officials that deferring the admission of cases under the Insolvency and Bankruptcy Code (IBC) would not only prevent orderly resolution in the banking system, but could also be viewed as a retrograde step, two senior bankers told ET.

According to banking circles, neither the government nor the regulator may approve a loan restructuring scheme without enough checks and balances — particularly, after the experience of loan rejigs carried out between 2009 and 2013 when many undeserving corporates took advantage of the offer.

Bank CEOs in their meetings with RBI have proposed a midway path, where they will make balance-sheet provisioning for the unsustainable portion of the debt without tagging the account as a non-performing asset (NPA). This, they believe, would minimise misuse of the facility.

“In fact the need for a loan restructuring will be particularly felt if IBC, which is the only sensible resolution option, is deferred. But the government is yet to change the law. On the other hand, RBI, which views one-time restructuring as a serious regulatory measure, is likely to wait for a clearer picture to emerge. A loan restructuring would enable a bank to disburse fresh loans and changing the entire outstanding to match the borrower’s cash-flow in the post-pandemic business environment,” said an industry source. At present, any change in the key terms of a loan — rate of interest, tenor, and principal — amounts to ‘restructuring’ that requires categorising the account as an NPA and providing for the entire amount.

“Banks are proposing a partial provisioning — of only the unsustainable debt which cannot be serviced given the borrower’s reduced earnings. This would protect the bank’s books while the borrower preserves its credit score and reputation by staying out of the NPA list. Also, it may call for some tweaking of the earlier regulatory guidelines as any such restructuring would have to be done with the same promoter,” said a banker. (The unsustainable debt can be partly converted into equity and balance replaced with long-dated bonds with a lower coupon rate. The difference between the unsustainable debt and the net present value of the new instruments is roughly the haircut that lenders take in restructuring the loan.)

Some of the IBC experts have suggested that the government should at least allow the corporate debtor to file for bankruptcy while others feel the IBC option should be kept open for financial creditors, operating creditors as well as the borrowing company.

“The IBC suspension announcement also came as a surprise to many within RBI. Even if in case there is a rethink or delay by the government (in suspending the IBC), there is no reason to disallow a one-time loan restructuring,” said a banking source.

A restructuring scheme for MSMEs is in place for this year. Under the circumstances, the government and the regulator may take a while before allowing banks to take a haircut for bigger corporates. However, unlike the meltdown of 2008-09, Covid-19 has impacted a far higher number of industries.

Source: Economic Times