Resolutions under the Insolvency and Bankruptcy Code (IBC) may run into rough weather after the onset of the Covid-19 crisis as bankers fear winning bidders will review their interest in bankrupt companies and renegotiate bids or pull out altogether.

Last week Ramkrishna ForgingsNSE -0.98 %, the winning bidder for bankrupt automotive components maker Acil Ltd, wrote to lenders seeking renegotiations of its bid citing demand disruptions caused by the COVID 19 and the lockdown.

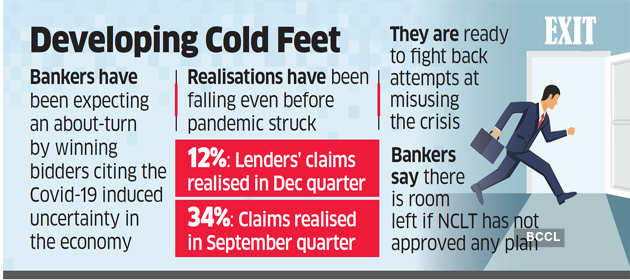

Bankers now fear other winning bidders will similarly invoke the force majeure or material adverse effect clauses to wriggle out of deals or lower the price they are paying to buy companies. “We have been expecting this and Acil is the first case we have seen. Ramkrishna won the approval from committee of creditors way back as August 2019. However, the NCLT has not yet approved it. The company is now citing the COVID crisis as basis for renegotiations,” said a banker involved in the process.

Acil owes creditors Rs 1,200 crore. Ramkrishna Forgings was the highest bidder at Rs 110 crore, a shade above the liquidation value for the company. “The amount the company has bid is so close to the liquidation value that many banks reluctantly agreed. Now this company is making such a song and dance about this amount. They were stingy always but what we are worried about is this being a trend and more bidders going back on their contract,” said another banker closely involved in this resolution.

Bankers are worried that winning companies will use this excuse even in larger deals. There are several deals including the Bhushan Power & Steel (BPSL) acquisition that has been embroiled in court cases as the winning bidder sought certainty and clarity on past liabilities from the creditors and authorities.

Lenders fear bidders of stressed assets will lose interest, especially in the post-COVID-19 era, a banker involved in the BPSL deal said. However, a senior JSW executive said this deal is concluded by both parties and will happen.

Realisations from IBC were already falling before this outbreak. Financial creditors realised just 12% of their claims in the quarter ended December, down from 34% in the quarter ended September, data from IBBI showed.

A resolution professional closely following cases said he feared renegotiations will happen across cases. “What resolution applicants sought to buy is different from what they will be getting post-COVID-19. Some of it is the Covid-19 impact and some the onset of stress even before. If NCLT has not approved the plan, there is a window,” he said.

Bankers said they will fight back any attempts to misuse this crisis.

“Companies will have to prove the destruction of value or material or quantifiable impact because of this crisis. You cannot be in negotiations for many months, push out other bidders, reduce the value of the asset and then wriggle out,” said the second banker quoted above.

Source: Economic Times