IDBI Bank is selling its Rs 6,151 crore legacy stressed asset portfolio to Omkara Asset Reconstruction Company (ARC) in a move that will help the government fetch an improved valuation for the proposed stake sale in the lender, people with knowledge of the matter told ET.

At inter-se bidding held on Saturday (August 3), Omkara ARC gave the highest offer of Rs 652 crore, outbidding government-promoted National Asset Reconstruction Company Ltd (NARCL). For IDBI Bank, the distressed portfolio sale equates to a recovery of 10.5%, which will be reflected in its second-quarter earnings.

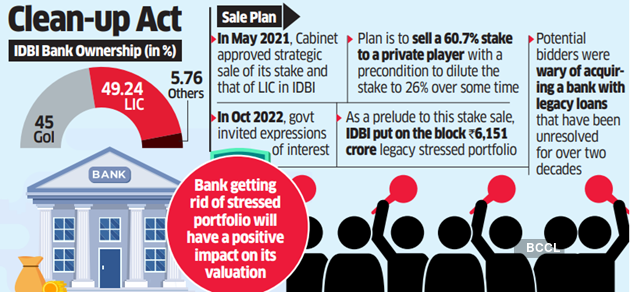

“The sale of the stressed portfolio will have a significant positive impact on IDBI Bank’s valuation since potential bidders were wary of acquiring a bank with legacy loans, which the bank itself failed to resolve for over two decades,” said an advisor involved in the transaction who did not want to be named.

IDBI Bank and Omkara ARC did not respond to ET’s request for comments.

For over two years, there has been a buzz about the government selling a part of its stake in the bank without it making much headway. In May 2021, the government said that the Cabinet approved the strategic sale of its stake and LIC stake in IDBI, and in October 2022, it invited expressions of interest from interested parties.

The government holds 45%, and the Life Insurance Corporation (LIC) has a 49.24% stake in the bank. They have proposed to sell a 60.7% stake to a private player with a precondition to dilute the stake to 26% over some time. According to a Reuters report last week, the Reserve Bank of India (RBI) has approved Fairfax Financial Holdings, Emirates NBD and Kotak Mahindra Bank as potential bidders.

As a prelude this stake sale, IDBI Bank has put on the block Rs 6151 crore legacy stressed portfolio comprising 239 accounts which is housed in Stressed Asset Stabilisation Fund (SASF)-a unit that was hived out the term lending institution when it was merged with bank in October 2006.

Inviting offers from the ARCs for finance companies, the bank had set a reserve price of Rs 642 crore. In the first round NARCL offered marginally higher than the Rs 642 crore reserve price, while Omkara ARC bid at the reserve price. At the interse bidding process, managed by EY on behalf of IDBI Bank, Omkara ARC offered Rs 10 crore higher than the reserve price.

The bank received expressions of interest from NARCL, Omkara ARC, Phoenix ARC, Asset Reconstruction Company (India), Assets Care & Reconstruction Enterprise (ACRE), JM Financial ARC, UV ARC, and CFM ARC, ET reported on July 16. Other EoI applicants include special situations funds Authum Investment & Infrastructure and Alpha Alternatives and the manufacturing firm Puzzolana, people cited above said.