The Centre is learnt to have reached out to global buyout funds and financial institutions, such as the Carlyle Group, TPG Capital and Prem Watsa-controlled Fairfax Holdings, to gauge investor interest in buying majority stakes held directly by the government and Life Insurance Corporation of India (LIC) in the bailed-out lender, investment banking and private equity executives familiar with the matter told ET.

The Department of Investment and Public Asset Management (DIPAM), which oversees the administration of government equity in operating companies, tapped the buyout funds and bulge-bracket financiers during investor roadshows held in several global banking hubs, industry sources attending such events said.

KPMG Helping with Transaction Process

“The talks are at a preliminary stage and the government is yet to fix a time frame for the share sale,” said one of the people cited above. “However, the buyout funds and some domestic strategic investors have been sounded out,” said this person who attended one such DIPAM event.

KPMG is helping with the transaction process. The proposed disinvestment of government equity in the bank has reportedly received the central bank’s approval.

DIPAM officials in New Delhi could not be immediately reached for their comments. Carlyle, TPG and KPMG declined to comment. ET’s mailed queries to Fairfax, controlled by the Indian-born Canadian billionaire Watsa, remained unanswered.

IDBI Bank and LIC did not comment on the matter.

The global private equity firms are also exploring the option of allying with local strategic investors to form bidding entities. Alternatively, they could also form a consortium with other investors.

The process of floating an expression of interest (EoI) will be followed by stages of formal bidding. The process is expected to be set in motion this year itself if the current momentum in the stock markets is sustained.

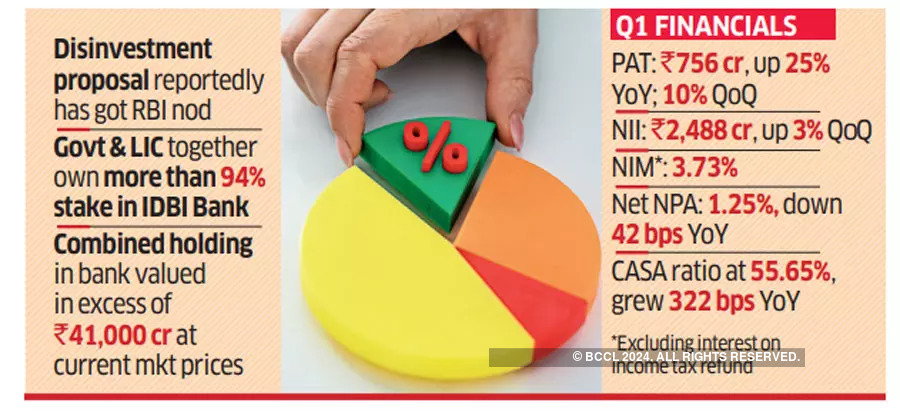

The government and LIC together own more than 94% equity in Bank. The combined state holding in the bank, which had among the highest proportions of bad loans, is valued in excess of ₹41,000 crore at current market prices.

Technological Know-how

“With the proposed divestment, the bank (IDBI Bank) is likely to get access to advanced know-how and technologies, in sync with the global best practices,” said Soumitra Majumdar, partner at law firm J Sagar. “This will pave the way for the bank’s future growth, enhancing shareholder value and (helping) the broader credit ecosystem.”

Set up in 1964 as Industrial Development, a specialised development financial institution, it could emerge as one of the leading commercial banks in the country.

The government has invested ₹27,000 crore into IDBI Bank between April 1, 2010 and March 31, 2021. Data shows the government acquired 4.5 billion shares in the bank during this eleven-year period, ET had reported earlier this month. LIC had also invested more than ₹25,000 crore over the past six years.

Both TPG and Carlyle were contenders for LIC’s stake in IDBI Mutual Fund. Separately, Fairfax, which holds a controlling stake in the South-based Catholic Syrian Bank, will also look at merging the entities to create a larger banking institution in the country.

Roadshows Held Overseas

DIPAM has held roadshows in the US, Europe and the Middle East.

The government had said in May last year that the Cabinet Committee on Economic Affairs has given in-principle approval for strategic disinvestment along with transfer of management control in IDBI Bank. IDBI Bank stock climbed 0.74% to close at ₹40.60 on the BSE on Wednesday. Its current market value is ₹43,655 crore.