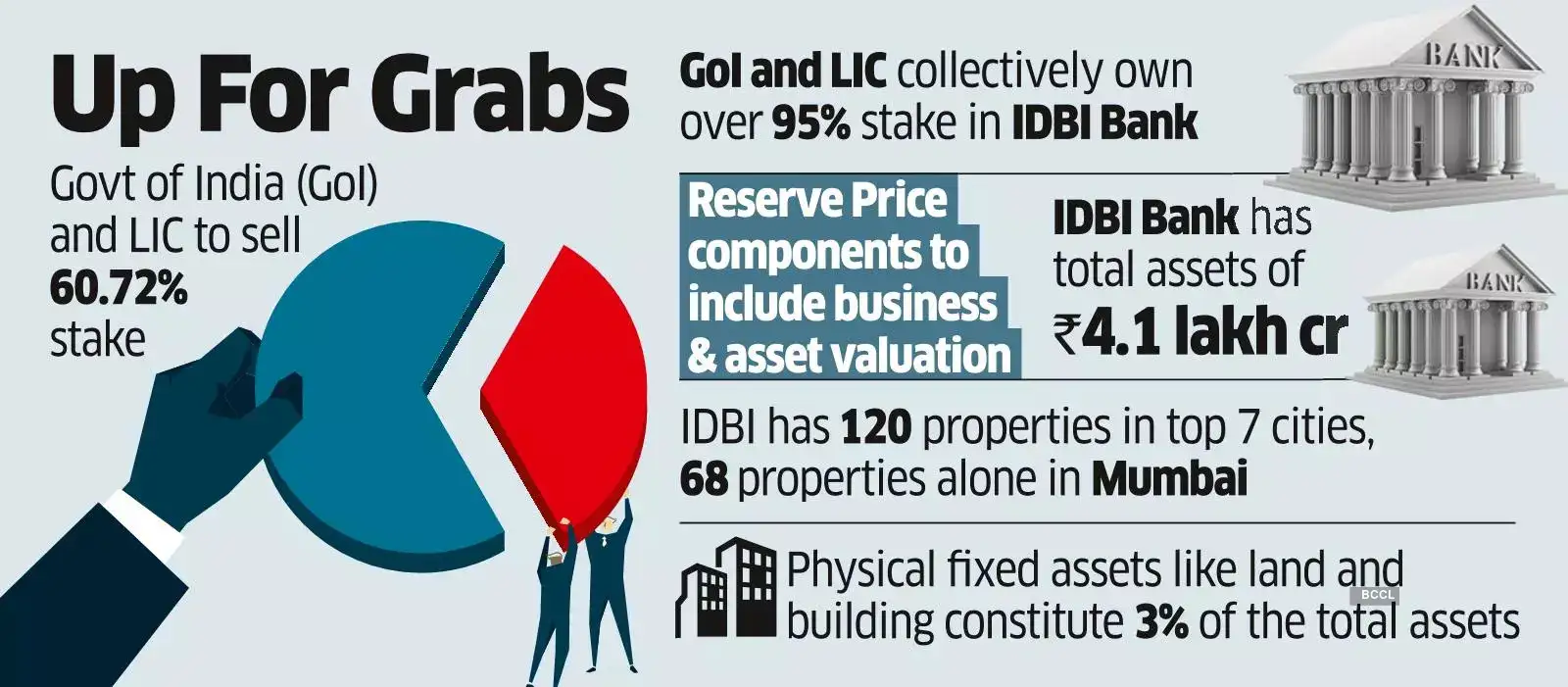

Prema Watsa’s Fairfax Financial and Kotak Mahindra Bank are set to submit financial bids separately for a majority stake in IDBI Bank along with supporting documents on Friday, according to people with knowledge of the matter. The two contenders are in a race to acquire the 60.72% stake belonging to the government and Life Insurance Corporation of India (LIC) that is on offer. The Centre and LIC own over 90% of IDBI Bank.

The reserve price will be decided after receipt of the financial bids and before they are opened, said the people cited. This will only be known to a small group of government officials, they said. The reserve price will not be disclosed to the bidders, according to them.

“The reserve price will be set up on the basis of business valuation and asset valuation, which have been completed,” said a government official. The Centre had appointed an asset valuer for IDBI. Immovable assets such as land and buildings constitute approximately 3% of the total.

Reserve price to be decided before offers are opened, but will not be disclosed to bidders: Officials

The Securities and Exchange Board of India’s (Sebi) open offer pricing mechanism could also be one of the yardsticks used for establishing the reserve price, the people cited said.

IDBI Bank’s disinvestment process was formally kicked off in October 2022 but faced delays due to various steps the government of India took to ease any hurdles for a potential buyer.

ET first reported on December 12 that Toronto-headquartered Fairfax Financial was a frontrunner to acquire IDBI Bank and that bids could be called in early January. The initial bid deadline was delayed to a date after the February 1 budget, ET reported last week.

Fairfax Financial and Kotak Mahindra Bank did not comment on the matter.

The budget has targeted ₹80,000 crore from disinvestment and asset monetisation in FY27. In a post-budget interaction, Department of Investment and Public Asset Management (DIPAM) secretary Arunish Chawla said that the strategic disinvestment of IDBI Bank had moved to the third phase, which meant technical and financial bids had been invited. “Before the end of this financial year, we will be able to give further information in this matter,” he said.

The successful bidder will have to go through a final assessment by the Reserve Bank of India (RBI) to ensure that it meets the banking regulator’s ‘fit & proper’ standards. In addition, approvals will be needed from statutory and regulatory authorities, including the Competition Commission of India. The successful bidder will also have to comply with the requirement to make an open offer to minority shareholders of IDBI Bank.

The sale process has undergone delays due to several procedural aspects that were addressed as the process unfolded. The government and LIC have sought approvals for cancelling their status as promoters of the bank to facilitate a smooth divestment process. Apart from that, Sebi has been asked to exempt IDBI Bank from following minimum public shareholding norms, which mandate listed companies to have a free float of at least 25%.

Source: Economic Times