IDFC Bank has sold more than Rs 2,400 crore of stressed assets to Edelweiss Asset Reconstruction Company for Rs 622.6 crore, a loss of 75% on the exposure, as it sought to clean up books ahead of the pending merger with non-banking finance company Capital First.

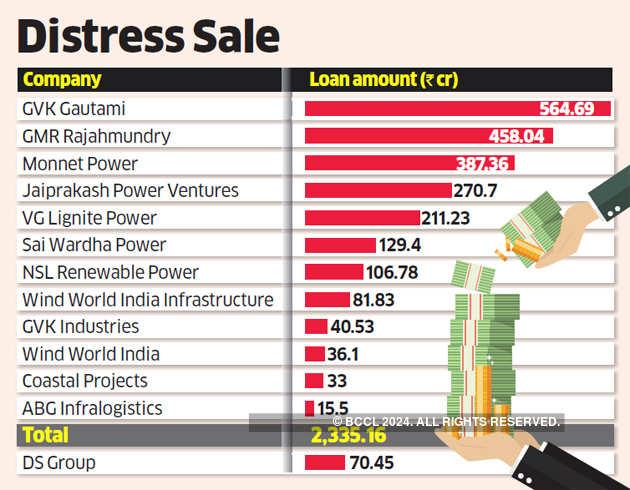

The assets were sold in two separate transactions. Loans to a pool of 12 companies, including GVK Gautami, GMR Rajahmundry, Monnet Power and Coastal Projects and totalling Rs 2,335 crore, was sold in August for Rs 621crore. Another Rs 70.45-crore loans — to two companies of the DS Group of HS Narula, erstwhile promoter of Delhi Gurgaon Expressways — were sold for just Rs 1.6 crore, a discount of about 98%. Of this, Rs 40 crore was loaned to DSC in February 2014 and secured by personal guarantee provided by Narula.

“In the September quarter, as part of the clean-up, IDFC Bank sold an additional Rs 2,400 crore of stressed assets (comprising exposure to several borrowers, including DS Group) on a full cash basis,” an IDFC spokesperson said. RK Bansal, managing director of Edelweiss ARC, said some of the large assets involved in transactions were gas-based power plants that had a lower valuation. “We acquired these through an open auction process,” he added.

The bank decided to sell loans to the DS Group after invoking the personal guarantee as the recovery process was very slow. The bank has “diligently and systematically” pursued all legal remedies, including Debt Recovery Tribunal, criminal action under Section 138 of the Negotiable Instruments Act, winding up petition, NCLT application, for over two years, said the spokesperson.

“It was only in the absence of satisfactory progress with resolution, despite these efforts, and after exhausting these avenues for recovery, that IDFC Bank sold the loans to the ARC,” she added. These assets were sold through a transparent process, as stipulated under the Reserve Bank guidelines for sale of stressed assets, wherein the list of the assets was offered to multiple ARCs and stressed asset funds, said another senior official of IDFC Bank. To obtain the best price for these assets, the Swiss Challenge Method was followed, where participants were given the opportunity to improve upon the best bid, he added.

Edelweiss has already started witnessing good recovery from these assets in the last two months, said an official at the asset reconstruction company. “We were negotiating with the DS Group for settlement. The ARC is expecting to settle with DS Group for around Rs 15 crore,” he added. Without disclosing the actual amount, managing director Bansal said, “We will make good recovery from the DS Group.”

The net book value of the pool of 12 accounts for IDFC Bank was Rs 683 crore as it had made a provisioning of Rs 1,652 crore. The transaction that was completed in August led the bank to make a fresh provision of Rs 62 crore, as the realisation value was even lower than the net book value.

Over the past three years, IDFC Bank has strengthened and transformed its balance sheet in a fundamental way, using a two-fold approach — cleaning up the stressed asset book and diversifying risk — so as to build a balanced portfolio, its spokesperson said.

“When the bank started its journey three years ago, around Rs 12,000 crore of its assets were identified as stressed or potentially stressed. It was hard to assess what share of this would become performing, how fast, and with what earning power the rest would actually become NPAs. The bank also started out with an acute and extreme concentration risk, with almost 80% of assets at that time being infrastructure by design, as IDFC was an infrastructure financeNSE -0.97 % company with no retail assets,” the other IDFC official cited above said.

Source: Economic Times