The merger of parent IDFC Ltd with its unit IDFC First Bank is likely to take longer than expected as the managements of both the institutions are looking to extract value for their respective shareholders, said two people familiar with the process.

While IDFC Ltd is asking for a higher returns for its existing shareholders, the private lender is seeking a fair value keeping in mind its future earnings and growth potential, said the people.

“Both parties are discussing how to discover the fair value. Valuations are yet to be worked out while IDFC Ltd is seeking a higher share swap ratio, the bank wants the holding company to consider its future potential before zeroing in on the ratio,” a senior executive involved in the talks said on condition of anonymity. “No final proposal is on the table yet and is most likely getting pushed to the next financial year.”

IDFC Ltd and IDFC First Bank did not respond to queries emailed by ET.

The merger will give IDFC First bank access to nearly ₹4,000 crore of capital, a bulk of which came from IDFC Ltd selling its mutual fund business to Bandhan Bank. IDFC Ltd shareholders are likely to benefit from the clean-up of the bank’s balance sheet and the groundwork laid for the retail loans growth take-off.

“The reverse merger could lead to value unlocking and remove the holding company discount. IDFC shareholders have lost out after the demerger as they do not have a direct line of sight to the operating earnings of the bank. Shareholders are expected to benefit if the plan goes through,” said another executive, who also did not wish to be identified.

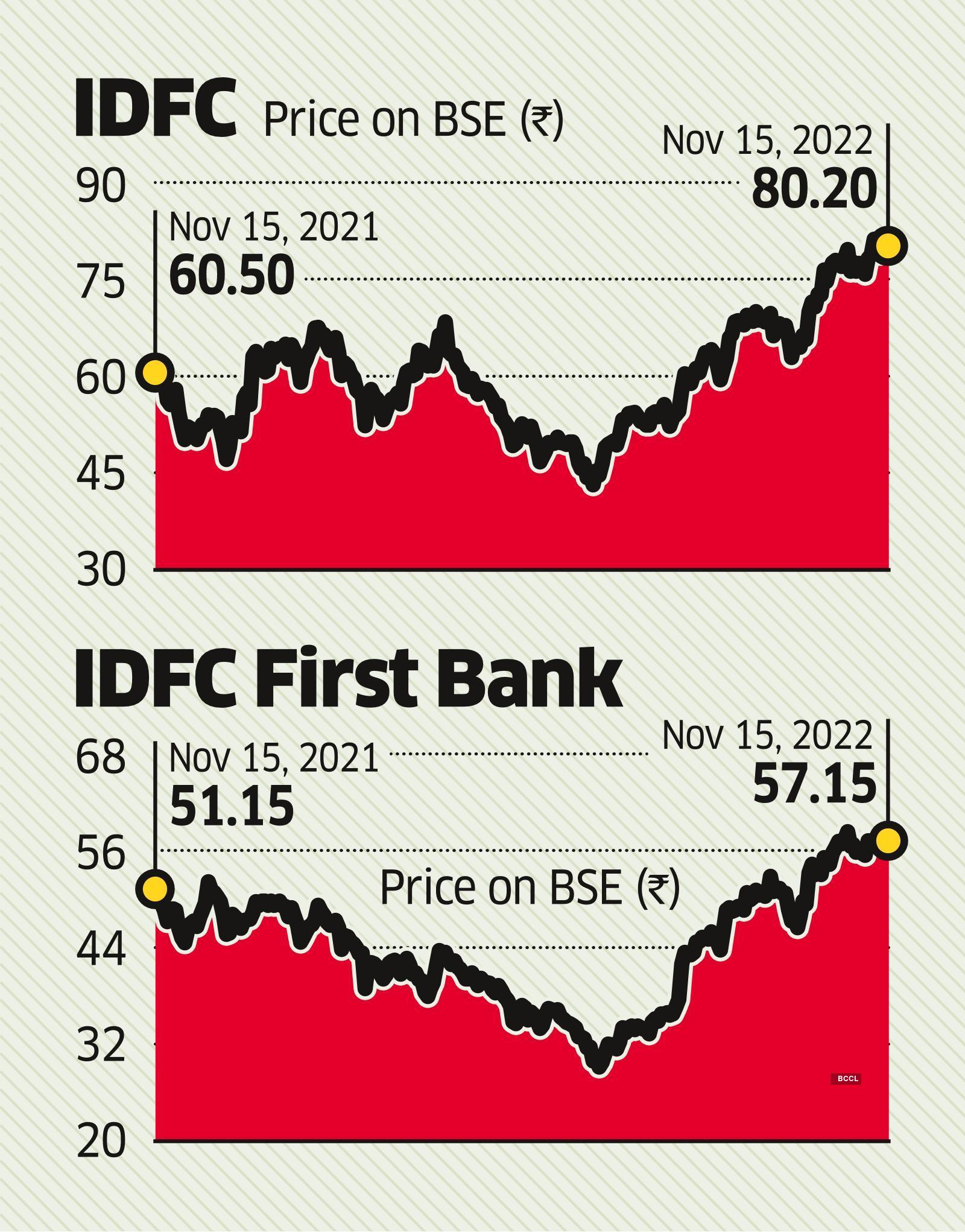

IDFC Ltd owns more than 36% stake in IDFC First bank. IDFC First Bank shares have risen 15% since the start of 2022, while IDFC Ltd shares have risen 25%.

While the bank has a market capitalisation of more than ₹35,000 crore its holding company, IDFC Ltd, has a market value of a little less than ₹19,000 crore.

In July last year, the Reserve Bank of India allowed IDFC Ltd to exit as the promoter of IDFC First Bank since the five-year lock-in period had ended, paving the way for a potential reverse merger between two entities.

In October 2021, IDFC Ltd, through its step-down subsidiary, IDFC Financial Holding Company Ltd, sought the bank’s consent for merger, to which the bank agreed in December 2021.

Source: Economic Times