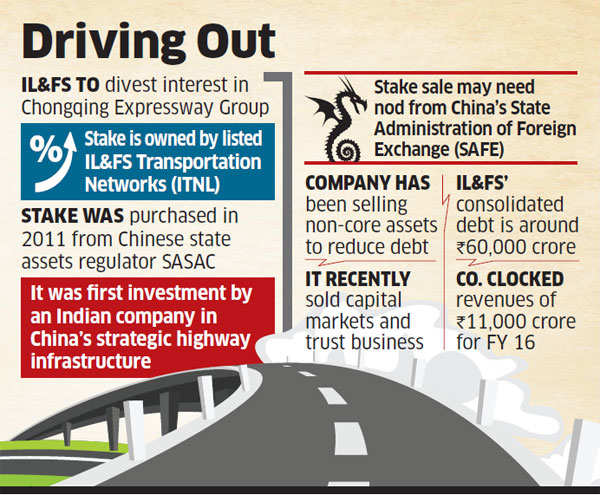

IL&FS is selling its 49% stake in its joint venture with China’s Chongqing Expressway Group (CEG), marking a premature end to its five-year-old foray into the booming infrastructure development business in that country.

The proposed sale is estimated to fetch as much as $170 million and has attracted interest from as many as 10 bidders comprising Chinese construction firms and toll road operators, said people directly aware of the matter.

IL&FS purchased a stake in an expressway project in the southwestern Chinese municipality of Chongqing in 2011 from State-Owned Assets Supervision and Administration Commission (SASAC), a powerful body that reports directly to the Chinese cabinet and owns CEG.

Chongqing is one of China’s four direct-controlled municipalities that include Beijing, Shanghai, and Tianjin.

The stake in the joint venture is held through the group’s publicly traded arm, IL&FS Transportation Networks Limited (ITNL).

The Chongqing Yu He Expressway is a 60-km stretch of road that connects Chongqing city to Hechuan county. The term of the concession for the road is 30 years.

The divestment is part of IL&FS’s plan to sell ‘non-core’ assets to reduce the group’s consolidated debt which stood at close to Rs 60,000 crore as on the close of the previous financial year, said the people quoted earlier.

The exit from China would be the third such sale of ‘non-core’ businesses by the group after it sold its trust and fiduciary services business last year and recently followed it up with the sale of its derivatives clearing and settlement arm. UBS is the advisor to the transaction.

IL&FS is a core investment company and has eight operating subsidiaries. Its businesses span development and financing of large scale urban infrastructure projects. It also has interests in ports, water, and waste management as well as an education business. The company reported consolidated revenues of Rs 11,000 crore for the financial year 2016 and net profit of Rs 249 crore.

Though its consolidated debt is eight times its equity, its standalone debt position is much lower at 2.4 times its equity allowing it to infuse capital into various businesses that are currently highly leveraged.

The group’s transportation arm recently unveiled a plan to reduce its debt of Rs 10,000 crore by as much as 60% through identification of ‘non-core’ projects.

IL&FS had identified the investment opportunity in China as part of a strategy to acquire operational projects that could help immediately provide a stable revenue base of toll-based/annuity income.

The Chinese joint venture would also enhance its technical qualifications to bid for projects auctioned by the National Highways Authority of India, ITNL had said in an investor presentation in 2011describing the details of the transaction.

The purchase of an economic interest in the Chongqing expressway project marked the first such investment by an Indian company in China’s strategic highway infrastructure at the time it was announced. IL&FS also has other international business interests through its subsidiary in Spain.

The present transaction would likely to require approval from China’s State Administration of Foreign Exchange (SAFE) as it would entail remittance of the renminbi, now closely regulated by the Chinese authorities after they imposed capital controls.

IL&FS recently announced a plan to raise Rs 5,000 crore by way of issue of bonds to meet funding requirements for as many as 30 infrastructure projects that are currently under development.

Source: Economic Times