IL&FS Investment Managers Ltd will raise a $1-billion infrastructure fund from pension funds in South Korea and Japan to invest in Indian companies which build power plants, logistic and set up waste management businesses, two people with direct knowledge of the plan said.

“The fund has got commitments from South Korean and Japanese pension funds and it is looking at closing the proposed infrastructure fund at higher level,” one of the two persons quoted above said.

“IIML is establishing a $1-billon infrastructure fund to tap into two distinct opportunity sets,” said Ramesh Bawa, chief executive, IL&FS Financial Services. IL&FS Investment Managers Ltd is the private equity arm of the infrastructure development and financial services group IL&FS.

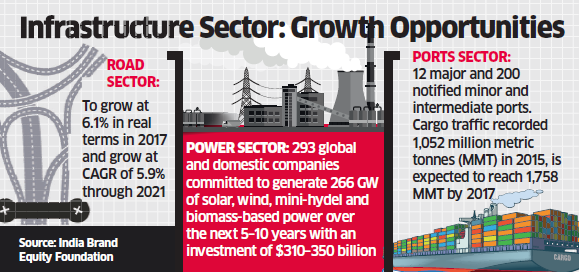

“One, a variety of reasons have led to excess leverage in the sector…there is, therefore, a need to recapitalise infrastructure developers so as to enable them to regain the investment appetite, specifically in sectors like power and roads. Secondly, the economy continues to offer significant growth opportunities, many of which have got a considerable push on account of a positive government action.”

The fund will focus on logistic companies that got a booster shot from the rollout of the goods and services tax and waste management companies bolstered by the government’s ‘Swachh Bharat’ push.

In addition to the equity fund, IL&FS Investment Managers is also in the final stages of negotiations with the $124.3-billion Islamic Development Bank’s private investment arm ICD to raise a billion dollar debt fund to invest in Sub Saharan Africa, one of the four largest target regions for the Islamic Bank.

IL&FS will contribute a smaller amount, leaving the larger commitment to the Islamic Bank, and will be managing the fund to lend to companies which build infrastructure projects in 28 countries in Africa.

“We are collaborating with the Islamic Corporation for the Development of the Private Sector (ICD) for creating a $1b debt fund to invest in the capital starved region on Africa,” Bawa said. “Relationship with ICD helps us in building a de-risked and diversified portfolio spanning transportation, utilities and social sectors.”

“Significantly, higher exposure to debt and mezzanine instruments with a very modest equity allocation help us further mitigate risks of investing in a new region,” he added.

Consultants say IL&FS is using the debt route to reduce risk and study the market for an equity play in future. “It is interesting to see IL&FS planning to invest in Sub Saharan Africa and I would like to believe this is on the back of India and Indian companies wanting to increase engagement in that region,” said Harish HV, head, private equity, Grant Thornton, India.

“IL&FS would be able to leverage their knowledge of infrastructure to support the fund and also earn good returns from its investment. Clearly IL&FS is using the debt route to reduce risk and learn the market as possibly a preparatory exercise to do an equity play at a later date,” he added.

IL&FS PE, in partnership with Standard Chartered bank, has previously raised a $660 million infrastructure fund with Standard Chartered known as Standard Chartered IL&FS Asia Infrastructure Growth Fund, which focuses on investing in Asia market. “The current infra fund will be an India focussed fund, where the fund intends investing in roads and energy projects in the country,” said another person with knowledge of the fund’s plans.

IL&FS Investment Managers has assets under management (AUM) of $3.2 billion.

The fund manager has made 163 investments across 13 funds since it started operations in 1996. IL&FS has built a strong portfolio of infrastructure projects aggregating to $25 billion.

In February 2017, IL&FS teamed up with global PE fund Lone Star Funds to create a $550 million stressed assets fund to buy stressed Indian assets from the banking system to the tune of $2.5 billion.

The joint fund will assist banks, private equity investors and asset reconstruction companies recycle capital, thus enabling reinvestment capital in fresh projects, the company had said at that time.