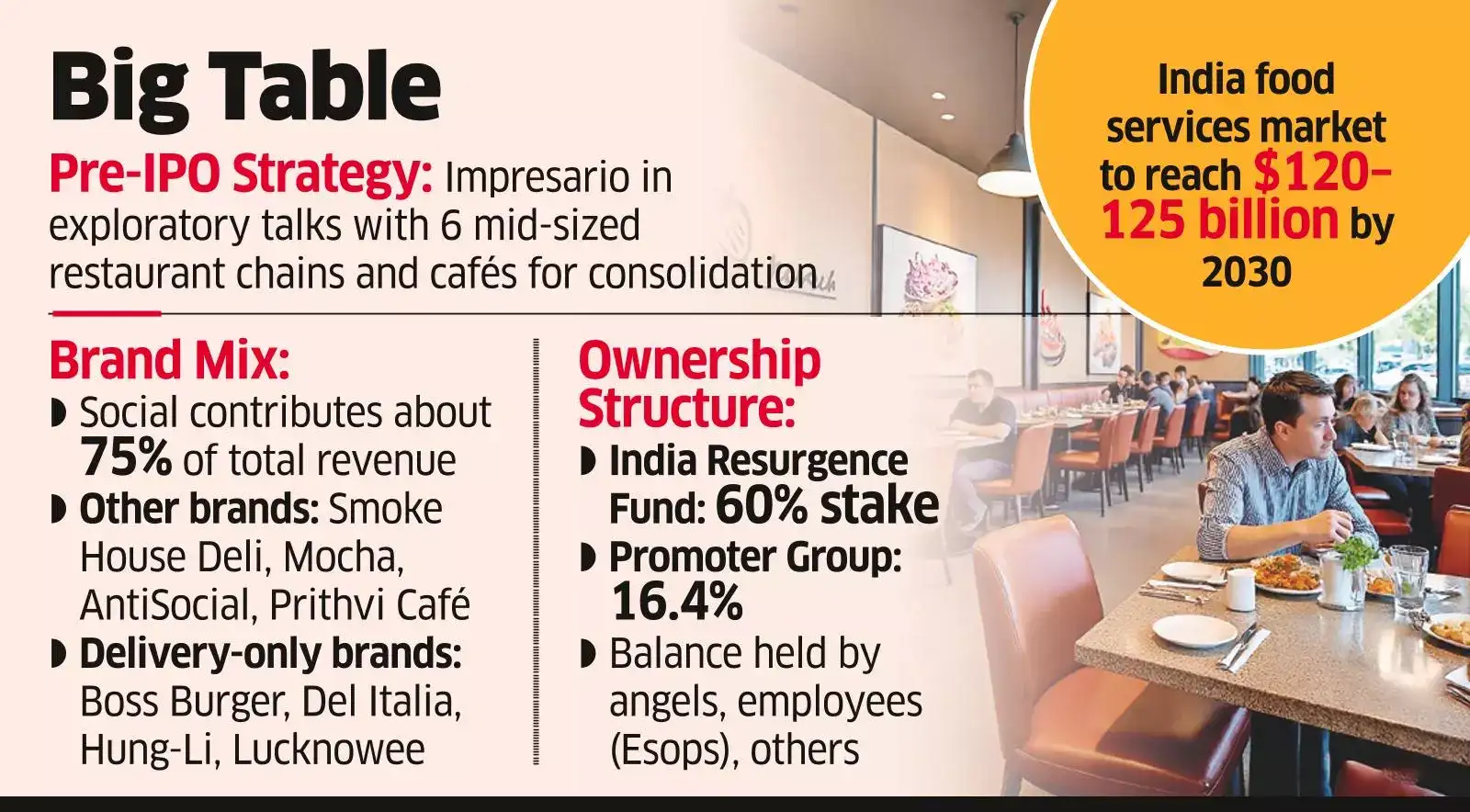

Impresario Entertainment & Hospitality, which owns casual dining chains Social, Smoke House Deli, and Mocha, is in talks with about half a dozen mid-sized restaurant chains and cafes for potential acquisitions, and to eventually absorb them under the holding company ahead of a proposed public listing in the next few years, said people familiar with the matter.

Through this initiative, the company, majority-owned by India Resurgence Fund (IndiaRF), is looking to gain scale amid intensifying competition in the food and beverage industry.

When contacted, Riyaaz Amlani, founder and managing director, Impresario, told ET that the company is looking “at a large platform play, pre-IPO, through consolidation, with mid-sized players”.

“Talks are at exploratory stages,” he said without elaborating.

Impresario reported revenue of $95 million (₹810 crore at the time) in FY25, a 18% increase, per regulatory filings data. The company swung to a profit after tax of $2 million during the year from a net loss of $1.7 million in FY24.

Social, the company’s largest brand, contributed about 75% of Impresario’s annual revenue.

As on March 31, 2024, Impresario operated 88 restaurants and cafes under the brands Social, AntiSocial, Smoke House Deli, Prithvi cafe and Mocha, the filings showed. The company has also ventured into delivery-only brands such as Boss Burger, Hung-Li, and Lucknowee.

Executives underlined that achieving scale through consolidation is vital for growth in the sector facing intense competition.

On January 1 this year, Devyani International and Sapphire Foods India, which operate Yum! Brand-owned KFC and Pizza Hut quick service chains in India, announced a merger to create the country’s largest single quick-service restaurant (QSR) entity, leading to a joint entity operating over 3,000 stores.

“The merger of Devyani International and Sapphire has set a precedent within food services,” said a banker involved in the negotiations of similar deals. “Chains are looking at consolidation as an optimum way for growth and tapping the markets.”

IndiaRF, an investment platform formed as a joint venture between Piramal Enterprises and Bain Capital Credit, currently holds a 60% stake in Impresario following buying out shares held by Sensational Eatery, Singapore.

India RF had invested ₹550 crore in Impresario in November 2022 to become the majority shareholder. The promoter group holds 16.4% stake, with the remainder held by angel investors, others, and employees through stock options, according to Tracxn data.

The transaction with IndiaRF followed the consumer-focused private equity firm L Catterton Asia exiting its previous five-year investment in Impresario. LVMH-backed L Catterton had invested in Impresario in 2017.

A November report by Kearney and Swiggy estimated India’s overall food services market to touch $120-125 billion by 2030, from $78 billion in 2025. The report noted that the organised segment is expected to expand to 55% of the market by 2030 from 45-50% in 2025, attributing the growth to rising disposable incomes, digital adoption, and growing number of consumers preferring the convenience of dining out.

Source: Economic Times