UltraTech Cement’s acquisition of a controlling stake in Chennai-headquartered India Cements will not only help in staying ahead in the highly competitive sector but also delay efforts of the Adani Group to catch up with it in the short to medium term. The latest acquisition by the country’s largest cement maker comes at a time when expanding organically has become expensive both in terms of cost and time.

While analysts consider the deal a bit expensive when compared with the recent transactions in the sector, they believe in its long-term benefits. Apart from the expensive valuation, there is another concern in the short term about the cost UltraTech would incur in making India Cements’ assets more profitable through cost efficiency.

According to Nomura Financial Advisory and Securities (India), UltraTech may have to invest at least Rs 1,000 crore to make old assets of India Cements cost-efficient and integrate them in its core operations. According to the brokerage, India Cements’ operating cost to manufacture a tonne of cement was Rs 5,306 in FY24 compared with the industry average of Rs 4,608. Also, the average earnings before interest, tax, depreciation, and amortisation (EBITDA) per tonne generated by India Cements has fallen sharply over the past five years to Rs 105 in FY24 from Rs 516 in FY20.

Considering these factors, the valuation of the deal looks to be on a higher side. According to Jefferies India’s estimates, the deal assigns an enterprise value (EV) of $110 per tonnes for 14.5 million tonnes (MT) capacity of India Cements compared with $85 per tonne offered by Ambuja Cements while acquiring Telangana based Penna Cement’s 14 MT capacity in June. To be sure, the Adani Group acquired assets of Ambuja and ACC in 2022 in a bid to become a significant player in the country’s cement sector.

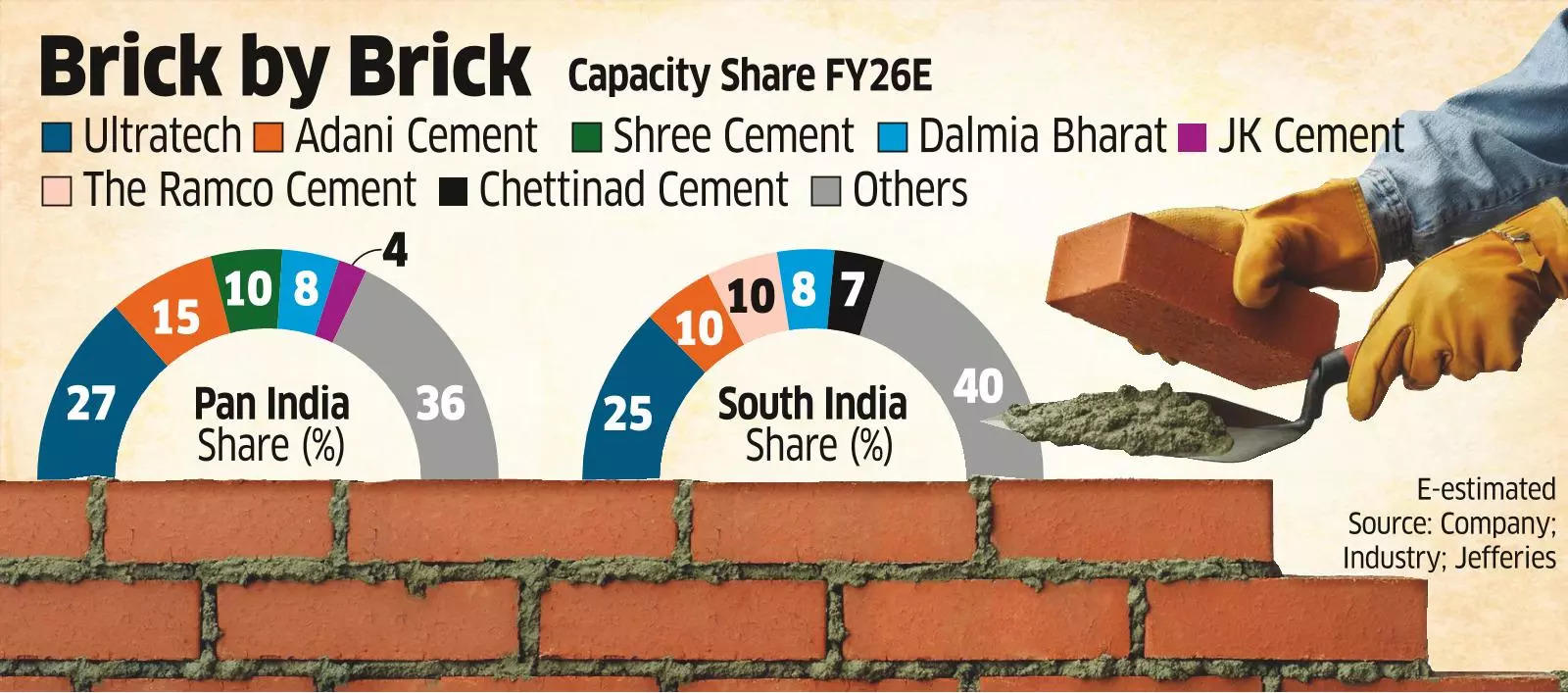

In the long-term, though, UltraTech’s latest acquisition serves a larger purpose. It not only provides the company presence in Tamil Nadu and Telangana apart from Andhra Pradesh but increases its capacity share to close to 25% from 11% in the south region at present. In addition, according to Nomura, UltraTech has also acquired 1.2 billion tonnes (BT) limestone reserves, a major raw material in the southern region through this deal. Further, India Cements has 50 MW captive power plants in Tamil Nadu and Telangana and a 20 MW captive power plant in Rajasthan. It also operates a gas-based power plant of 26.25 MW capacity in Tamil Nadu. The company has a presence in the shipping sector with two handymax vessels. Besides, it owns coal mines in Indonesia.

The company’s closest peer Ambuja Cements plans to achieve a capacity target of 140 MT by FY28 from 89MT at present through inorganic and organic routes. With the acquisition of Penna Cement, Ambuja Cements will be able to raise share of low-cost sea logistics and become a dominant player in the coastal distribution of cement.