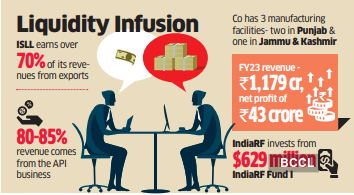

India Resurgence Fund (IndiaRF), an India-focused distressed and special situations investment platform sponsored by the Piramal group and Bain Capital Credit, is in talks to acquire the active pharmaceutical ingredients (API) business of the debt ridden Ind-Swift Laboratories (ISLL), said two people aware of the development. The investment size could be in the range of ₹1,000 crore, said sources.

The company will use the money to restructure its existing debt. Ind-Swift Labs has been bogged down by debt, including a non-convertible debenture liabilities of ₹743 crore as on March 31, 2023. The company has been working to repay the NCDs through debt refinancing or liquidity infusion.

The recovery of volumes for its key APIs such as clarithromycin, fexofenadine, ezetimibe, quetiapine fumerate and donepezil, along with anticipation of a possible liquidity infusion has helped the stock rose 30% in last six months. The stock gained 1.16% and closed at ₹91.81 on BSE on Thursday. Company has a market cap of ₹542 crore.

The company has issued NCD of ₹450 crore during June 2018 for the repayment to its lenders under the one-time settlements (OTS) scheme. These NCD has IRR of 20% with annual coupon of 10% and redeemable in June 2024. Considering the higher IRR, the company eventual liability will be higher than ₹450 crore and as on September 30, 2022 stood at ₹670 crore, said a recent Care Rating report.

Earlier in July 2021, Ind-Swift Laboratories had agreed to sell its API business to PI Industries on a slump sale basis, for ₹1,530 crore. However, the deal had been terminated by PI Industries in November 2021.

Incorporated in 1995, IISL is engaged in the manufacturing of APIs, advanced intermediates and providing Contract Research and Manufacturing Services (CRAMS). The company has three manufacturing facilities- two in Dera Bassi (including research facility), Punjab and one in Samba, Jammu & Kashmir.

The product line of the company finds its application in a varied range of therapeutic segments as antibiotics, anti-coagulants, anti-virals and lipid lowering agents.

The company earns over 70% of its revenues from exports. The company reported revenue of ₹1,179 crores in FY23, with a net profit of ₹43 crore. About 80-85% revenue of ISLL comes from the API business.

There has been a considerable improvement in the overall financial risk profile of the company as reflected by increase in total operating income along with improvement in profitability margins and debt protection metrics leading to improvement in solvency profile as well, says the report.

Mails sent to IndiaRF, Ind-Swift did not elicit any responses till the press time.