Canadian pension fund Caisse de depot et placement du Quebec (CDPQ) is in talks with Vodafone Plc to buy the residual 21% stake the UK telecom major owns in Indus Towers, India’s largest mobile tower installation company, said multiple people aware of the negotiations.

Both sides have had management meetings and a formal due diligence is expected to start as the stake sale process has been revived in recent weeks.

The discussions are still preliminary in nature and there is no guarantee that they will translate into a transaction, said people aware of the development.

Spokespersons of CDPQ and Vodafone declined to comment. Indus Towers and Airtel did not respond to ET’s queries.

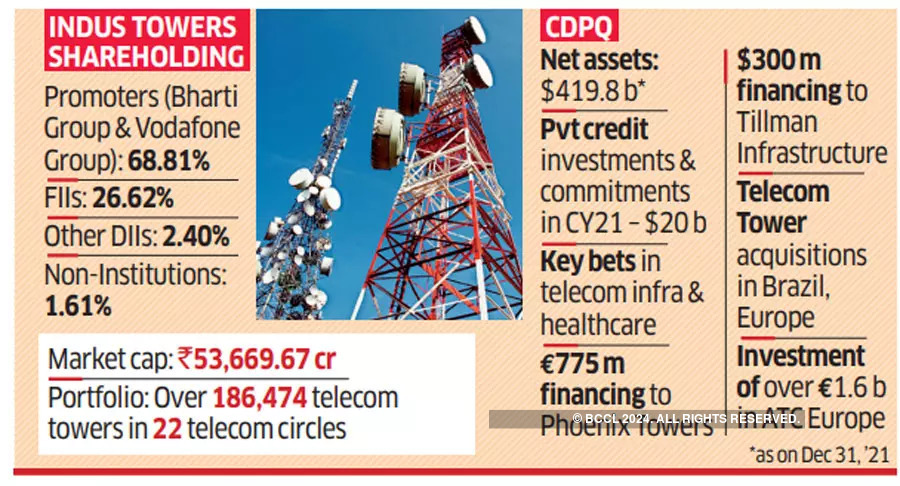

Based on current market price, Vodafone’s 21% stake in Indus is valued at around ₹11,270 crore, based on the tower company’s ₹53,669.67 crore market capitalisation on Thursday. The stock ended the day flat at ₹199.15. JP Morgan and Citi have been mandated to find potential suitors for the Vodafone stake. ET in its March 9 edition had reported Vodafone was negotiating with American Tower Co and Crown Castle International.

Deal Would be Largest by CDPQ in India

The report also mentioned discussions with long-term infrastructure investors such as Brookfield and other sovereign wealth and pension funds, but those talks remained inconclusive.

“Vodafone has to make up its mind. This process has seen several starts and stops. Moreover, it’s an open debate if a tower company should be capitalised before the mother ship that is Vodafone Idea,” said an official privy to the discussions.

Another person aware added that an incoming investor like CDPQ may only be keen on a partial stake. A final decision will evolve in the coming days.

If Vodafone sells its residual stake in Indus, it would mark the British telco’s exit from the passive telecom infrastructure business in India. It would also be the largest deal by the Canadian pension fund – that has taken big bets in Indian toll roads, power utilities, among others – in the country till date.

MOUNTING DUES

“Any further share sale by Vodafone in Indus can only happen if the UK company ensures its Indian JV (Vodafone Idea) will clear its payment arrears to the tower company,” a person aware of the discussions told ET.

Back in February and March, Vodafone UK had sold 7.1% in Indus – 2.4% via a block deal and 4.7% to Bharti Airtel – raising around Rs 3,831 crore. Of this, it invested Rs 3,375 crore in Vodafone Idea by subscribing to newly issued shares. The proceeds were used by Vi to partly settle outstanding payments to Indus. Vi is the telecom JV between Vodafone Plc and India’s Aditya Birla Group.

Earlier this month, the tower company reported a 66.3% on-year fall in its June quarter net profit to Rs 477.3 crore, stung largely by heavy receivables due from a key customer that analysts said was cash-strapped Vi.

Indus’s trade receivables stood at Rs 6,249.6 crore in the April-June period, largely due to delayed payments by Vi. In fact, the prolonged trade receivables issue prompted Indus to recently take a provision for doubtful debts of Rs 1,230 crore for aging receivables. Analysts at ICICI Securities said Indus’ receivables have grown by Rs 420 crore in Q1FY23, or 6% sequentially, if adjusted for the provisioning.

“Indus Towers may have to take additional provisions over the next couple of quarters as Vodafone Idea receivables keep increasing. Management mentioned that Vi is currently making payments for only 50-60% of billings apart from repayments from periodic infusion from Vodafone Plc (as part of the security package for Indus Towers, but most of which is now exhausted),” said Varun Ahuja, analyst at Credit Suisse.

“Our back-of-envelope calculations indicate that the receivables could increase by another ~Rs 2000-2,500 crore by December 2022, until when Vi has proposed to make part payments. Vi’s latest proposal offers to make payments in full from January 2023 onwards as well as repaying the outstanding dues up to December 2022 between January 2023 and July 2023 with interest.”

Analysts, though, expect Indus to benefit from accelerated 5G rollouts that are likely from FY24. The first wave of 5G rollouts could start from next month itself, but Indus executives expect the initial rollouts to be largely via loading. That means, operators would mount 5G network gear on existing tower sites. But, given that 5G sites would be bulky and require more energy solutions, Indus could demand higher loading charges for 5G gear compared with 3G /4G.

Vi had recently raised another Rs 436.21 crore from Vodafone Plc through a preferential issue of convertible warrants as part of its efforts to mop up all available funds ahead of the 5G spectrum sale.

Bharti Airtel is the largest shareholder in Indus with a near 48% stake. It will have right of first refusal if UK’s Vodafone decides to sell its 21% stake in the telecom tower company to an external investor. Following the merger of Bharti Infratel with Indus Towers in end 2020, Canadian pension fund CPPIB ended up owing a 2.17% block of the merged company along with US PE fund KKR that owns 4.85%. There have been reports that both are keen for an exit too.