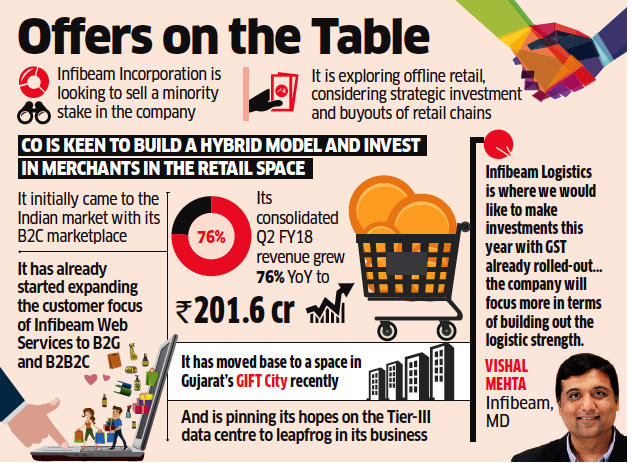

Infibeam is in talks with Prem Watsa’s Fairfax Financial Holdings to sell a minority stake, a person with direct knowledge of the matter said, even as the local ecommerce firm looks to expand into offline retail.The company is also considering strategic investment in and buyouts of retail chains that are using its platform to sell online, the person said.

Further, with it strengthening its B2B2C (business-to-business-to-consumer) platform by providing its logistics framework to brands like Amul and Adani Wilmar, the company is keen to have full control of logistics, the person said.

Infibeam continues to evaluate opportunities as they come, managing director Vishal Mehta said, when contacted by ET. He did not comment on talks with Fairfax, but said Infibeam did not have any plans now to invest in the offline space. Harsha Raghavan, managing director of Fairfax’s India affiliate Fairbridge Capital, refused to comment.

The company is keen to bolster its presence in the mind space of the Indian consumer,” the person added. Mehta said the company has been strengthening its technology capabilities to pursue new business opportunities and improve operational efficiencies. Also, it is expanding its warehouse and logistics capabilities and strengthening fulfilment capabilities for the Infibeam web services business as well as Infibeam.com e-retail operations by adding 75 logistics centers, he said.

Although the company initially came to the Indian market with its B2C marketplace, it has started expanding the customer focus of Infibeam web services to B2G (sales to government) and B2B2C. This has helped it produce strong growth and profit. In the second quarter, Infibeam’s consolidated revenue grew 76% to Rs 201.6 crore. “Infibeam web services continues its upward journey while the Infibeam e-retail platform maintains stability without burning cash, and we want to continue growing like this,” Mehta said.