BharatPe’s proposed joint venture with non-banking financial company Centrum Finance to set up a small finance bank and acquire troubled Punjab and Maharashtra Co-operative (PMC) Bank is a landmark event for fintech players harbouring banking ambitions.

The deal, however, has not been easy to stitch up.

The story of how a startup has within three years partnered a 44-year-old NBFC led by veteran banker Jaspal Bindra to acquire a banking licence has more to it than meets the eye.

The idea behind this SFB is anything but conventional—considering BharatPe’s leadership dynamics to the Reserve Bank of India’s approach towards reviving a dying bank.

“As far as resolution plans go (for PMC Bank), this is a highly unusual one,” a senior banker at a private sector lender said. “While there is no set resolution framework to revive a dying bank, it is definitely a measure RBI has taken out of desperation rather than choice.”

Over the last two weeks, ET spoke to more than a dozen sources to make sense of the BharatPe-Centrum SFB.

We asked them what the central bank’s thinking was, how soon PMC Bank’s depositors could access their hard-earned deposits and what were the conditions that the RBI had conveyed to stakeholders in private before giving approval to set up the SFB.

Special exemption

The alleged Rs 6,500-crore fraud at PMC Bank is one where several regulatory and audit checks had been given the go-by over the last two decades.

The bank’s board had for many years allegedly concealed loan defaults by real estate firm Housing Development and Infrastructure Ltd. (HDIL) of the Wadhawan Group.

Ultimately, the RBI had to step in to freeze depositors’ accounts last year. In light of this, the resolution plan has to be completed at the earliest since retail depositors’ withdrawal limits have been capped at Rs 50,000.

Even as the BharatPe-Centrum bid received its nod, the banking regulator has been at the forefront of drafting the resolution plan, which includes repaying depositors’ principal along with interest.

“The sense is that while a significant portion, or 45% of deposits less than Rs 5 lakh, will be returned as soon as the Deposit Insurance Scheme kicks in, the rest—amounting to deposits of nearly Rs 5,000 crore—will be converted into a low-yielding debt instrument, likely a 10-year bond,” a source privy to the plan told ET.

RBI has yet to finalise these, though.

Ashneer Grover, the cofounder of BharatPe, said operationalisation of the SFB was still “3-4 months away”.

There are other deal riders not yet in the public domain.

These include the future structuring and listing propositions for the SFB, sources close to the company said.

The as-yet unnamed SFB will be a 50-50% partnership between BharatPe’s parent Resilient Innovations and Centrum Capital Finance.

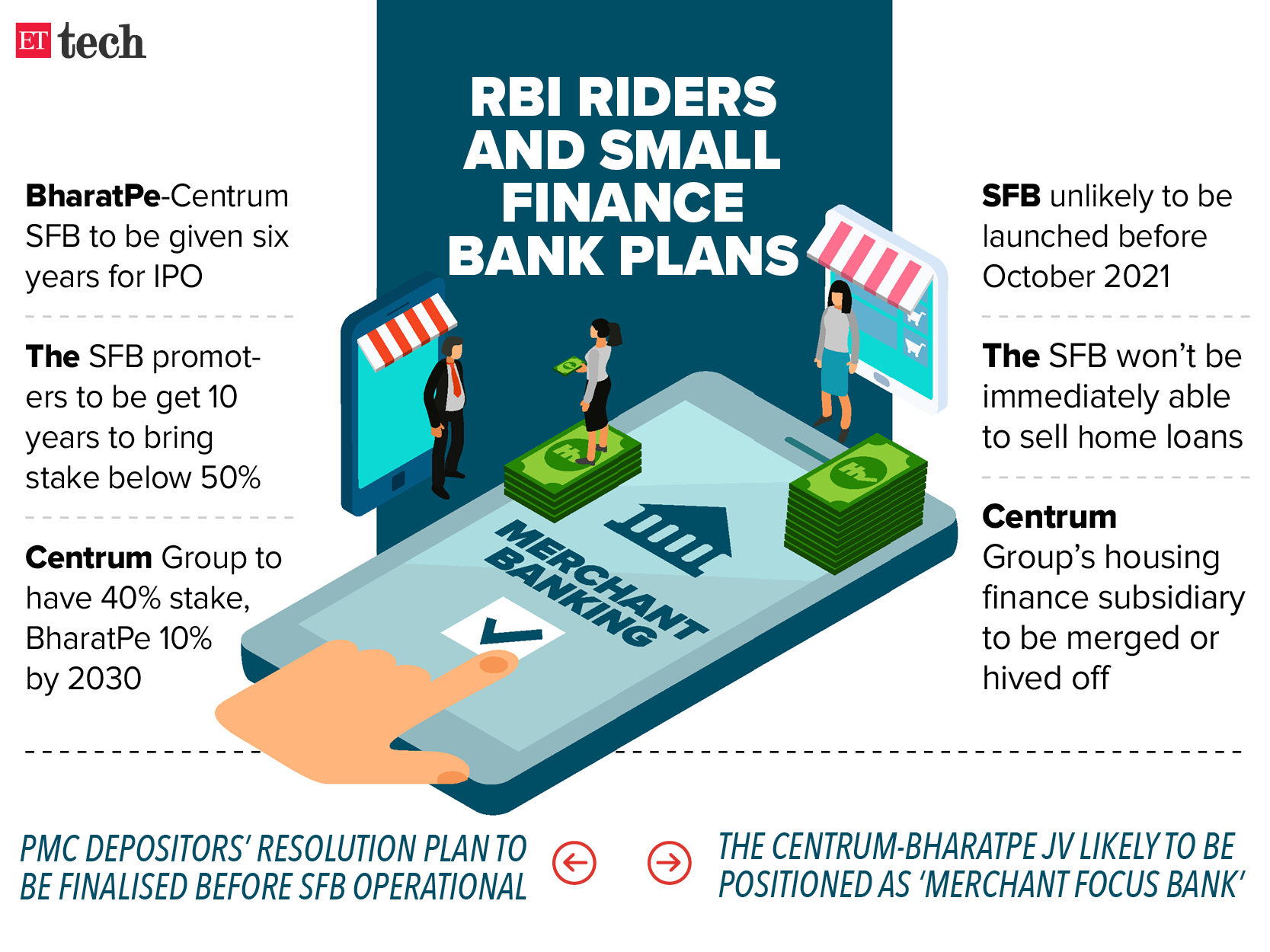

A typical NBFC converted to an SFB is given three years’ time after achieving a net worth of Rs 500 crore before its mandatory initial public offering (IPO). The proposed JV has been provided a special exemption to go in for an IPO in six years.

Second, BharatPe and Centrum must also reduce their combined shareholding to less than 50% from the current 100%. RBI has sought that the process be completed in eight years. While Centrum can hold 40% stake, Resilient Innovations has been told to cut its stake to a maximum of 10%. This effectively means that BharatPe will lose majority ownership of the banking venture by 2030.

The SFB will also not be allowed to offer housing loans or microcredit until Centrum Group is able to hive off its own housing finance and microfinance arms.

Both the owners had agreed to these conditions before RBI gave the in-principle approval.

A merchant-focussed bank

According to sources, the bank will be positioned as “India’s first merchant-focused bank”. “BharatPe is planning on building a lot of its offerings around merchant-focused credit and savings products,” a person directly aware of the matter said.

According to sources, the SFB is likely to offer loans to small and medium enterprises as well as unsecured retail loans lower than Rs 50,000.

BharatPe is likely to take the lead in acquiring merchants and providing technology support to the banking entity, while Centrum will handle financials and compliances.

BharatPe will not transfer its existing merchant base of around six million small vendors to the new SFB as most are with its existing banking partners, ICICI Bank and Yes Bank. These merchants could, however, be a base for cross selling its loan products.

The firm is also expected to retain its autonomous identity as a payment-focused fintech.

The SFB could also leverage BharatPe’s digital payment capabilities while building out new products, just like the operational structure currently followed by fintech unicorn Paytm and its Payments Bank entity.

“We will continue to operate as an independent entity,” Grover told ET. “For its payments business, BharatPe works with multiple banks (ICICI Bank, Yes Bank) and will continue to do so. There are no plans to transition the existing base to the new SFB. We will work with the new SFB in areas where it adds value to our existing and to-be-acquired merchant base.”

Centrum Finance did not respond to ET’s queries.

The promoters of Centrum and BharatPe are expected to commit Rs 1,800 crore to the SFB, of which Rs 900 crore will be infused in the first year, Grover said. The remaining will be infused “when needed”, he added.

Next leg of growth?

Centrum Finance’s Bindra, a veteran banker and former head of Standard Chartered Plc’s Asia unit, has reportedly been influential in getting RBI’s approval in the JV’s favour.

The banking foray by BharatPe—which has been working with Centrum Finance for the last three years—is expected to boost its next leg of growth for several reasons.

While there is an obvious opportunity to increase margins on loans through lowered cost of acquiring funds, there could be a greater purpose, sources said.

Payments companies no longer command the same valuation premiums as they did a few years back.

Competition from players such as Walmart, Google and Amazon mean that a company looking to build a profitable payment business will need to compete effectively with these tech giants—an endeavour where Paytm has also failed.

The differentiator is, therefore, in having a banking licence, which is not easy to get for companies outside India’s legacy banking ecosystem. This not only increases the entry barrier to compete at the same scale but allows the company to expand its product portfolio significantly.

“What is happening here is BharatPe wants to emulate Paytm, but on steroids,” said an industry expert.

“As a banking entity where the entry barriers are high, BharatPe will bypass the competitive challenges it was set for several years before making a meaningful dent. It will now be a banking entity and have access to cheaper funds and the margins will be much higher. As a bank, you are destined to be profitable, and that for an Indian fintech is invaluable,” the expert said.

BharatPe is on the verge of closing a $350 million funding round led by Tiger Global, which will likely make it a unicorn, valuing it at around $2.8 billion, a person directly aware of the matter said.

Leadership changes

BharatPe has made at least six senior management hires in the last year. It expects to do the same this year as well.

Suhail Sameer was brought in last year as group president and has emerged as an influential voice within the company. He is expected to assume the role of ‘founder’. Sameer is also now positioned as the only other public face of the startup besides Grover.

Bhavik Koladiya and Shashvat Nakrani are the other cofounders of BharatPe.

Koladiya has largely been under the radar but sources aware of BharatPe’s origin said he has been hands-on as a founder from the beginning. In fact, Grover met Koladiya and firmed up plans to set up BharatPe and soon Nakrani joined as well, a person aware of the matter said.

Earlier this year, Gautam Kaushik joined BharatPe as group president, the second executive at this level after Sameer. Kaushik was CEO of loyalty platform Payback India, which was acquired by BharatPe in June. Sameer has been virtually leading all the funding talks and been a core part of strategic decision making at BharatPe.

“He has been actively involved in all the fundraising discussions with investors—for both equity and debt rounds. As the company moves to the next stage of its journey—especially with banking aspirations—it’s important to have senior experienced executives at the helm and that’s why Sameer has become critical to BharatPe’s strategic decision-making,” a person aware of the thinking of the company and its investors said.

BharatPe also hired Parth Joshi as chief marketing officer in June.

While senior executives like Sameer and others strengthen its leadership team, sources said some of BharatPe’s investors have not been comfortable with Grover’s mercurial style of leadership.

Grover said this was not true.

“We have a strong leadership team of 14 people, including the founders. All of us are well established professionals in our respective domains and bring enormous credibility and expertise to BharatPe. We all have our role to play for the success of BharatPe. Suhail is a critical member of this leadership team, like others,” he said.

Grover’s public remarks on disputes with rivals like PhonePe have not helped in addressing these concerns, the sources added.

“Our investors are extremely supportive of BharatPe and what we have built in such a short span of time. Leadership hiring is done in sync with the business requirements,” Grover said.

One of the sources said: “Look, every founder has his way of doing things and not everyone will like it. Some have had concerns but that doesn’t dilute Grover’s position as a cofounder.”

BharatPe is also on the lookout for senior management roles in compliance, finance and legal departments to strengthen its entry into the world of banking.

“The other younger members of the founding team have done well but the need for more experienced hands was felt and thus they continue to beef up the senior positions,” one person said.

Source: Economic Times