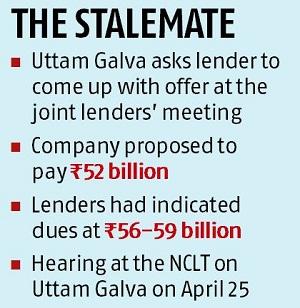

Uttam Galva Steels, one of the companies undergoing insolvency proceedings at the National Company Law Tribunal (NCLT), has asked for a counter offer from its lenders at a joint lenders’ meeting. Uttam Galva had offered to pay Rs 52 billion and settle its dues with all its lenders. However, the lenders had indicated the dues to be between Rs 56 billion and Rs 59 billion.

Sources said that it was indicated at the meeting, held on Saturday, that if the lenders confirmed to the terms then an investor who had agreed to pay Uttam Galva’s dues would deposit the same.

Sources said that once the lenders accepted the terms, Uttam Galva would submit a scheme that would detail the payment schedule. The lenders, however, said on Sunday they would think about the offer and get back.

If Uttam Galva’s dues are paid, it could smoothen ArcelorMittal’s bid for Essar Steel. The NCLT Ahmedabad Bench had observed that mere sale of shares and declassification by ArcelorMittal will not make it eligible for Essar Steel.

ArcelorMittal was an investor in the company with a 29.05 per cent stake, but it transferred the shares inter se to the promoter group at Rs 1 a share before submitting its resolution plan for Essar Steel in February to make itself eligible.

Uttam Galva was a non-performing asset for more than a year and under Section 29A of the Insolvency and Bankruptcy Code (IBC), a promoter of a defaulting company is debarred from the bidding process unless it pays all dues. ArcelorMittal sold Uttam Galva shares to terminate the co-promotion agreement even though it did not have management control or board representation. In KSS, L N Mittal had personal shareholding. KSS, in turn has a subsidiary, KSS Petron, which is also an NPA for more than a year.

The NCLT Bench, however, observed that ArcelorMittal would have to pay the overdue amount for Uttam Galva and KSS Petron to make itself eligible.

The court also felt that enough time had not been given for rectification of bids. The court has referred to proviso 30 (4), which says that if the resolution applicant is ineligible under clause (c) of Section 29A, the resolution applicant shall be allowed by the committee of creditors (CoC) such period, not exceeding 30 days, to make payment of overdue amounts, in accordance with the proviso to clause (c) of Section 29A.

A hearing at the Mumbai Bench of the NCLT for Uttam Galva is scheduled for April 25.

At the last hearing on April 17, Uttam Galva’s legal representatives told a special division Bench that it proposed to revise its offer and take into account all of its lenders’ interests. The firm had sought four to five weeks, stating it planned to bring in a foreign investor.

Though Uttam Galva had been referred to the NCLT, it had not been admitted. Meanwhile, minority shareholders of Uttam Galva, representing 0.03 per cent shares, had moved the Securities Appellate Tribunal against declassification of ArcelorMittal as promoter from the stock exchanges. This case will be heard on Monday.

Source: Business-Standard