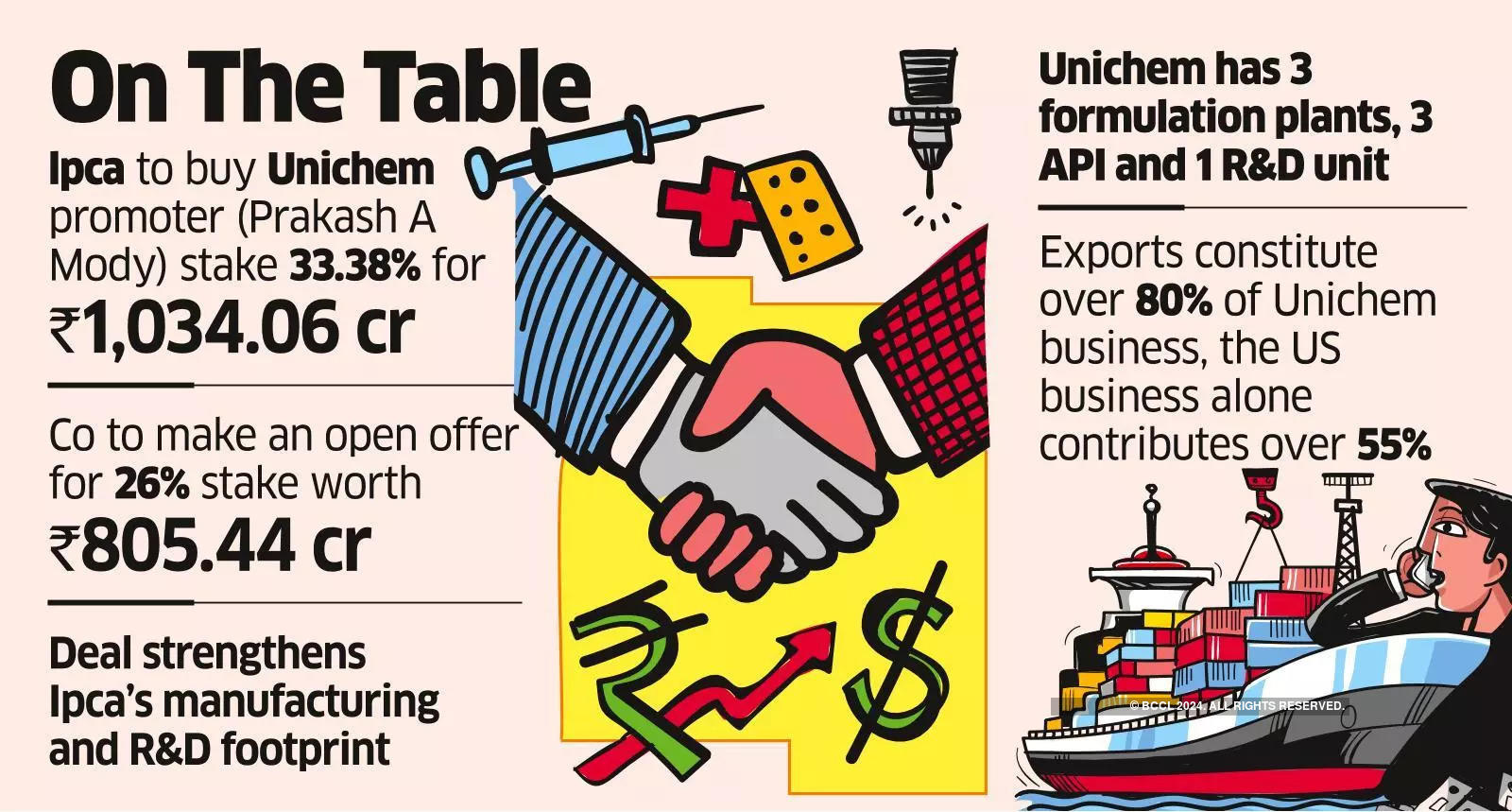

lpca Laboratories on Monday said it has entered into a definitive share purchase agreement to acquire Unichem Laboratories promoter’s stake for ₹1,034.06 crore in an all cash deal. lpca will acquire 2,35,01,440 fully paid-up equity shares of ₹2 each,· constituting 33.38% of the paid up equity share capital of Unichem from one of its promoter shareholders at a price ₹440 per share.

The Mumbai-based Ipca will also make an open offer to the public equity shareholders of Unichem to acquire from them upto 26% of the fully diluted outstanding equity share capital at a price ₹ 440/- per share for ₹805.44 crore.

The transactions are subject to approval of the Competition Commission of India and other approvals.

Ipca said the acquisition will be funded from the company’s retained earnings, and the business and product range of lpca and that of Unichem are complementary.

The deal will boost Ipca’s export business, especially US and Europe businesses.

The US business of Ipca suffered following USFDA import bans on three of its manufacturing sites at Silvassa and SEZ Indore and APIs manufacturing site at Ratlam. The Unichem deal also will strengthen manufacturing and R&D footprint for IPCA, as Unichem has formulations manufacturing facilities in Goa, Ghaziabad (Uttar Pradesh) and Baddi (Himachal Pradesh); the active pharmaceutical ingredients (API) manufacturing units at Roha (Maharashtra), Pithampur (Madhya Pradesh) and Kolhapur (Maharashtra). Unichem has a large R&D centre in Goa, with over 300 scientists including over 30 PhDs, over 72 abbreviated new drug applications (ANDAs) across markets & therapeutic categories.

Unichem had sales of ₹974.33 crore for the nine months ended December 31 in FY23 with a net loss of ₹157 crore. The company revenues stood at ₹1,270 crore in FY22, with a net profit of ₹33 crores. Unichem manufactures pharmaceutical formulations as branded generics as well as generics in several countries across the globe, with major markets being US and Europe. While exports constitute over 80% of Unichem business, the US business alone contributes over 55%. Unichem performance has been hit by steep price erosion in the US, along with elevated prices of raw materials.

Ipca’s export revenues constituted 42% in FY22, around 47% of the exports come from Europe and US. The US business constitutes 8.5%.

“Unichem has developed an excellent and proven quality track record with a differentiated capability which is highly complementary to lpca’s strengths,” said Premchand Godha, promoter and executive chairman of lpca in a statement to stock exchanges “This acquisition is in line with our stated strategy to enhance our portfolio in our chosen growth markets. We both are well positioned to successfully integrate our product offerings and grow our businesses,” Godha added. “We are very excited about this transaction and believe that lpca is an ideal partner to take business of Unichem through its next phase of growth,” said Prakash A Mody, promoter chairman and managing director of Unichem.

“For Unichem, employees and customers have been core to its business and I strongly believe, they will benefit from lpca’s expertise in providing competitive’ and integrated services globally,” Mody added.

In 2017, Unichem divested its domestic branded formulation business in India and Nepal to Torrent Pharma in a ₹3,600 crore deal.